Chat to Checkout Is Live: ACP vs AP2 and what to build

Instant Checkout in ChatGPT moved agentic shopping from demo to real orders. We compare ACP and Google’s AP2, why they matter for merchants and platforms, and the concrete playbooks and product ideas to ship in the next 90 days.

The moment chat to checkout arrived

OpenAI flipped the switch on Instant Checkout inside ChatGPT, and with it the first mainstream rail for agentic shopping. In plain terms, you can ask for a gift, see real products, and complete a purchase without leaving the conversation. That experience is powered by the Agentic Commerce Protocol, a new standard co‑developed with Stripe that lets agents, merchants, and payment systems speak the same language. OpenAI calls this the start of agentic commerce and explains how Instant Checkout works, what merchants control, and why the protocol is open for others to build on in its announcement of Instant Checkout and the Agentic Commerce Protocol. The details are summarized in the OpenAI Instant Checkout and ACP overview.

The headline is not just that shopping happens inside a chat. The headline is distribution. Hundreds of millions of people already spend time inside conversational interfaces each week. Turning those minutes into a native purchase flow changes the path to revenue for both startups and incumbents. Browsers and blue links are no longer required waypoints. The conversation itself becomes the store, the product shelf, and the checkout line.

Why ACP matters: a merchant‑first rail for agents

The Agentic Commerce Protocol is designed around a few principles that will feel familiar to any operator who has ever had to protect margin and brand:

- Merchants stay the merchant of record. Payment flows to the merchant. They can accept or decline orders based on inventory, risk, or policy.

- Existing stacks stay in place. The protocol does not demand a new commerce platform. It defines a standard way to start and update checkout sessions, pass buyer and cart context, and finalize an order. If a merchant already uses Stripe they can turn on agentic payments quickly. If they use another processor, they can still participate through delegated payment and shared token approaches spelled out in the spec.

- Trust is explicit. Users confirm each step, payment tokens are scoped, and the protocol carries a verifiable record of what the user saw and approved.

Think of ACP like a universal translator at the register. A user’s agent says, “I want this ceramic mug, gift wrap, arrive by Friday, under seventy dollars.” The merchant responds with an authoritative cart: item, taxes, shipping method, and any constraints. The agent may adjust options on behalf of the user, but the merchant defines the authoritative truth of price, availability, and policy. The result is a checkout flow that can live inside many agents without asking merchants to rebuild their back office.

Instant Checkout uses ACP to power a concrete, limited scope. It starts with single‑item purchases and a shortlist of payment methods and platforms. That focus is a feature, not a bug. It means merchants can adopt a working rail now and expand over time as carts, bundles, and more regions are added.

Google’s AP2 arrives: a rival vision of agent payments

Two weeks before ACP went public, Google introduced the Agent Payments Protocol, known as AP2. The company describes AP2 as an open protocol for agent‑initiated payments that composes with two other pieces: Agent to Agent messaging, often shortened to A2A, and the Model Context Protocol, or MCP, which is a way for agents to request tools. AP2 specializes the payments layer. It standardizes how agents generate mandates that capture user intent, how those mandates get signed and verified, and how an auditable trail flows through the ecosystem. Google’s announcement lists dozens of launch collaborators from card networks to acquirers to fintechs. You can read the framing in the Google announcement of AP2 protocol.

AP2’s most interesting concept is the split between an intent mandate and a cart mandate. The intent mandate is like telling an assistant, “Find me a carbon steel pan under one hundred dollars, nonstick coating preferred, deliver by Thursday.” The cart mandate is the moment you approve a specific cart with a specific merchant. AP2 allows fully automated purchases only when the user grants a more detailed, time‑boxed mandate. The design tries to solve a future problem today: how do we keep an agent’s autonomy while preserving user consent, auditability, and the ability to unwind a mistake.

ACP vs AP2: what really differs

We now have two ambitious standards that overlap and diverge.

- Scope and sequence. ACP is narrower and ships with a flagship experience in ChatGPT. It is tuned for near‑term utility and integrations that match how merchants sell today. AP2 aims broader. It sketches a world where many agents negotiate with many merchant agents across many payment methods, with consent and audit primitives baked in.

