AP Goes Autonomous: Inside Ramp’s Agents for Payables

Ramp just switched on Agents for AP, a context aware system that codes invoices, guides approvals, and can pay when allowed. Here is why this leap from scripts to autonomy matters and how to ship it safely.

A switch flips in the back office

On October 7, 2025, Ramp announced Agents for AP, a set of autonomous capabilities inside its Bill Pay product that code invoices, guide approvers, and, with permission, execute payments. The company describes the release as a break from brittle rules toward context aware action. You can see the framing in the company’s own AP just became autonomous announcement.

This is not another pass at optical character recognition that turns paper into pixels. Agents for AP ingest the same context a human analyst would use: prior invoices from the vendor, contracts and purchase orders, approval history, and the accounting logic that governs how your business books spend. Then they act. They pick general ledger codes for line items, propose approvers with rationale, and, if allowed, complete a payment in the correct vendor portal.

For years, accounts payable software digitized the journey but left humans hiking. Invoices moved from inboxes to portals. Rules routed approvals. Yet the thinking still fell to people who had to remember vendor quirks, policy exceptions, and which shipping address implied which cost center. The promise of autonomous agents is different: fewer clicks, fewer follow ups, and fewer chances for drift between policy and practice.

From scripts to senses

Scripted automation is a turnstile. If data hits the right dimensions and flags, the turnstile spins. The moment anything falls outside a predefined pattern, a person steps in. Procurement and payables are messy by design. Vendors change item descriptions. Projects shift mid quarter. Approvers want to know if the bill looks like the last three from that supplier.

An autonomous agent behaves more like a concierge. It gathers context across systems, weighs what matters, and proposes or performs the next step. Two examples make the difference concrete:

- A rule might say: if the vendor is CloudCo and the amount is under 5,000 dollars, route to IT and code to software. An agent can inspect line items, link object storage to a prior S3 category, notice the ship to plant is in Ohio, and split the entry across two cost centers because similar bills were coded that way after the August reorg.

- A rule can route approvals based on department. An agent can see that the project closed last month, read the contract clause about true ups, and recommend routing to the budget owner who signed the change order, not the default manager.

The hinge is contextual grounding. Without it, automation becomes a maze of exceptions. With it, workflows feel elastic instead of stiff.

What it takes to productionize autonomy in AP

Shipping a demo agent is easy. Shipping a production agent that touches real money with audit grade traceability is the work. Here is what changes when you commit to autonomy in payables.

1) A policy engine the model cannot bend

- Encode payment ceilings, vendor risk tiers, and dual approval rules as hard constraints. The agent should reason within policy, not try to learn policy from examples.

- Maintain an allow list of payment methods by vendor and geography. Disallow high risk routes regardless of model confidence.

