Nansen’s AI Trader and the Rise of Vertical Finance Agents

Nansen launched an AI trading agent built on labeled onchain data. This article explains why vertical agents are winning in finance, which guardrails matter most, and how constrained autonomy will roll out.

Vertical agents finally arrive in finance

On September 25, 2025, Nansen introduced an AI trading chatbot built on its labeled onchain dataset and packaged as a mobile agent for real investors. The company framed it as a research team in your pocket that answers questions, pulls live wallet and token context, and organizes portfolio intelligence without the usual dashboard digging. It is a clear stake in the ground for vertical, data‑advantaged agents in markets, and a signpost for where consumer trading interfaces are going next. You can see the product details in Nansen’s launch announcement.

Why this matters is simple. The first wave of chat assistants impressed with conversation. The next wave is about competence. In finance, competence comes from proprietary signals, strong execution discipline, and guardrails that keep the model honest, safe, and compliant. Nansen’s move shows how pairing a narrow domain, high quality data, and a capable model can outperform general chat for a high stakes job.

What exactly launched

Nansen’s agent wraps three pillars into a single conversational surface:

- A deep onchain knowledge base, including hundreds of millions of labeled addresses that track funds, whales, and consistent perps winners.

- Real time telemetry that explains price moves, flows, and wallet behavior across chains in response to plain English queries.

- A portfolio layer that can summarize holdings, PnL, and exposures, then suggest next steps like diligence checks or risk trims.

At launch, the agent is focused on research and decision support. It answers questions such as who is buying a token, whether concentration risk is rising, or how a specific wallet’s positions have evolved. The roadmap includes trading flows with user confirmation. Reporting on launch day also noted that the system currently runs Anthropic’s model under the hood and that Nansen cut pricing on its entry plan during rollout, as covered in an Axios report on the launch.

Why data advantage beats general chat for trading

General chat models are amazing writers and decent researchers. They are not portfolio managers. When money is on the line, two levers dominate outcomes: signal quality and latency. Nansen’s advantage is that its signals are native to the venue where trading decisions originate, the blockchain itself. That changes five things.

-

Grounded answers, not guesses. When a user asks why a token is moving, the agent can point to concrete wallet flows, recent swaps, or fresh governance actions tied to labeled actors. This reduces the temptation to confabulate from stale web pages.

-

Feature richness that matches trading decisions. Traders think in flows, holder distributions, unlock schedules, perps funding pivots, and risk buckets. Labeled onchain data gives the model the right features to reason over, which makes its step by step analysis more relevant than a broad web summary.

-

Better priors for discovery. Token hunting is mostly about ranking noisy candidates by asymmetric payoff. A vertical agent with years of curated Smart Money labels can promote the right candidates faster than a general model that must infer relevance from text alone.

-

Personalization without losing truth. Because the agent can inspect a connected portfolio, it can tailor suggestions to user constraints, then back each suggestion with fresh evidence from chain. The personalization does not corrupt the facts, because those facts are pulled from an external data plane the model cannot invent.

-

Fewer blind spots, faster iteration. Onchain datasets are append only and permissionless to observe. That means fewer gaps versus off chain sources that change or disappear, and faster feedback loops to refine prompts, tools, and heuristics.

The result is not magic. It is a more capable research partner that knows the market’s plumbing, and it tends to produce better trade adjacent answers than a general assistant, especially under time pressure.

From advice to constrained autonomy

The line between chat advice and trading automation is thin. Nansen’s path points to a middle state that will likely become standard: constrained autonomy. The agent prepares the order, explains the rationale, and enforces hard limits. The human approves. Over time the approval surface gets smaller as trust builds and guardrails prove themselves under stress.

Constrained autonomy looks like this in practice:

- Pre trade plan generation that cites the onchain evidence it used.

- A previewed order with size, route, slippage, and fees, plus a post trade monitoring plan.

- A checklist that must pass before the Trade button lights up, including liquidity checks, contract risk scans, and exposure limits.

- An execution sandbox that cannot step outside its budget, venue list, or asset universe.

This setup gives users most of the time savings of automation without ceding full control. It also creates cleaner audit trails for teams that must justify decisions.

Guardrails that actually matter

Agents that can move money need more than polite disclaimers. They need coded limits, external verification, and runtime oversight. If you are building or evaluating an agent like Nansen’s, start with these.

Hallucination controls

- Evidence first answers. The agent must surface the wallet flows, transactions, or contract states behind any material claim. If it cannot fetch proof, it should say so.

- Deterministic checks for factual queries. Some questions have canonical answers on chain, like whether a contract is upgradeable, or whether a wallet increased its token balance. Those should call typed functions, not free form generation.

- Confusion triggers. If the model’s internal confidence drops or signals conflict, force a retry with stricter retrieval or route to a safe default like do nothing.

Execution limits

- Risk budgets by token, venue, and day. Encode hard ceilings for gross and net exposure, per order and cumulative, with cool offs after losses or volatility spikes.

- Slippage and liquidity guards. Block orders that would consume more than a set percent of quoted depth or exceed a slippage ceiling given historical volatility.

