Codi’s AI Office Manager puts workplace operations on autopilot

Codi’s new AI office manager moves from chat to completed work by scheduling vendors, restocking supplies, and reconciling invoices. See how agentic systems cut costs and time, and run a confident 90 day pilot in 2026.

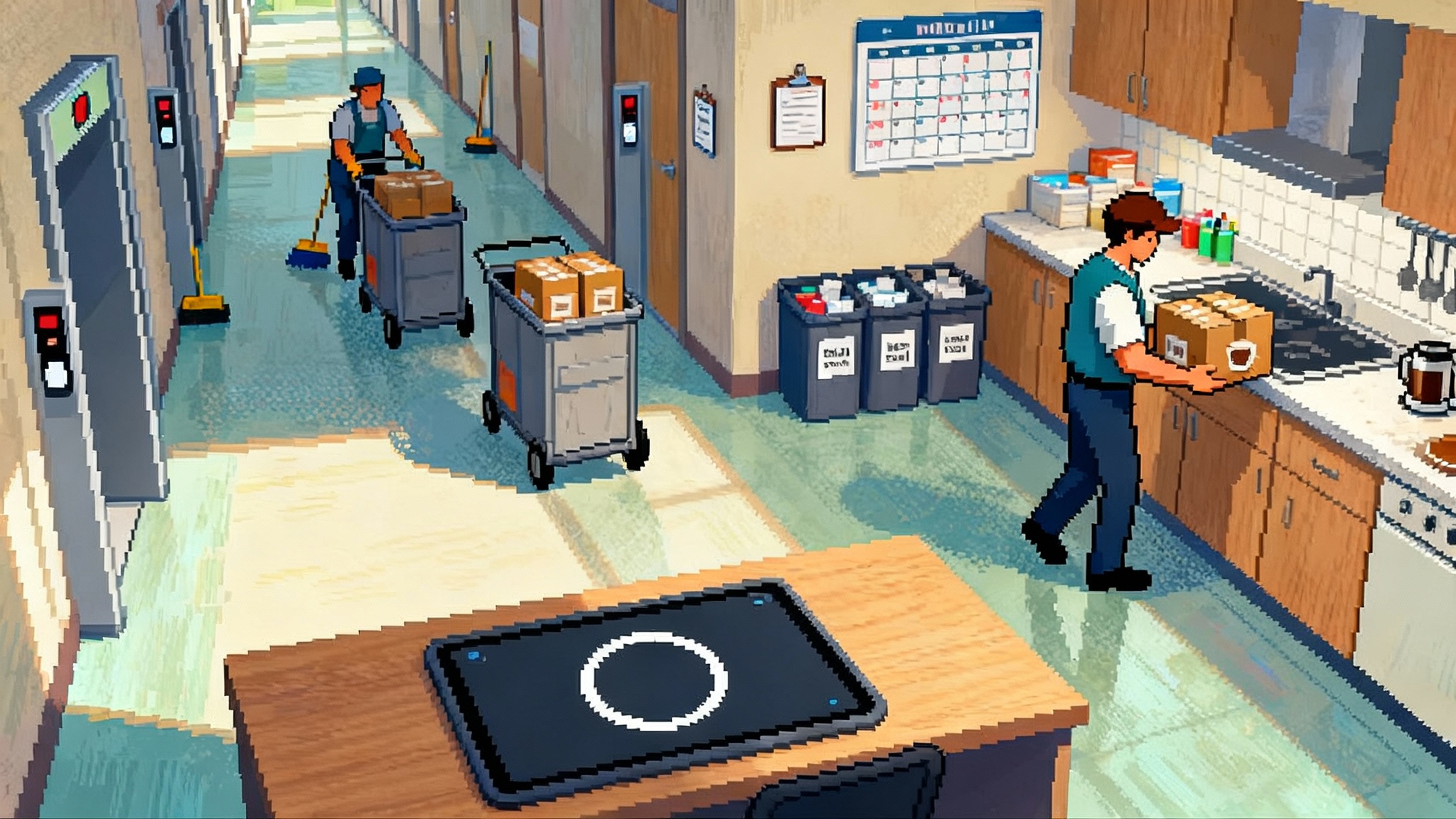

From chat to action in the office

On October 21, 2025, Codi announced an autonomous office manager designed to do more than answer questions. The product promises to run the daily logistics of a physical workplace by scheduling vendors, restocking supplies, and reconciling invoices. The shift matters because it moves the category from chatty assistants to end to end operators that plan, execute, and verify work in the physical world. Early coverage highlighted both the timing and the ambition in a detailed TechCrunch report on Codi's agent.

Codi’s pitch is simple. Plug in the vendors your office already uses, set budgets and policies, then let the system coordinate routine facilities jobs. In public statements, the company says the product moved from beta to launch with early revenue momentum and named customers, including TaskRabbit and Northbeam. The specifics appear in Codi's October 21 press release, which cites one hundred thousand dollars in annual recurring revenue within five weeks of beta.