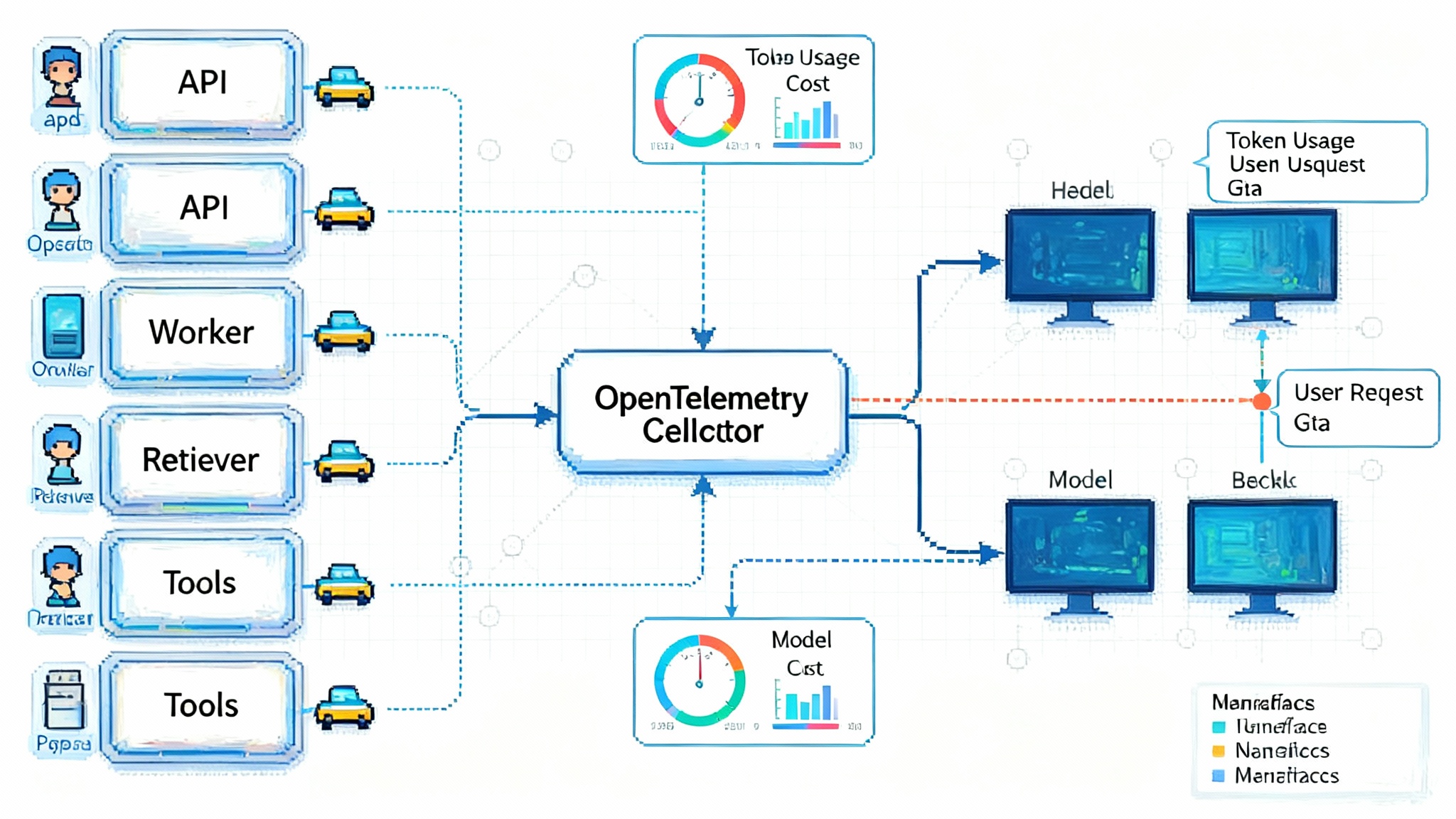

2) Context retrieval that is deterministic and debuggable

- Build a vendor graph that links legal entities, tax identifiers, bank accounts, contracts, purchase orders, prior invoices, and approval histories. Retrieval must be versioned so you can replay the exact context the agent saw for any decision.

- Use a retrieval index that is explainable. When an agent cites a prior bill, show the document pointer and the snippet that influenced the decision.

3) Decision logs that read like a junior analyst’s notebook

- Every action needs a rationale. Capture features considered, confidence scores, policy checks applied, and which tool calls executed. Store this alongside the before and after state in the ledger.

- Version the model and the prompt template. If accuracy changes week over week, you need to know if it was a model update, a prompt tweak, or a shift in upstream data.

4) Deterministic checks ahead of model output

- Keep three way matching as a first class tool. Let the agent request a match, but keep the matcher deterministic and auditable.

- Validate vendor banking changes out of band. Require identity and account verification before the agent uses new remittance data.

5) Progressive autonomy with a kill switch

- Start with propose only mode for coding and approvals. Graduate to auto apply for low risk vendors under a dollar threshold. Require human sign off for payments until your false positive and false negative rates stabilize.

- Implement a one click freeze that halts payments and reverts to proposal mode across the tenant if anomaly rates spike.

6) Latency budgets and backpressure

- Agents are not useful if they block the month end close. Give invoice ingest and coding a single digit second budget. If the agent cannot decide in time, fall back to a safe default code and flag for review.

- Rate limit external portal interactions. If vendor sites throttle, the agent should queue card payments without failing the bill.

7) Evaluation that mirrors the real world

- Build a harness with messy data. Include duplicates, renamed line items, and lookalike bills that code differently due to subtle project rules. Score by invoice, by line, and by dollar weighted error.

- Track autonomy rate by vendor cohort and by spend category. An overall number hides the long tail where humans still drown.

