AP2 launches: Google’s open rails for AI agent commerce

Google’s AP2 turns autonomous checkout from demo to default with a portable, signed mandate for consent, risk, and refunds. Here is what it enables, how to pilot in 90 days, and where founders should build now.

The news: AP2 makes agentic payments real

On September 16, 2025, Google announced the Agent Payments Protocol, or AP2. It is an open specification for how autonomous software agents request, authorize, and settle purchases on behalf of people and businesses. AP2 is positioned as the missing trust layer between an agent pressing buy and a merchant actually shipping goods. In Google’s launch post, the company framed AP2 around three pillars: authorization, authenticity, and accountability, and noted support from more than sixty payments and technology partners. For full scope and language, see Google AP2 launch post.

If the last decade of checkout innovation was about reducing clicks for humans, the next decade is about letting trustworthy agents transact without a human in the loop on every step. AP2 gives those agents a common grammar for consent and a standard envelope for payment requests that merchants and payment providers can verify.

Why an open, interoperable spec is the missing trust layer

Today, payment systems assume a person is on a trusted screen clicking buy. Agents break that assumption. Without a standard, each agent and merchant must negotiate custom rules for consent, payment instrument selection, dispute handling, and audit. That creates fragmentation and risk.

AP2 addresses this with a portable, cryptographically signed mandate. Think of a mandate like a notarized letter that says: here is who I am, here is the agent I delegated, here is what it may buy, here are the limits, and here is the proof that I agreed. The merchant reads the letter, verifies the signatures, and can accept or decline. The payment provider uses the same letter to route funds, apply risk checks, and record liability. Everyone sees the same machine readable truth.

The internet took off after Transport Layer Security made encrypted communication interoperable. Email worked because Simple Mail Transfer Protocol defined a universal handoff. AP2 aims to do the same for agent commerce. Once an agent mandate means the same thing everywhere, experimentation can focus on value rather than plumbing.