What makes a system agentic

Most people’s first experience with AI at work was a chat window that could draft an email or summarize notes. An agentic system is different. Think of a reliable operations coordinator who not only writes the task list but actually calls the cleaner, books the elevator, creates the purchase order, and updates the ledger. It has four essential parts:

- Memory. It stores policies, vendor contracts, room sizes, service levels, and price caps so each decision reflects institutional context.

- Perception. It reads inputs such as ticket queues, calendars, inventories, and invoices, then normalizes signals into structured events.

- Planning. It breaks a goal into steps like request quote, compare options, schedule work, confirm completion, and pay invoice. Plans are revised as facts change.

- Action with verification. It takes steps through integrations, then reconciles outcomes against the plan and the budget. Evidence gates payment and closure.

The magic is not tied to a single large language model. The value comes from a workflow that chains model reasoning with systems of record and real vendors, then checks results with the rigor of an operations playbook. That same orchestration pattern shows up across domains, from facilities to scenarios where a RUNSTACK meta agent orchestrates teams of narrow tools.

Why office operations is a high leverage wedge

Office operations are a near perfect proving ground for autonomy. The work is high volume, rule driven, and measurable. It spans pantry restocking, cleaning, minor repairs, ergonomic equipment, visitor management, and safety drills. It touches budgets, procurement, and compliance. That cross functional surface area means a small improvement multiplies across the company.

Consider a concrete example. The coffee machine jams on a Tuesday afternoon.

- Perception. The agent sees a spike in pantry tickets and detects low stock on beans from the last inventory sync.

- Planning. It checks the knowledge base and finds the machine is under warranty. It drafts two options: a warranty repair or a swap to the backup machine in storage.

- Action. It schedules a warranty technician for the morning window, queues the backup deployment for today, submits a temporary order for pour over supplies, and messages the office channel with the plan.

- Verification. It closes the original ticket only after a quick follow up survey shows satisfaction and the inventory count returns to target.

No one asked for a status update. No one played telephone across emails. The system moved from signal to resolution with a cost trail and an audit log.

What Codi’s launch signals about the market

Codi is not introducing software to track facilities. Workplace platforms already help with room booking and visitor check in. The claim is that execution itself becomes autonomous. The agent requests quotes, selects the best option within policy, schedules work, and pays within budget limits. That crosses a line for business software. It turns facilities from a queue you watch into a system that gets things done and asks for input only when a decision has real tradeoffs.

The launch also hints at a broader transition. If routine office logistics can be automated with clear guardrails, the same pattern applies to travel booking, field services, and light procurement. The wedge is attractive because the feedback loop is fast, costs are visible, and stakeholders are tolerant of change when service improves. In parallel markets we already see agents managing complex migrations, as in our look at overnight ERP upgrades.

How an AI office manager actually works

The architecture is straightforward if you think in systems rather than features.

- Data foundations. The agent connects to calendars, ticketing, inventory, accounting, and identity. Examples include Google Calendar or Microsoft Outlook for scheduling, help desks like Jira Service Management or Zendesk for tickets, expense and card platforms for spend, and identity systems for roles.

- Budget constraints. Finance defines monthly and category caps. The agent generates purchase orders or card transactions only within limits and writes back to the ledger.

- Vendor orchestration. The vendor directory includes each provider’s scope, pricing, insurance certificates, and service levels. The agent requests quotes by template, compares proposals, and considers both price and promised speed.

- Human on the loop. The system asks for approval when costs exceed a threshold or when the decision changes policy.

- Continuous verification. When a job completes, the agent checks a signed work order, reconciles photos or sensor data if available, then issues payment and closes the task.

Think of it like air traffic control for your space. The agent does not replace pilots. It choreographs many small landings on time, under budget, with a record of each touch.

Metrics that prove ROI in 2026

Executives do not buy autonomy. They buy outcomes. Here are practical key performance indicators, with realistic targets for a first year pilot.

- Ticket resolution time. Baseline median close time. Target a 30 percent reduction within three months on categories the agent can fully execute such as cleaning and pantry.

- Stockout rate. Track the share of workdays when any pantry item or essential supply is out of stock. Target under 2 percent after automation.

- Vendor response time. Measure time from request to confirmed vendor scheduled. Target under four business hours for standard jobs.

- Cost per desk, non rent. For an office of one hundred people, many companies spend forty to eighty dollars per desk per month on supplies and light services, excluding rent and utilities. Target a 10 to 15 percent reduction through better bundling and fewer rush fees.

- Budget adherence. Track category variance. Target plus or minus five percent monthly on automated categories.

- Human time saved. Log time an operations coordinator spends on quote collection, scheduling, and invoice reconciliation. Target a fifty percent reduction by month three.

- Satisfaction after service. Use a one click post task rating in your chat tool. Target a consistent 4.5 out of 5 on automated jobs.