- Venue allowlists and sanctions filters. Only trade on pre approved DEXs or centralized venues that pass compliance checks. Enforce geofences and block listed addresses.

- Human in the loop. Maintain user confirmations for any action that changes state, along with a one tap kill switch and a deadman timer that pauses the agent if it cannot phone home.

Monitoring and audit

- Structured logs for every decision, including inputs, retrieved evidence, prompts, tool calls, and outputs.

- Post trade scorecards that attribute PnL to signals versus execution. If a trade failed, you need to know whether the research was wrong or the route was poor.

- Drift alarms on the data plane. If labeling coverage drops or an upstream provider degrades, the agent should reduce scope rather than plow ahead on thinner data.

These guardrails are not optional. They are the difference between an assistant and an operator you can trust.

Risk and compliance by design

Even if an agent trades only with user funds, it still lives within a web of rules and norms. The right posture is to design for compliance from day one, then add market structure safeguards that go beyond minimum requirements.

- KYC and customer suitability. If a product offers execution, it needs a sane tiering model. Retail users get conservative defaults and fewer venues. Pros can unlock more tools after enhanced due diligence.

- Travel rule and sanctions checks. Routing through custodians or fiat ramps will pull you into existing regimes. Plan the integrations and data flows early.

- Best execution and conflict transparency. If the agent routes to a venue where the provider also earns, disclose it. Explain the routing logic and let users opt into neutral routing when it matters.

- Recordkeeping and explainability. Save the chat, the rationale, the evidence, and the order. Make it exportable. Teams will need this for operations, not just regulation.

What it means for retail traders

Retail users get three benefits right away:

- Faster diligence. Ask who is buying, how concentrated holders are, or whether a contract has risky permissions, and get a sourced answer in seconds.

- Personalized guidance. The agent sees your positions, then explains how a new trade would change exposure and correlation.

- Fewer tabs, more clarity. You do not need to reconcile multiple dashboards when the agent assembles a clear picture on demand.

The risks are equally clear. Convenience can encourage over trading. A friendly voice can over persuade. The fix is product design: conservative defaults, small size caps until a user demonstrates discipline, and prominent statements about what would need to be true before any risky action.

What it means for professional teams and funds

For pros, a vertical agent is a force multiplier rather than a replacement. It can:

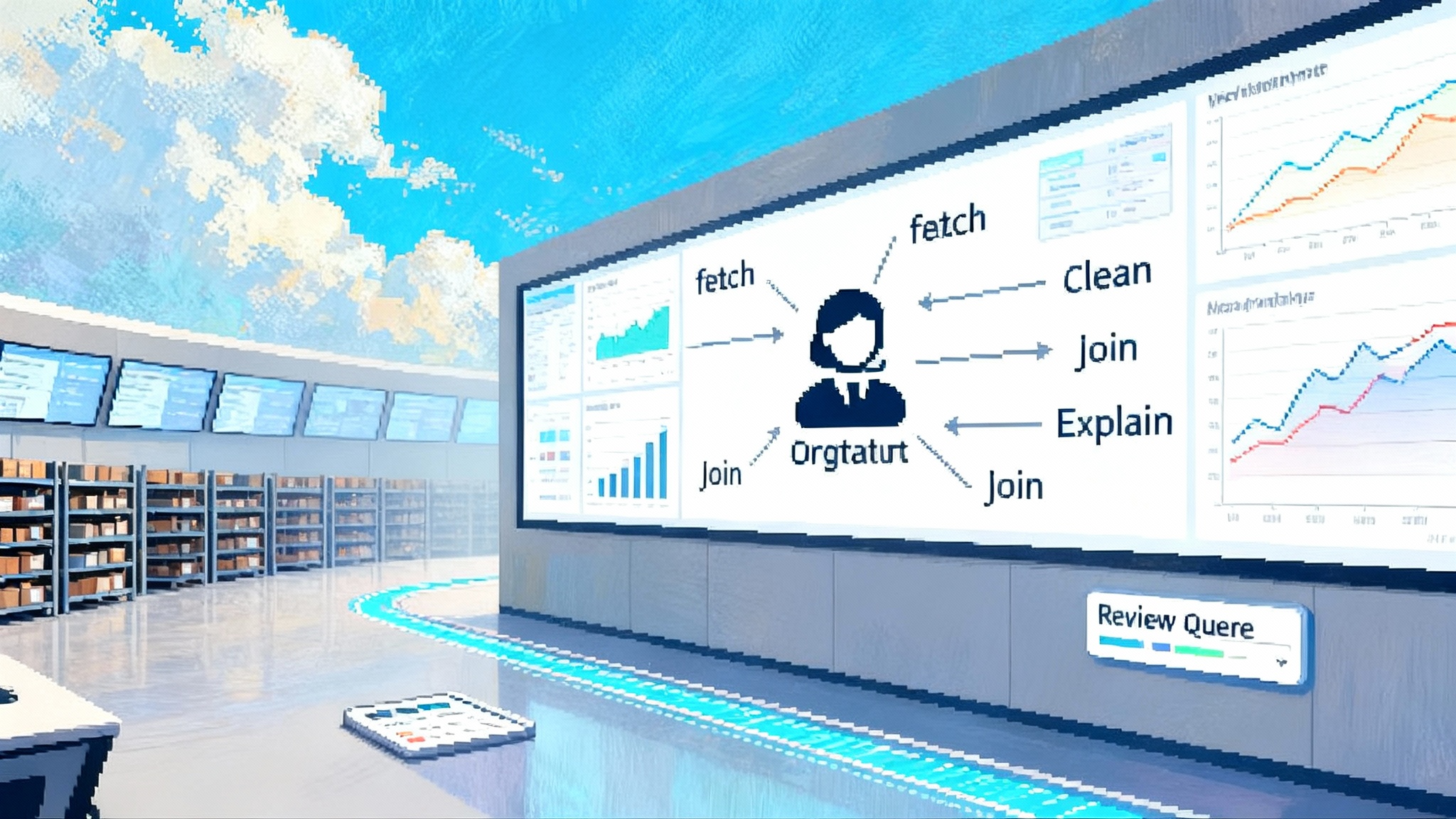

- Generate briefs your PM will actually read, with labeled counterparties and flow diagrams instead of walls of prose.

- Enforce mandate constraints during research. If the fund will not touch tokens under a certain float or with admin key risk, the agent can filter them out.

- Clip hours off routine tasks like attribution, cross venue liquidity checks, and compliance summaries.

The integration litmus test is whether the agent plugs into existing order management, custody, and risk stacks without forcing a rebuild. Teams will demand APIs for pre trade checks, notebooks for reproducible analysis, and policy objects that encode limits once for both humans and agents. This pattern rhymes with the move from dashboards to doers explored in the shift from dashboards to doers, and with the enterprise push toward agent platforms covered in Inside Algolia Agent Studio.

What exchanges should expect

Exchanges and brokers will feel two pulls at once. First, agents will become the default user interface for many investors. Second, the best agents will route orders across venues based on liquidity, price, and risk. This weakens the advantage of any single exchange’s front end and shifts competition to liquidity, reliability, and agent friendly tooling.

What to do about it:

- Ship agent SDKs that make account linking, risk limits, and previewable quotes easy.

- Offer attribution on price improvement and slippage so agents can score venues apples to apples.

- Align incentives. If an exchange wants preferred routing, it should offer tangible value in adverse selection protection or reduced fees under agent verified conditions.

The playbook for builders

If you are building the next wave of finance agents, Nansen’s launch hints at a workable blueprint.

-

Own a real data advantage. This is not just access. It is curation, coverage, freshness, and labels that matter to decisions.

-

Start with read only competence. Answer questions a human expert would be proud of. Cite evidence. Solve workflow pain before touching execution.

-

Build the action space carefully. Define a small set of safe, composable actions: fetch wallet flows, compute concentration, generate an order preview, submit with guardrails. Grow it slowly.

-

Align the agent to user constraints, not vibes. Teach it position limits, loss triggers, and time budgets. Make breaching a constraint impossible without a human override.

-

Measure what matters. Score on percent of answers with verifiable evidence, decision time saved, improvement in realized slippage, and drawdown control. Do not only track engagement.

-

Earn autonomy. Move from proposals to human confirmed trades to limited auto execution under hard caps. Reduce scope, not safety, when conditions get weird.

If your team is navigating analytics sprawl while adding agents, it is worth pairing this approach with a focus on explainable analysis. The same philosophy shows up in Agentic BI and the end of dashboards, where agents distill data into actions rather than reports.

Beyond trading bots: the specialized agent wave

Nansen’s move is part of a broader shift from general assistants to specialist operators. The pattern will repeat across finance and adjacent domains:

- Agentic underwriting for onchain credit that evaluates cash flows and collateral in real time.

- Compliance copilots that draft SAR narratives with links to exact transactions and counterparties.

- Treasury agents for DAOs and startups that enforce budget policies, manage runway, and rebalance stables and yields within defined risk bands.

- Tax and reporting agents that keep a running, evidence backed ledger of dispositions, cost basis, and jurisdictional quirks.

Each of these favors builders with a proprietary data spine and users who value outcomes over conversation. The lesson is simple. The general assistant era was about breadth. The agentic era will be about depth.

How we will know this is working

Six months from now, the telltales will be practical, not viral:

- Response quality measured by evidence coverage, not word count.

- Adoption among professionals who pay for speed and accuracy.

- Lower realized slippage for users who let agents route small orders under a budget.

- Fewer fat finger mistakes and faster incident response when markets jump.

If these show up, constrained autonomy will feel less like a risk and more like a safety feature. The best agents will become the calmest traders in the room.

The bottom line

Nansen’s launch set a new baseline for what a trading chatbot should be. A vertical agent earns trust by grounding claims in onchain facts, proposing actions with clear limits, and exposing a path from chat to safe execution. That combination outperforms general chat for trading because outcomes matter more than eloquence. As more products follow this pattern, the question will not be whether to use AI for markets. It will be which specialized agent you trust with your next decision.

Nothing in this article is financial advice. Always do your own research and use strict limits when testing any form of trading automation.