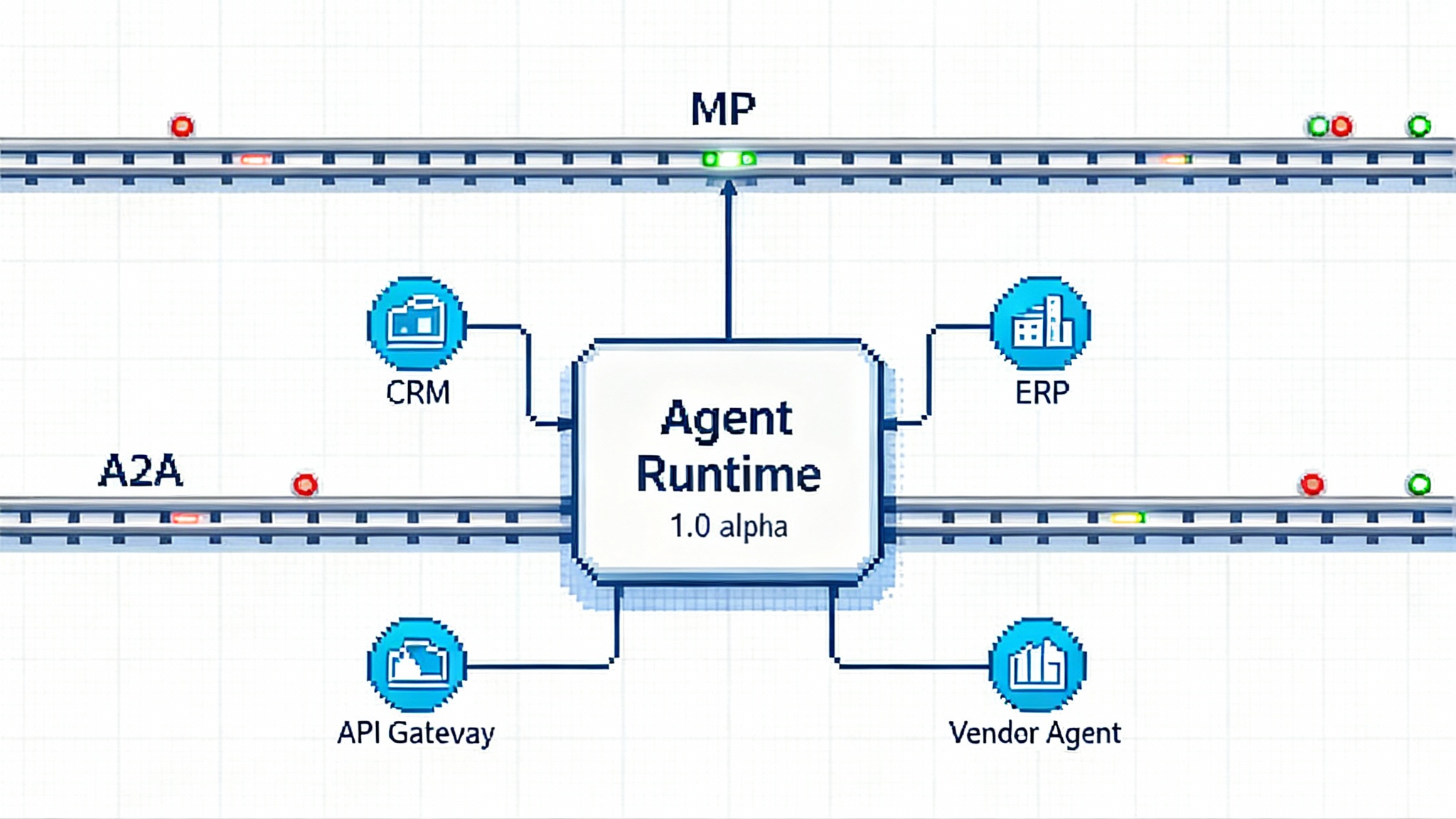

How AP2 fits with existing agent protocols

AP2 builds on two adjacent ideas that have gained traction in the agent ecosystem:

- Agent to Agent protocol: a common way for agents from different vendors to discover each other and exchange messages.

- Model Context Protocol: a way to connect tools and data sources to language models in a structured, portable manner.

AP2 handles the moment where intent meets money. The agent that plans a trip or negotiates a price must eventually pay. AP2 defines how the agent proves it is allowed to do so, what it is paying for, which rails to use, and how the counterparty can hold it accountable after the fact.

What startups can build right now

The protocol opens a large surface for new products. Here are concrete opportunities that can ship this quarter.

1) Agent wallets with consent receipts

Build a wallet that stores payment instruments, spend caps, merchant allowlists, and human readable permissions. Every transaction produces a consent receipt that mirrors the signed mandate: who, what, when, why, and how much. The receipt is machine readable for automated dispute resolution and human readable for trust. Useful features:

- Granular scopes: one item, one merchant, one trip, or one budget window.

- Step up triggers: require a one time passcode or biometric when price exceeds a threshold, or when the category changes.

- Shared controls: team and family accounts with per user limits and audit.

2) Merchant risk governors

Offer a drop in service for merchants that evaluates incoming AP2 purchase requests. Inputs include the agent identity, mandate scope, device and network signals, and merchant policy. Outputs include allow, challenge, decline, or defer. The governor can call third party fraud tools, connect to 3-D Secure card flows when necessary, or require additional evidence from the agent. This is a new layer that sits before the gateway and complements existing fraud engines because it understands mandates and agent identity.

3) Refund and chargeback APIs for agents

Create a unified interface that lets merchants and consumers trigger refunds or respond to disputes using the same mandate record. Map AP2 metadata to card network dispute codes, real time payment reversal windows, and crypto refund mechanics. Provide templates for agent written dispute narratives that include the original scope and consent receipt. Add timers and notifications so agents can escalate before a chargeback becomes irreversible.