A simple payback sketch

Suppose your coordinator costs ninety thousand dollars fully loaded and spends half of each week on tasks that the agent should handle. Even without headcount changes, freeing one thousand hours per year is meaningful. Add twelve thousand dollars in saved rush fees and reduced over ordering, and the case sharpens. A subscription that is a fraction of a full time hire can clear a one year payback if you hold a firm line on budget caps and proof before payment.

A 90 day pilot plan you can run now

A tight pilot keeps risk small and evidence strong. Use this four phase plan.

Weeks 1 to 2: scope and guardrails

- Choose two categories with fast feedback. Pantry and cleaning work well.

- Set a monthly spend cap per category and a per transaction limit that triggers approval.

- Define success in writing. Pick three metrics from the list above and baseline them for the past ninety days.

- Map systems. Confirm access to calendars, ticketing, inventory, procurement, and accounting. Use role based access control so the agent only touches what it must.

Weeks 3 to 6: controlled autonomy

- Turn on autonomous execution for low risk tasks. Require approval for anything that changes vendor, exceeds a threshold, or touches security.

- Standardize quotes. Use a template with scope, materials, price per hour or square foot, and a completion window.

- Ask for evidence. Require a job photo and a signed work order before payment.

Weeks 7 to 10: expand and reconcile

- Add minor repairs and ergonomic equipment to the agent’s scope.

- Start budget reconciliation. Match spend to categories automatically and review anomalies weekly.

- Run a side by side test. Keep one task type manual for two weeks to compare time, cost, and satisfaction.

Weeks 11 to 13: decide and scale

- Present a simple scorecard. Show before and after on resolution time, stockouts, spend, and satisfaction.

- If the pilot clears thresholds, extend autonomy to more categories and relax approval gates only where data supports it.

Integration and safety pitfalls to address early

- Shadow purchasing. Agents that can buy things can also create unauthorized spend. Solution: issue the agent a virtual corporate card with per merchant and per category limits. Require receipts and matched work orders.

- Permissions creep. Over time, privileges expand and are not revoked. Solution: tie the agent’s permissions to groups in your identity provider, review access quarterly, and auto expire elevated roles.

- Auditability gaps. Many tools log actions but not intent or context. Solution: store a structured record for every step. Include the goal, plan, alternatives considered, model prompts, approvals, evidence of completion, and links to transactions. Export to your data warehouse.

- Vendor risk and insurance. An agent may pick the fastest option instead of the compliant one. Solution: enforce vendor eligibility based on insurance certificates, background checks, and preapproved scopes.

- Data leakage. Facility tickets can contain personal information. Solution: apply data loss prevention rules to redact sensitive fields before model calls. Keep data processing within required regions.

- Automation loops. Two agents can trigger each other and repeat the same action. Solution: add idempotency keys to tasks and enforce cool off periods for repeated failures.

Why the wedge matters: toward an agent as COO stack

Today the agent schedules cleaners and reconciles invoices. Tomorrow the same pattern can stitch real estate, human resources, and information technology into an operational nervous system.

- Real estate. The agent syncs leases, square footage, access schedules, and building rules from property systems. It can forecast when to add or give back space based on headcount and occupancy.

- Human resources. It reads start dates, work locations, and equipment entitlements. On a new hire, it orchestrates badge access, desk assignment, and ergonomic kits.

- Information technology. It talks to identity providers, device managers, and service desks. When an employee leaves, it coordinates badge deactivation, device pickup, and seat reallocation.

- Finance and procurement. It reconciles spend in accounting and card systems such as NetSuite, QuickBooks, Ramp, and Brex. It respects budgets, close calendars, and approval chains.

- Workplace experience. It pairs with visitor management and room scheduling tools to turn events and heavy traffic days into staffing plans for cleaning and security.

These building blocks parallel other agent first stacks we have covered, including how agentic Postgres unlocks parallelism for data heavy workflows.

Standards and signals to watch in 2026

- Identity and policy. Expect opinionated defaults for role based access control and least privilege operation as vendors deepen identity integrations.

- Payments with proofs. Look for agent issued card controls that combine spend limits, vendor allowlists, and evidence requirements to reduce fraud and chargebacks.

- Model governance. Clearer patterns will emerge for redaction, retention, and region control that align to common audit frameworks such as SOC 2 and ISO 27001.

- Interoperability. Vendors will expose more deterministic task APIs so agents do not rely on fragile screen interactions to get work done.

- Insurance and warranties. Brokers will begin pricing riders for agent initiated work, provided evidence and audit logs meet their thresholds.

The bottom line

Codi’s launch is a useful marker for the next phase of workplace software. The story is not a chatbot that writes a checklist. It is a system that closes the loop from request to result and brings a verified record back to finance. If you run a small or midsize company, pick two categories, set tight spend caps, and run a ninety day test. Measure time to resolution, stockouts, and variance to budget. If the numbers move, expand scope with the same discipline. The prize is not novelty. It is a quieter office that runs itself and a team that spends time on the work only people can do.