Insurance’s Agentic Turn: Majesco Lands 13 AI Agents

On October 7, 2025, Majesco made 13 guardrailed AI agents generally available inside its Property and Casualty and Life and Annuity core suites. With telemetry and citations, this looks like the first scaled, compliant beachhead.

Breaking: 13 embedded agents land in the insurance core

On October 7, 2025, Majesco announced general availability of 13 guardrailed artificial intelligence agents embedded across its Property and Casualty and Life and Annuity core suites, covering quoting, claims, billing, and payments. The Fall 2025 release also includes telemetry, human‑in‑the‑loop controls, and a next‑generation document system called DocScribe that provides sentence‑level citations for every extraction. This is not a demo, not a pilot, and not a beta. It ships as part of the enterprise core. If you care about where autonomous software will first take root inside regulated industries, this is one to study. See the details in the Majesco Fall 2025 release.

Call the move what it is: the clearest at‑scale beachhead yet for vertical, compliance‑ready agents in a document‑heavy domain. Insurers have experimented with general‑purpose copilots at the edge of their stacks. The news here is different. Agents are baked into the core data plane and operational plumbing where transactions, documents, and decisions actually live.

Why this matters now

Insurance runs on documents, state rules, and auditable decisions. Quote bind issue. First notice of loss. Subrogation. Endorsements. The daily work is a parade of forms, long attachments, and deadlines. The systems that run this work are the core suites. By embedding agents inside those suites, Majesco changes the default speed of the back office. It also changes who gets to orchestrate models, guardrails, and human handoffs.