4) KYC and compliance plug ins

Provide identity verification for both ends of an agent transaction. For consumers, support government ID scanning, selfie checks, and watchlist screening. For businesses, support beneficial ownership collection and sanctions checks. Add transaction monitoring rules that understand mandates: repeated small purchases outside scope, purchases at odd hours, or category drift. Include privacy controls so merchants only see what they need to approve a purchase, not the entire identity dossier.

5) Procurement bots for the back office

Build a business to business agent that keeps software licenses, cloud capacity, and office supplies within policy. The bot uses AP2 to issue purchase orders with signed scopes, then reconciles invoices against consent receipts. Add budget alerts, vendor scorecards, and automatic renewal negotiations. The same rails work for marketplace purchases where the agent can compare prices, enforce preferred vendors, and total cost of ownership rules.

A 90 day pilot plan with early AP2 compatible merchants

You do not need every merchant to support AP2 to learn. You need a narrow slice with enough volume to test risk, consent, and support flows.

-

Days 0 to 15: choose one category and three to five merchants. Travel, software subscriptions, office supplies, or food delivery are good candidates. Instrument a sandbox that can simulate approvals and declines. Define success metrics: conversion, step ups per hundred transactions, fraud rate, refund resolution time, and dispute win rate.

-

Days 16 to 30: implement mandate creation in your agent wallet, and verification in your merchant governor. Capture full telemetry: signature checks, challenge reasons, user confirmations, and post purchase satisfaction. Begin a red team exercise that tries to bypass scopes or inject misleading item descriptions.

-

Days 31 to 45: start real money tests with low limits. Route a percentage through cards, a percentage through real time bank transfers, and a small percentage through supported crypto rails if your risk team approves. Validate how mandates survive each rail’s quirks. Track failure modes by rail.

-

Days 46 to 60: add refunds and disputes. Run forced error cases: wrong size, out of stock, late delivery. Confirm that the consent receipt lets you resolve quickly and that users can reverse clearly unauthorized payments without calling support.

-

Days 61 to 90: expand merchant count and increase limits. Measure how often step ups fire and whether they cause abandonment. Tighten your governor rules where fraud appears. Publish a pilot report that includes numbers, not adjectives. Use the report to recruit more merchants and payment providers.

AP2 versus walled garden checkouts

Closed checkouts like mobile wallet buttons and single vendor pay flows are excellent when a human taps a trusted button. They are not designed for autonomous agents that roam across surfaces and vendors.

Here is the practical difference:

-

Consent portability: AP2 standardizes a mandate that travels with the payment request. A walled garden holds consent inside its own app. An agent cannot easily prove to a third party what a user allowed.

-

Payment agnosticism: AP2 supports cards, real time bank rails, and approved crypto instruments through the same envelope. Closed systems tend to favor a specific rail or bundle multiple rails behind a proprietary interface that is not agent aware.

-

Risk clarity: AP2 gives merchants evidence about user intent and agent identity. Closed systems abstract risk behind opaque scores and policies. Agents cannot explain themselves.

-

Liability assignment: AP2 encourages explicit rules about who is responsible when things go wrong. Closed systems often rely on program terms that are not machine readable, which makes automated resolution hard.

-

Ecosystem velocity: AP2 invites any gateway, network, wallet, or agent to integrate. Closed systems move at the speed of a single vendor roadmap.

The result is not that closed checkouts vanish. They remain excellent surfaces for people. AP2 makes agent to merchant transactions first class citizens on equal footing rather than awkward one off integrations.

Build versus buy: where to differentiate

Founders will be tempted to build everything. Resist. Invest where you can create a durable edge, and buy commoditized parts.

Build in house:

-

Mandate experience: your agent consent flow is your brand. Design readable scopes, simple spend limits, and one tap revocation. Teach the agent to explain purchases in plain language.

-

Policy engine: write the rules that decide when to step up, when to pause, and when to switch rails. This is where proprietary data and model quality shine.

-

Post purchase intelligence: use receipt data to improve planning and negotiation. For example, your travel agent should learn that you always prefer a two night weekend stay with late checkout and can negotiate automatically.

Buy from specialists:

-

Identity verification and compliance: vendors already handle document checks, sanctions screening, and monitoring. Integrate and move on.