- Adoption wedge. ACP’s wedge is distribution. If you want to sell when the conversation becomes shoppable in ChatGPT, you integrate ACP. AP2’s wedge is ecosystem gravity. It pulls in networks, processors, and wallets that already handle global payments at scale.

- Philosophy of control. ACP preserves merchant control by treating the merchant system as the authoritative source of price and policy during checkout. AP2 preserves user control by formalizing intent and cart mandates that are cryptographically verifiable across participants.

This is not VHS versus Betamax. The most likely outcome is layered coexistence. A merchant might expose an ACP‑compatible checkout surface to capture ChatGPT demand while also supporting AP2 mandates that flow through search, wallets, or partner agents. Shared patterns will emerge around product feeds, consent objects, receipts, and dispute data. Standards tend to converge where money, risk, and scale force them to.

The 90‑day plan: what builders should ship now

The opportunity is immediate. The risk is letting habits from web funnels blind you to how agents change the work. Here is a practical plan for the next ninety days.

1) Make catalogs and payments agent‑ready

- Publish a clean, high‑recall product feed that includes canonical identifiers, high quality images, structured attributes, delivery promises, warranties, return rules, and live availability. Agents need unambiguous data to make confident recommendations.

- Normalize price rules and promotions. If your promotional engine is opaque, agents will misprice carts or miss offers entirely.

- Map your payments stack. Identify your processor, tokenization strategy, and refund pipeline. If you are on Stripe, evaluate fast‑path enablement for agentic payments. If not, outline the delegated payment path you will take and test refund and partial capture behavior.

2) Ship adapters based on the Model Context Protocol

- Build MCP adapters that expose read and write operations for catalog, inventory, pricing, fulfillment, returns, and support. Model Context Protocol gives agents controlled tool use. Adapters are the safe handles.

- Publish test harnesses. Provide a sandbox endpoint that simulates common outcomes: out of stock, address mismatch, fraud review, split shipment, and partial refund. Agents learn through interaction. Your sandbox is the classroom.