Ramp reports that its agents now prefill most accounting fields correctly on the first pass and that early users saw more than one million dollars in fraudulent invoices flagged within 90 days. You can find those claims in the company’s press release detailing early metrics.

Why AP is a capital efficient first domain

Finance leaders are under pressure to improve cash conversion and cut operating expense. Accounts payable is the rare function where autonomy unlocks both. Several properties make it an attractive starting point.

- Bounded action space. The universe of valid actions is small compared with customer support or sales. You code to known charts of accounts, pick from finite approver lists, and pay through a handful of rails. A constrained canvas reduces safety risk.

- High quality feedback loops. Every invoice either posts or it does not. Every approval either was needed or not. You can measure autonomy rate, exception rate, and rework precisely. That lets you improve agents quickly without heroic labeling.

- Obvious unit economics. Time saved per invoice multiplies across thousands of bills. Card payments can capture interchange or cashback. Early fraud detection prevents the most expensive mistake of all.

- Contained blast radius. With guardrails and staged limits, the worst case is usually a miscode or a delayed payment, not a customer churn event. You can scale autonomy vendor by vendor and raise thresholds as trust grows.

If you are tracking how autonomy enters real companies, see how customer experience is evolving as a first beachhead in our analysis of agentic AI makes CX autonomous. Patterns from CX translate cleanly to AP: tight scopes, measurable outcomes, and clear safety rails.

What changes inside the finance team

Autonomy does not replace people. It changes when they are needed. Controllers and AP managers get to invest more time upstream in clean vendor data, sharper policies, and proactive exception handling. The human loop moves toward judgment and away from tab switching.

Consider the daily cadence once an AP agent is live:

- New invoices land, get parsed, and are coded with references to prior bills and the relevant contract clauses. Reviewers see the rationale inline.

- Approvals route with context the approver actually needs. Instead of a PDF and a blind request, they see how the entry compares to the last three bills, whether the project has closed, and what policy rules were applied.

- Payments queue with confidence and policy checks visible. A human can accept, edit, or hold with a single click, and the agent learns from the outcome.

Better tooling also lets finance own more of the system behavior. Teams can define autonomy budgets per vendor, per dollar bucket, and per payment rail, then raise limits over time. That control function becomes a core competency, not a ticket to engineering.

From AP to agent to agent commerce

Once an agent can read an invoice, find the purchase order, justify the coding, and pay, the next step is to remove the human intermediary on both sides of the transaction.

- Agent to agent payment negotiation. A buyer agent could ask a supplier agent for a two percent discount for payment in 10 days, check cash on hand, and schedule the payment. The supplier agent could counter with one and a half percent in 5 days based on its own working capital model.

- Portal navigation becomes protocol. Today, many payments require logging into vendor portals. As more vendors expose programmatic endpoints, buyer agents will exchange signed requests for payment and remittance advice directly. Electronic Data Interchange has existed for decades. Agents make it usable without a heavy integration project each time.

- Continuous reconciliations. If both sides are agentic, a supplier’s agent can send structured shipment confirmations that the buyer’s agent matches against the purchase order. Disputes can be flagged instantly instead of at month end.

- Procurement on autopilot. For recurring spend like software or freight, an agent can monitor usage, compare options, and renew or rebid with human oversight at pre set checkpoints.

If you want a preview of that future, study how hiring is already tilting toward automation in our report on bot to bot hiring deals. The precedent is clear. Once both sides are autonomous, negotiation protocols emerge and throughput jumps.

The builder’s playbook for auditable finance agents

The fastest path to value is narrow scope, strong controls, and steady expansion. Use this sequence as a template.

-

Choose a narrow slice with clear payback. Start with a well instrumented vendor cohort. For example, pick the top 50 vendors by bill count and exclude anything with construction retainage or complex taxes. Define a target autonomy rate and a maximum acceptable error by dollar.

-

Canonicalize your vendor and document graph. Merge duplicates across legal entities. Attach bank accounts, W 9 forms, contracts, purchase orders, and historical invoices to each vendor record. Normalize item descriptions where possible and map common phrases to spend categories.

-

Decide what the agent is allowed to do. Begin with propose only coding and approval recommendations. Require human review for payments until you hit accuracy thresholds for two months in a row. Write stop conditions for fraud flags or low confidence events and define the escalation path.