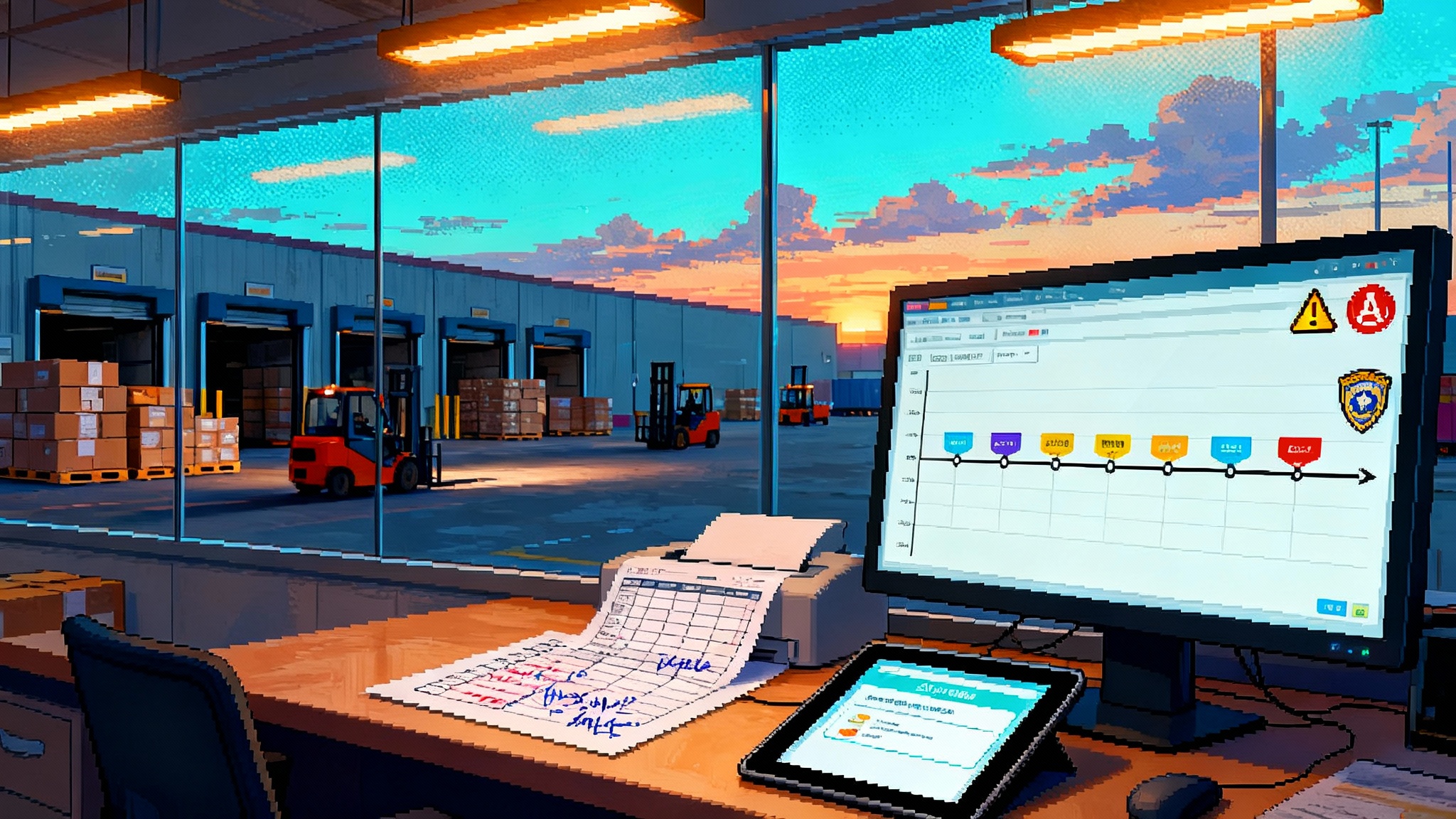

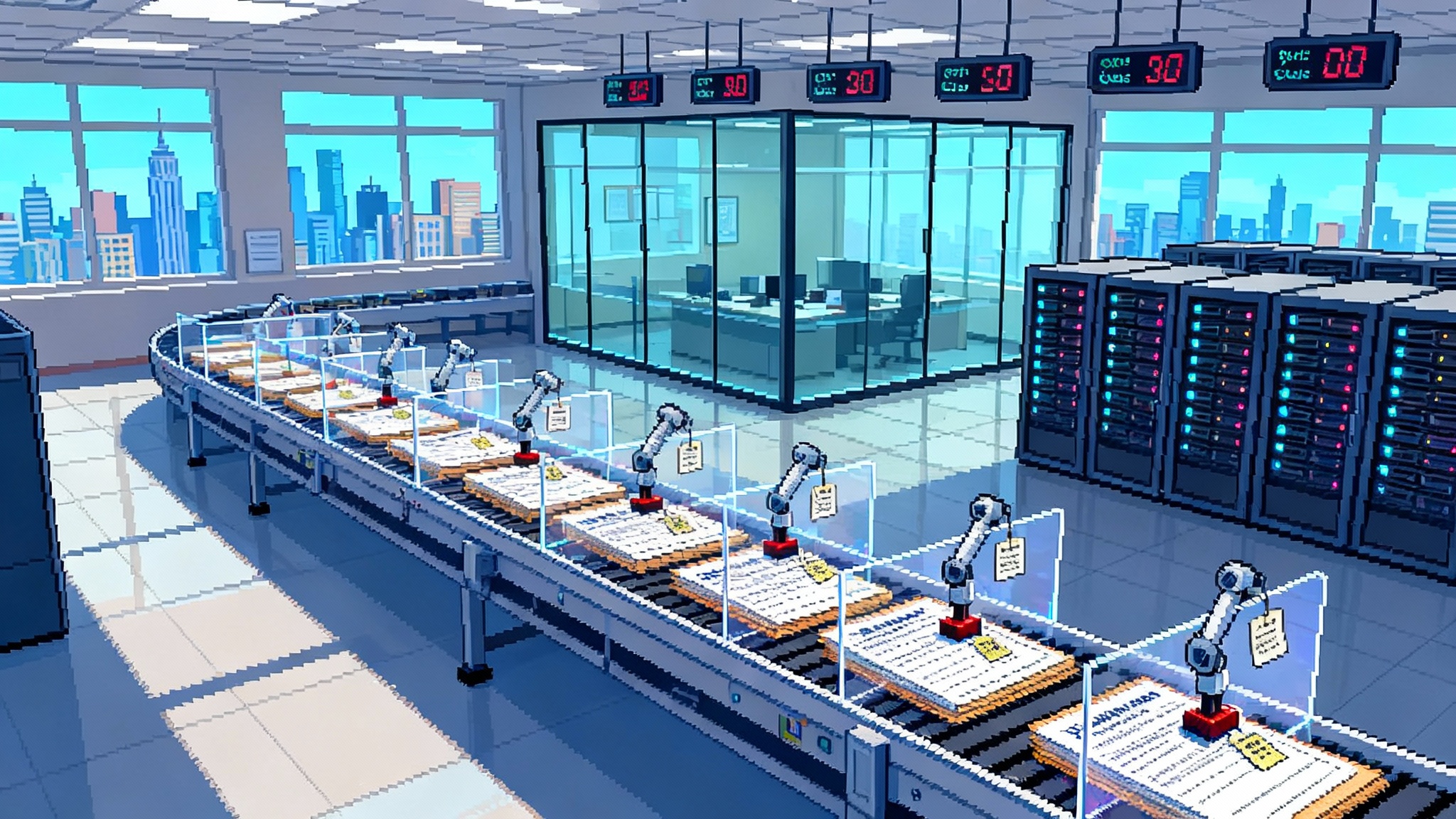

There is a simple way to visualize the difference. A bolt‑on copilot is a helpful headset. It can whisper suggestions and draft emails, but it stands outside the production line. An embedded agent is a trained co‑worker on the factory floor. It sees the conveyor belt, knows where materials come from, and can pick up the wrench without breaking safety rules. The second one moves throughput and reduces rework; the first one mostly saves keystrokes.