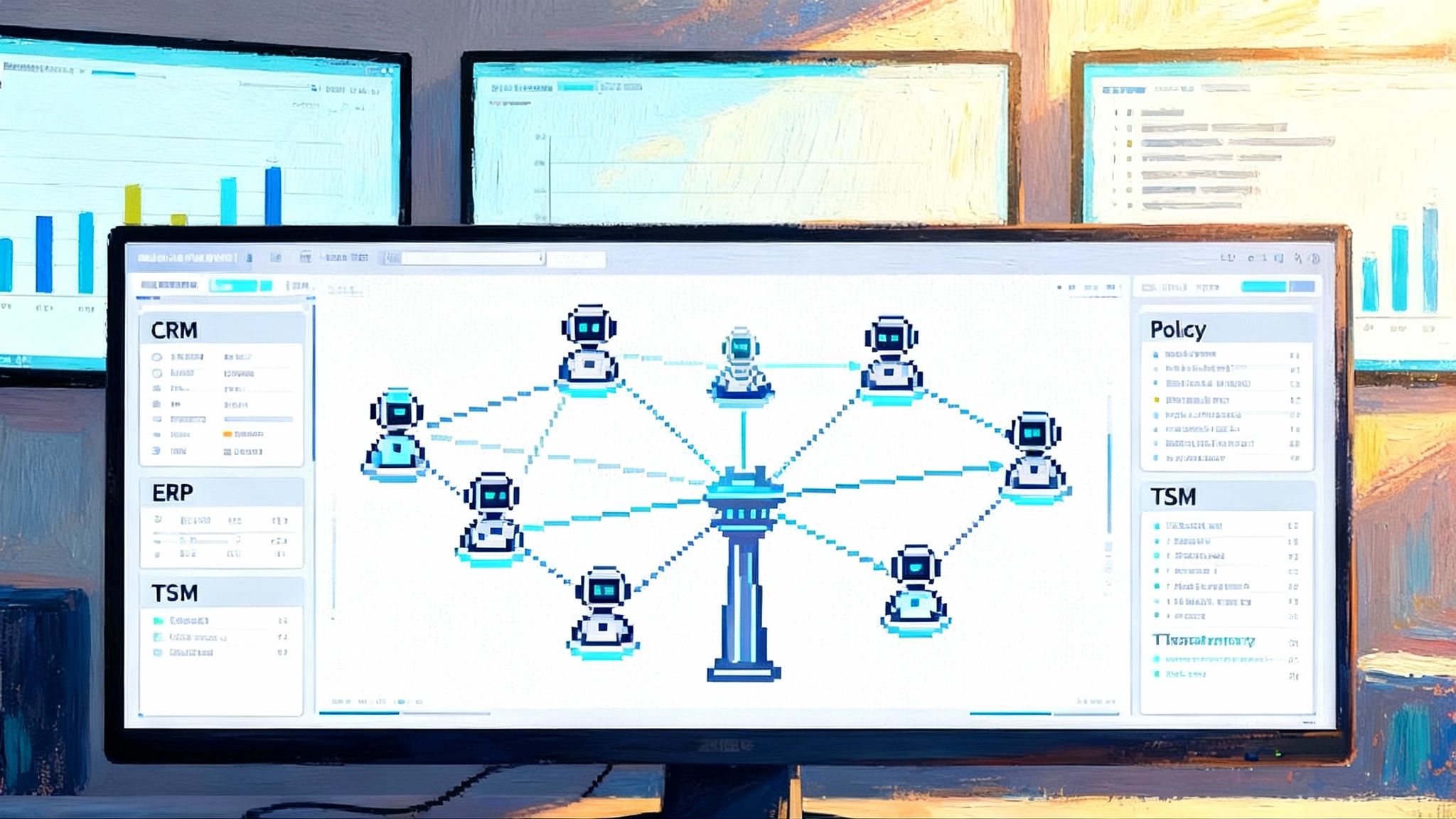

For a deeper view of how enterprises are operationalizing agent tooling, see how enterprise AI agents are real and note the implications for governance, observability, and ROI.