-

Build deterministic tools, then let the agent orchestrate. Tools include three way match, bank account verification, vendor risk checks, and an approval path builder. Keep these as separate, testable services. The agent should call tools to gather facts, then propose or perform the action. Log tool inputs and outputs.

-

Ground the model with auditable retrieval. Use retrieval augmented generation to feed the agent only the relevant parts of contracts, purchase orders, and prior bills. Store document pointers and snippets used. Prefer structured outputs with enumerated options for codes and cost centers.

-

Establish an evaluation harness before you scale. Sample a diverse set of invoices, including ugly scans and near duplicates. Score accuracy by line and by total. Track decision latency. Run monthly drift checks and update mappings when vendors rename items or your org shifts cost centers.

-

Add human feedback loops that improve the system. When reviewers correct a code, capture the reason. Was it a new vendor rule, a contract change, or a one off? Use that signal to update mappings or policy, not just the model.

-

Monitor with metrics that matter. Track autonomy rate by vendor, spend category, and dollar bucket. Watch exception rate and rework minutes per invoice. Measure fraud alerts resolved and prevented dollars. Instrument time to post and time to pay.

-

Plan the rollout like a product, not a project. Market the change internally. Show approvers how recommendations arrive with context so they can decide in seconds. Offer a self serve escape hatch so anyone can take manual control on tricky invoices and explain why.

-

Write the audit story as you build. Create a standard report that shows, for any bill, the inputs retrieved, policies applied, tools called, the agent’s rationale, and who approved what. Auditors should not need to learn your system to follow the money.

-

Price with outcome alignment. If you are a vendor, consider pricing that rises with autonomy. Customers feel value when busywork disappears. Align incentives so both sides want more autonomy where it is safe.

-

Keep a human in the loop for ethics. Some decisions are technically correct but reputationally poor. Keep human oversight for vendor changes, approval path overrides, and large off cycle payments.

If you are building the plumbing that agents depend on, there is a growing case for standard interfaces and tool catalogs. For a view of that movement, see our take on the USB C moment for agents. Interchangeable tools and predictable protocols shorten the distance between a working demo and a trustworthy production agent.

Practical pitfalls and how to avoid them

- Inconsistent vendor identities. If a supplier appears as three entities in your system, retrieval will misfire. Invest early in a canonical vendor record and require supporting documents to be attached.

- Hidden policy logic. If policy lives in slides and tribal memory, your agent will behave like a bright intern. Move rules into a declarative policy engine and treat changes like code deployments.

- Latency blind spots. A powerful agent that takes 30 seconds to code a bill will get bypassed at month end. Set budgets and enforce fallbacks that keep the close on schedule.

- Portal fragility. Many payments still flow through vendor portals. Build queuing and retry behavior, and keep health checks on external endpoints so your agent does not create silent failures.

- Evaluation that ignores dollars. A high accuracy score on small line items can hide large dollar mistakes. Weight accuracy by dollar and review errors that move the P and L.

What to measure in the first 90 days

- The share of invoices where the agent prefilled all accounting fields and a human approved without edits.

- The autonomy rate by vendor cohort, especially top 50 by bill count and top 20 by spend.

- Exception rate and minutes of rework per invoice for the reviewers who handle the long tail.

- Fraud alerts triggered, investigated, and prevented dollars.

- Time from invoice ingest to post, and from post to pay, segmented by payment rail.

Treat these as your early warning system. If autonomy stalls below your target, inspect the vendor graph for missing context, check the policy engine for contradictions, and review the playbook steps above.

The bottom line

Autonomy in accounts payable is not about removing people. It is about removing the drag of tasks that sap attention and introduce error. With Agents for AP, Ramp put a stake in the ground that finance software can sense and act, not just route and wait. The elements that make it credible are the hard parts: context retrieval that can be audited, policies that are unbreakable, and a rollout that prefers safety to spectacle.

Finance leaders have a window to move first while the terrain is favorable. AP has bounded actions, clear payback, and strong guardrails. Build the vendor graph, define the constraints, and start the agent in propose only mode. Measure, expand, and only then let it pay. Do that well, and you will be ready for the next turn of the flywheel, when an agent does not just process a bill but negotiates the terms, schedules the payment, and reconciles the result in hours, not weeks.