Embedded agents beat bolt‑on copilots

Bolt‑on copilots typically sit in a chat panel, call out to an API, and act on partial context. They usually cannot see the full policy, loss history, or billing exception path unless someone plumbs a one‑off integration. They rarely share the same telemetry, access control, and upgrade cycle as the core system. When a regulator or internal audit asks why a claim was denied or a rate changed, the answers live in two places.

Embedded agents invert that. They run where the data originates and where decisions are recorded. Because they share the same data model, permissions, and lifecycle as the core, every action can carry the right identifiers. That means a decision path that is inspectable and replayable, instead of a chat transcript stapled to a screenshot.

Concretely, this unlocks three things:

- Consistent context: agents can use the complete, canonical policy and claims records rather than a partial snapshot.

- Native controls: role‑based access, segregation of duties, and retention policies apply without custom code or third‑party glue.

- Unified telemetry: performance and quality metrics land in the same dashboards as core transactions, so leaders can measure outcomes rather than count prompts.

DocScribe’s sentence‑level receipts

If you have ever watched a claims team open a 180‑page medical packet, you know the pain. People tab through scanned forms, retype numbers, and paste findings into notes. Errors creep in. Reviews take days. Majesco’s DocScribe is designed to work the problem at production scale. It parses long documents, extracts fields, and attaches sentence‑level citations that show exactly where each value came from. Picture a data field for date of loss carrying a clickable reference to the line and page that supplied it. The agent does not just say trust me, it leaves a receipt.

This matters for compliance. United States insurance regulators have made clear that artificial intelligence must be governed, documented, and explainable. The National Association of Insurance Commissioners has adopted guiding principles and advanced a model bulletin that spells out expectations for accountability, documentation, and consumer protection. When an agent’s extraction and recommendation are paired with precise citations and an audit trail, the system aligns with those expectations. Read the NAIC model bulletin on AI for the regulatory direction of travel.

Telemetry, audit trails, and human‑in‑the‑loop by design

Guardrails do not live in a slide deck; they live in code paths. The notable choice in this release is to wire controls into the execution layer:

- Telemetry everywhere: timers, error codes, confidence scores, and reviewer decisions are captured as first‑class events. That lets teams build quality dashboards that plot cycle time, exception rates, and recovery steps. Leaders can tune the work, not just the model.

- Explicit audit trails: every agent action writes who, what, when, and why with identifiers that link back to the policy or claim. That is crucial for market conduct exams and internal audits.

- Human‑in‑the‑loop controls: reviewers are inserted at meaningful gates, such as approvals over a threshold or any extraction with low confidence. The platform can require a second set of eyes before a payment goes out or a cancellation triggers.

These are not nice‑to‑haves. They are what turn a clever prototype into an operational system that survives the first regulator inquiry and the tenth upgrade.

From workflow automation to outcome automation

Traditional automation moved work forward one step at a time: route a task, prefill a field, assign to a queue. Agentic systems aim at the outcome: issue a quote within target loss ratio, clear a claim within service‑level objectives, reconcile a payment with zero residuals. The difference is not just technical. It changes how teams measure success and how leaders design roles.

Consider quoting. A copilot might suggest coverage language and calculate a premium if someone feeds it the risk factors. An agent with access to underwriting rules, rating, and the document plane can pull the submission packet, extract the key attributes with citations, call rating, apply appetite, suggest endorsements, and draft customer‑ready terms. A reviewer approves or edits the output, and the agent incorporates that feedback into its playbook. What used to be ten screens and five handoffs becomes one review task with traceable logic.

Or take claims triage. The agent classifies the claim, checks policy in force, flags potential fraud indicators, proposes reserves, and drafts the correspondence. If the confidence on causality extraction drops, it escalates to a human adjuster with the relevant pages highlighted. That is outcome orientation. It is also how you move cycle time and leakage at the same time.

What lands today, without the hype

According to the release, the agents span both Property and Casualty and Life and Annuity core suites. They cover quoting, claims triage, billing, payments, cancellations, and related workflows. The package arrives with telemetry, analytics, and performance improvements, including better document generation and multithreaded batch processing. Loss Control adds an agent and a copilot to accelerate surveys and inspections, again with audit trails. The emphasis is plain: ship capabilities that reduce manual work on the highest volume back‑office tasks.

This is not to say everything is solved. Agents still depend on data quality and clear operational rules. Some jurisdictions demand special disclosures. Certain high‑severity decisions will remain human‑only for now. But the center of gravity just moved.