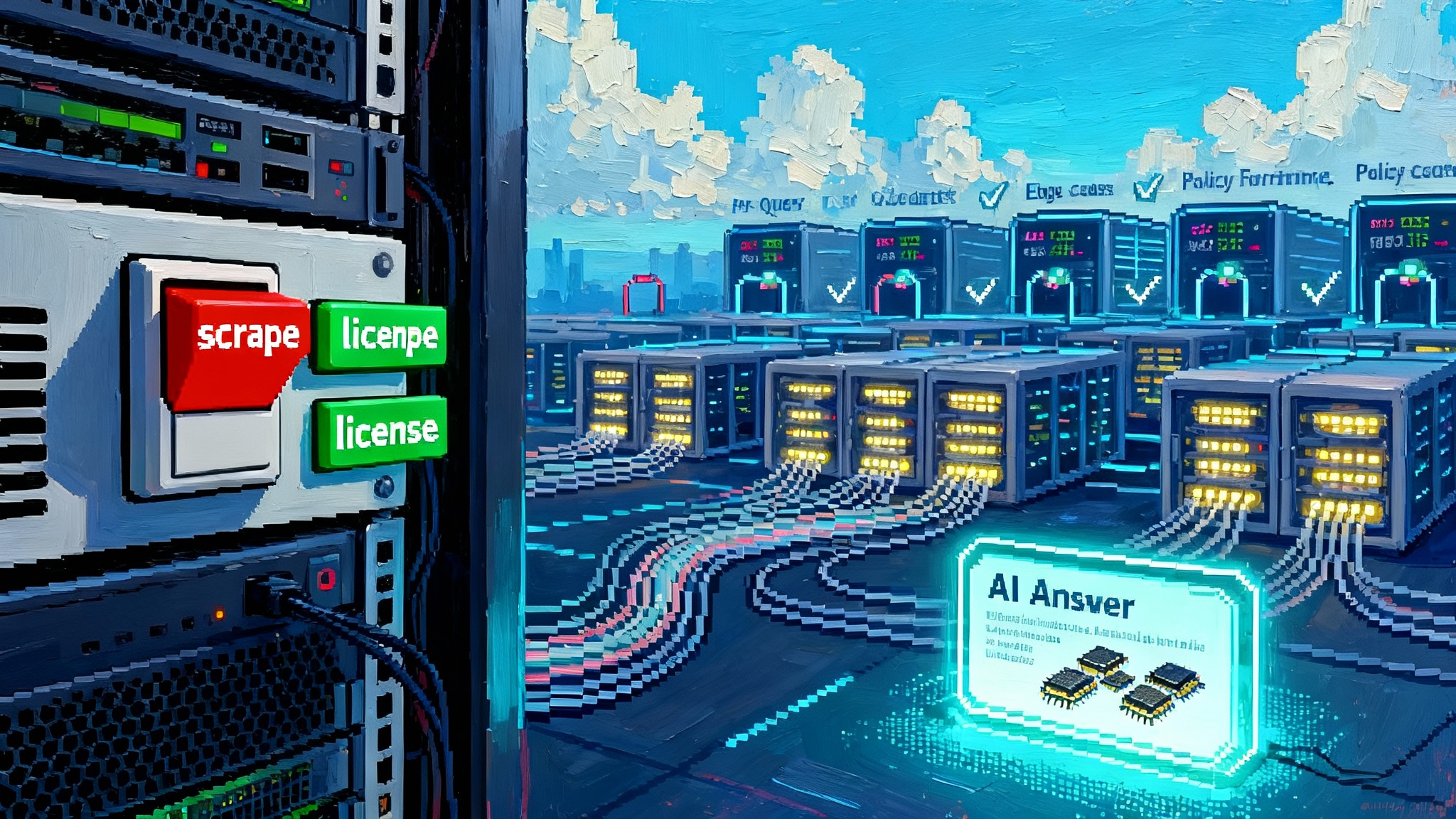

3) Layer in trust and verification

- Implement consent checkpoints. Whether you follow ACP’s session model or AP2’s mandate model, confirm key transitions: payment instrument selection, address changes, and final cart totals.

- Emit signed receipts that include item identifiers, taxes, fees, discounts, and policy links. Tag every receipt with identifiers that let you trace back to catalog versions and pricing rules.

- Store a compact, privacy‑aware action log for each agent‑mediated order. Think of it like a flight recorder. When a dispute hits, you will need to prove what was shown, what was confirmed, and what changed.

Runtime safety is not optional. Many teams are adopting runtime security for agentic apps to enforce guardrails on tool calls, data access, and transaction limits without blocking legitimate orders.

4) Design agent‑native funnels

- Replace web steps with conversational checkpoints. Instead of five pages, design three moments: intent capture, option refinement, and purchase confirmation.

- Build bundle logic that makes sense in dialogue. If a user asks for trail running shoes, your agent should propose socks and a hydration flask with a clear discount and delivery promise.

- Rethink retargeting. The follow‑up is a message in the original thread, not a banner on a news site. Use context from the conversation, plus consent, to nudge, confirm, or resolve.

Startup opportunities hiding in plain sight

Agent observability

- What to build: a platform that records and visualizes agent actions across discovery, checkout, and post‑purchase. Include replay, diff views between agent decisions and merchant policies, and alerting on outlier behaviors.

- Why it matters: when a thousand small agent decisions shape conversion, teams need to see cause and effect. Observability is the new heatmap, except it speaks in tool calls and consent objects instead of clicks.

- How to win: ship native support for ACP sessions and AP2 mandates, add guardrail tests that catch hallucinated fees or invalid coupons, and integrate with incident channels used by operations teams.

Compliance and policy automation

- What to build: a rules and evidence engine that keeps agentic flows aligned with consumer law and network rules. Think disclosures, taxes, cross‑border restrictions, strong customer authentication, and accessibility checks.

- Why it matters: consent that is not compliant is not consent. Regulators and card networks will demand explainability and evidence.

- How to win: codify jurisdictional templates, produce machine‑readable disclosures, and attach them to receipts and session logs so that disputes and audits can be resolved with data, not anecdotes.

Returns and disputes as an API

- What to build: a unified returns, exchanges, and chargeback resolution service designed for agent‑originated orders. Provide standard events, shipping labels, refund rules, and escalation paths.

- Why it matters: agents remove friction at purchase, but they can magnify pain when something goes wrong. A neutral layer makes merchants more willing to open the channel.

- How to win: integrate directly with merchant order systems and with networks and acquirers. Bundle risk scoring that predicts return likelihood during option refinement so agents can steer toward lower risk baskets.