-

Dispute plumbing: use providers that map mandate data to network reason codes and bank dispute portals. This work is tedious and changes often.

-

Gateways and aggregators: choose processors that adopt AP2 quickly. Multi processor routing gives you resilience and cost control.

If you are moving an agent from a prototype to a real product, the mindset and tooling change. See how teams are making that leap in our take on the production shift for agents.

Regulatory and user experience pitfalls to avoid

-

Consent that is not human friendly: a cryptographic signature is not a user experience. Present scopes in plain language. Summarize vendor, items, price, timing, and recurring terms. Offer a clear revoke button.

-

Irreversible rail misuse: real time transfers and some crypto movements are hard or impossible to reverse. Use smaller limits, more step ups, and richer descriptions before funds leave. Reserve the fastest rails for trusted merchants and repeat purchases.

-

Inadequate parental or team controls: minors and shared cards require layered approvals. Add guardian or manager countersignatures for higher risk categories and recurring charges.

-

Data oversharing: merchants need proof of consent, not the user entire identity. Use scoped disclosures. Store sensitive data in vaults and tokenize wherever possible.

-

Patchwork rules across regions: card rules, bank transfer regulations, and crypto travel rules differ. Maintain a policy matrix by country and rail. Validate that your consent receipts carry the right fields for each market.

-

Weak transparency after errors: if an item list changed between mandate and charge, show the diff and require a new confirmation. If a merchant substitutes a product, the agent should pause and ask.

How AP2 moves agents from demos to default

For a decade, agent demos looked magical and then stalled at the checkout step. The agent could plan and negotiate, but a human had to open a browser, re enter details, and accept terms. Each hop was a chance to abandon the purchase. AP2 compresses that last mile. The agent can now carry a signed mandate that any AP2 aware merchant and processor can validate. That flips the default. Agents will be expected to complete purchases, and people will step in only when the agent asks for help.

Two more ingredients point to acceleration. First, AP2 is public and versioned. Developers do not need to reverse engineer private flows. Second, reference implementations and samples are available so teams can stand up pilots quickly. You can review types and examples in the AP2 technical specification and samples.

Teams building voice forward experiences can also move faster by pairing AP2 with real time interaction stacks. For a look at how code centric teams are shipping speech agents, see our note on code first voice agents.

Where this leaves competing agent platforms

Many platforms teach you how to build agents but stop short of payments. Microsoft Copilot Studio, Amazon Bedrock agent frameworks, and Zapier agent tools are examples. These are great for orchestration and tool use, but still rely on human centric checkout buttons.

AP2 does not replace those platforms. It fills the payments gap. Expect them to adopt AP2 or offer adapters so their agents can pay natively. The winning developer experience will let you plan in your favorite framework and transact with AP2 under the hood. That shift mirrors a broader trend in the agent world, where systems evolve from dashboards you watch to doers you trust. We explored that mindset in shift from dashboards to doers.

The window for picks and shovels is now

History suggests that open rails create new categories of infrastructure companies. Stripe rose with card tokenization and easy gateways. Twilio rode standard communications protocols. AP2 can do the same for agent commerce. The first wave of standout companies will likely be mandate first wallets, agent aware fraud governors, dispute automation, and business to business procurement bots. The second wave will be analytics and financing for agent driven demand.

The opportunity is both technical and operational. Teams that master consent language, risk policy, and messy integrations will earn trust. Trust is the currency that lets agents buy the next thing without asking.

A closing roadmap

- Start a narrow 90 day pilot today with a few merchants and one category.

- Build your mandate experience, policy engine, and post purchase intelligence in house.

- Buy identity, dispute plumbing, and multi processor routing from specialists.

- Measure conversion, fraud, step ups, and resolution speed with numbers, not adjectives.

- Publish your results and invite more merchants to join.

Once a common mandate becomes the default, agent commerce stops being a demo and becomes the baseline. AP2 gives everyone a shared language for trust. The startups that learn to speak it fluently will become the rails that others build upon.