How this fits the broader agentic shift

We have been tracking where autonomy lands first. In finance operations, Ramp’s agents for payables showed how outcome‑oriented flows change approval cycles and exception handling. In customer experience, agentic AI makes CX the first autonomy beachhead by meeting customers in real channels and closing loops with measurable service levels. On the analytics side, agentic analytics on the semantic layer is turning dashboards into decisions.

Majesco’s move brings that same pattern into the heart of a regulated, document‑heavy industry. The difference is that the core suite defines the runtime, the telemetry schema, and the upgrade cadence. That concentrates power and responsibility where it already lives, which is exactly what governance teams want.

Three shifts to expect by mid‑2026

- Agent marketplaces inside core suites

Core vendors will curate catalogs of vetted agents, templates, and micro‑flows that can be installed like plug‑ins. Think claim setup agents tuned for personal auto versus workers compensation, or billing agents specialized in premium finance reconciliations. Marketplaces lower time to value and give risk teams a predictable approval surface. Expect insurers to standardize on a small set of approved agents per line, with configurable guardrails and logging patterns baked in.

- Model‑agnostic orchestration

If agents are about outcomes, the choice of foundation model becomes a tactical decision rather than a religion. Orchestration layers will select models based on task, jurisdiction, or data residency, and will switch when prices or quality move. Underwriting extraction might run on one model with strong tabular accuracy, while narrative summarization runs on another model that excels at long‑context reasoning. The orchestration layer must carry the guardrails and citations with it, so that swapping a model never breaks auditability.

- New vendor power dynamics

When agents live inside the core, the core vendor controls the default runtime, the telemetry schema, and the upgrade train. That raises the bar for point‑solution copilots and reduces the surface area for custom integration shops. It also makes domain expertise and data stewardship more valuable than general‑purpose model access. Insurers will still buy best‑of‑breed tools, but those tools will increasingly plug into the core agent runtime rather than bolt on at the edge. Procurement will evaluate vendors on how well they honor the core’s guardrails, not just the flash of a demo.

A 90‑day action plan for insurers

Here is a concrete plan to separate noise from signal and move value to production without inviting risk.

- Pick two outcomes, not ten features. For example, reduce small‑claim cycle time by 25 percent and shrink billing exceptions by half. Tie agents to those targets and instrument them.

- Write a guardrail specification. Define which actions require human approval, confidence thresholds that trigger review, and what gets logged for audits. Use business language, then translate to policy.

- Run a double‑entry period. Let the agent do the work and keep the human process in parallel for a few weeks. Measure deltas in speed, accuracy, and rework. Use the findings to set final thresholds.

- Wire telemetry to business dashboards. Exposure leaders should see cycle time, exception rate, and dollar impact on the same page, not in a separate artificial intelligence console.

- Update your model governance memo. Reference the NAIC principles and your state guidance, document your testing, note your human‑in‑the‑loop steps, and describe how sentence‑level citations will be stored for later review.

Where autonomous agents will quietly win first

The flashy dream of artificial intelligence sells front‑office magic. The reality in 2026 will be quieter. Autonomous agents will win where the work is boring, gated by rules, and drowning in documents. That is billing reconciliation. That is endorsement processing. That is claim intake and triage. These are places where you can encode the outcome, isolate risk, and capture clean telemetry. They are built for receipts, not vibes.

There is a deeper implication. Once the back office runs on agents with citations and audit trails, the ground truth of the business changes. Training materials, quality reviews, and even performance incentives can attach to data rather than anecdotes. Leaders can ask how often a reserve was adjusted after payment and pull exact counts with explanations. That kind of visibility is how a function compounds operational improvements.

What to watch as adoption scales

A few signposts will tell you how quickly this shift spreads:

- Upgrade cadence: embedded agents that ride the core’s upgrade cycle will compound faster than one‑off bots. Watch release notes, not show‑floor demos.

- Benchmarkable outcomes: vendors will publish cycle‑time and exception‑rate deltas by line of business and geography. Ask for ranges, not single numbers.

- Contract language: more deals will include service‑level objectives for agent accuracy, human approval thresholds, and log retention. Those terms become the operating guardrails.

- Role redesign: reviewers will look more like editors and adjudicators. Entry‑level work shifts to supervising agents, checking citations, and handling exceptions.

- Data hygiene: programs that start with a data‑cleanup sprint will outperform. Bad data turns agents into brittle scripts.

The bottom line

This release is a breakthrough because it puts agentic software where it can be governed, measured, and improved. Agents that live in the core data plane inherit the controls and context that regulated industries require. They swap the novelty of a chat window for the utility of receipts and telemetry. That is how back‑office work changes shape. Not with slogans, but with fewer rekeys, shorter queues, and cleaner audits.

The cadence of enterprise transformation is often quiet. It starts with the plumbing. Majesco just turned the valve. If you want to see where autonomous systems will first reshape enterprise software, watch the boring parts of insurance. That is where the agents now clock in, collect their citations, and ship outcomes at scale.