Agent search engine optimization

- What to build: tools that make catalogs visible and compelling to shopping agents. Provide schema validation, attribute completion, ranking diagnostics, and experiment frameworks that test phrasing and attribute emphasis.

- Why it matters: the new shelf is a ranked list that appears in a conversation. Merchants will fight for that first screen.

- How to win: observe the features that correlate with top placement inside agent results, predict gaps, and generate compliant fixes to feeds and on‑site data.

Integration playbooks you can run this quarter

Playbook for a Shopify merchant

- Enable Instant Checkout via your commerce platform’s ACP integration once available. Audit your product feed quality, then prioritize top margin items and time‑sensitive categories where speed to purchase matters.

- Add structured return and warranty data to your feed. Instrument order webhooks to emit agent‑aware events for fulfillment and support.

- Measure agent conversion separate from web conversion. Compare average order value, time to purchase, and return rate.

Playbook for an Etsy seller

- Focus on listings that benefit from conversational selling. Gifts with personalizable attributes convert well when the buyer can ask questions.

- Use high resolution images and complete materials and sizing attributes. Agents downgrade vague listings.

- Prepare for post‑purchase by templating messages that confirm personalization details and delivery windows inside the original thread.

Playbook for a direct to consumer brand on a custom stack

- Implement ACP’s checkout session endpoints in a sandbox. Connect to your payment gateway and risk system, then run scripted conversations that force edge cases: preorders, split shipments, and address changes.

- Build MCP adapters for inventory, pricing, returns, and support. Gate every write operation with a consent check and a policy validator.

- Pilot with a narrow product set that has clean attributes and reliable inventory, then expand once the operational playbook stabilizes.

Playbook for a marketplace or aggregator

- Treat agents as a new channel with distinct rules. Prevent double selling by reconciling inventory updates more frequently.

- Offer a marketplace‑wide returns and dispute program that agents can call as a single operation. Merchants that enroll get higher placement inside agent results because the post‑purchase experience is predictable.

- Build fair ranking signals that balance price, availability, shipping speed, and policy quality. Publish those signals so sellers can improve without guesswork.

For marketplaces where data gravity is strong, plan for agent compute closer to product data. As agent workloads move toward data stores and event streams, patterns from agents move into the database will start to matter to commerce teams as well.

Twelve month predictions to plan against

- Agent surfaces become a top three channel for product discovery in categories like gifts, home, beauty, and hobby. Merchants that feed clean attributes and clear delivery promises will capture disproportionate share.

- Web funnels get compressed. Instead of product page, cart, address, payment, confirmation, the dominant pattern becomes three conversational checkpoints. Merchants retire pages that only exist to move a user through form fields.

- New affiliate economics emerge. Rather than last click, merchants compensate agents based on contribution to option refinement and purchase confidence. Expect transparent bounties for structured data quality and reliable fulfillment.

- Loyalty shifts from points to permissions. Users will grant agents standing mandates for routine purchases under price caps with preferred merchants. The most valuable asset will be the consent to act inside a category.

- Returns and dispute data become ranking inputs. Agents will downrank items and sellers with poor resolution outcomes. This incentivizes better packaging, clearer sizing, and honest delivery estimates.

- The browser does not disappear, but it stops being the default place where a purchase happens. For many low‑consideration items, the entire journey will live inside a thread that starts with a need and ends with a receipt.

What to watch next

- Payment networks will publish agent‑specific tokenization and dispute rules. That will accelerate interoperability and reduce fear around fraud or automation gone wrong.

- Regulators will ask for evidence that consent is meaningful and repeatable. Keep your consent artifacts durable, queryable, and attached to receipts.

- The first agent‑native marketplaces will appear, with inventory APIs designed for conversational discovery and with fulfillment promises that are checked in real time.

- Interop work between ACP and AP2 will begin in earnest. Expect bridges or adapters that translate session states to mandates and back.

The takeaway

This is not a thought experiment. A real distribution rail for agentic commerce now exists, and a rival open protocol is rallying an ecosystem around consent and auditability. The winners will not be the loudest advocates of a protocol. The winners will be the teams that make their catalogs unambiguous, their payments stack verifiable, their returns painless, and their funnels conversational. Build those capabilities now, and the Internet of Agents will not feel like a threat to your business. It will feel like the channel you were preparing for all along.