The Savings Layer Arrives: Inside Price.com’s AI Shopping Agent

Price.com has launched a beta shopping agent that blends product discovery with coupons, cash back, price history, and price match logic. Here is how a savings layer could reshape feeds, affiliates, and margins fast.

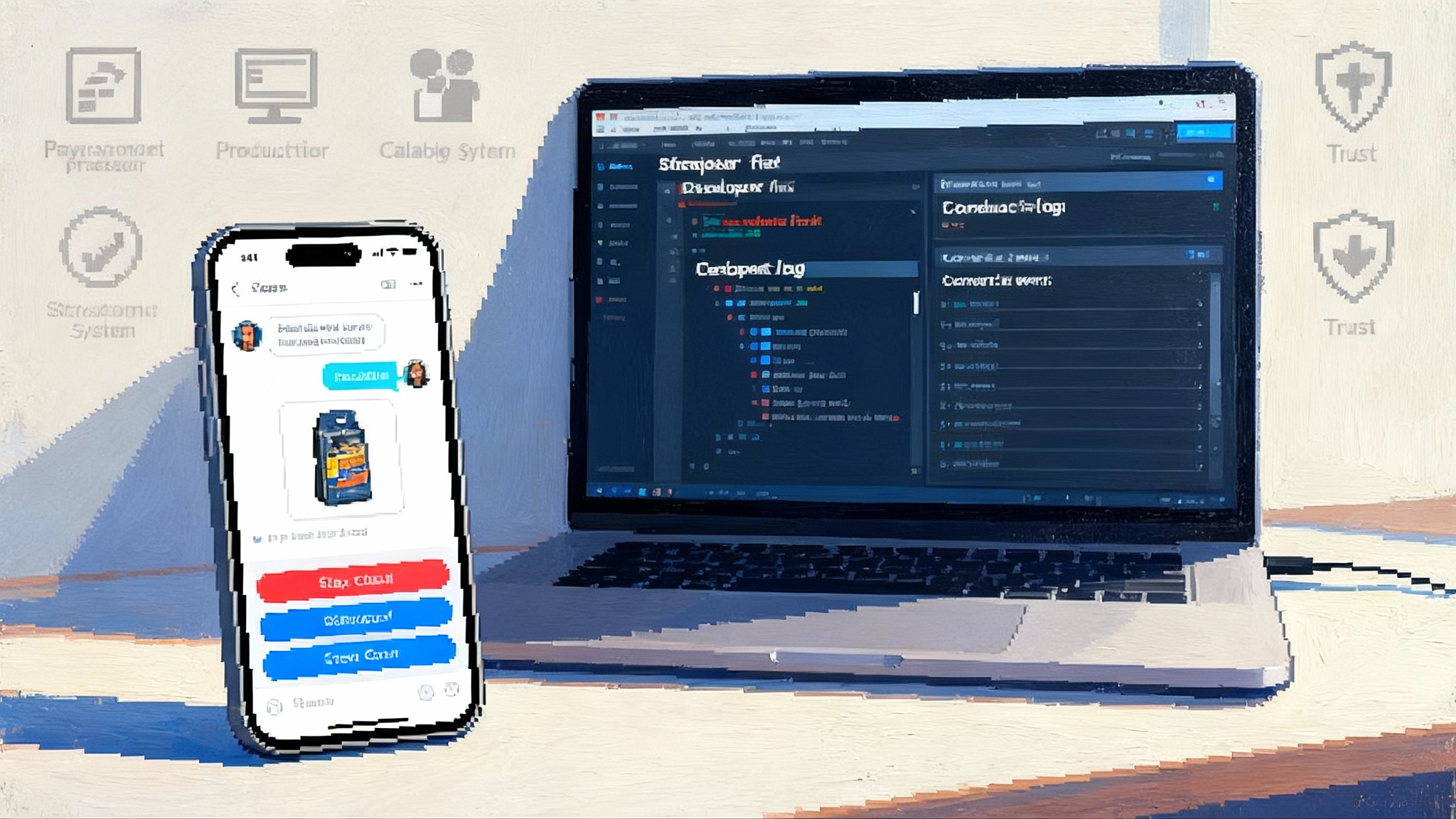

A conversational agent that knows how to save

On September 30, 2025, Price.com switched on a public beta for a conversational shopping agent that does more than recommend products. It brings coupons, cash back, real time price comparisons, and price history into the same chat, so discovery and savings sit inside a single flow. The company positioned it as an LLM system spanning over a billion products and more than one hundred thousand merchants, designed to help both consumers and retailers as the holiday season approaches. For details, read the official beta announcement.

If last decade’s shopping assistants were like travel agents with pamphlets, this one behaves more like a patient personal shopper with a calculator in hand. Ask for a 65 inch television under nine hundred dollars for a bright room, and you might get a shortlist that not only fits your viewing conditions but auto applies a ten percent code, adds five percent cash back, and flags that a competing store will price match. The conversation no longer ends at a product tile. It ends with money you did not have to hunt for.

Why the savings layer is the new default UI

A savings aware agent reshapes expectations in three practical ways:

-

It fuses intent and incentives. When you state the job to be done, the agent bakes in the optimal stack of discounts and rewards, instead of sending you to hunt for codes in another tab.

-

It makes price confidence measurable. Instead of wondering if you overpaid, the agent shows the components that led to the final price, including coupon success likelihood, cash back terms, and price history bands.

-

It moves discovery from pages to policy. The best result is not just the right product, it is the right product under the right merchant policy, including returns, price adjustments, and loyalty accrual. That requires new data structures.

This shift lines up with a broader move from static browsing to dynamic negotiation. In our look at chat driven purchasing, we mapped the technical patterns that remove friction from checkout. If you are exploring that frontier, you will find context in Chat to Checkout is live.

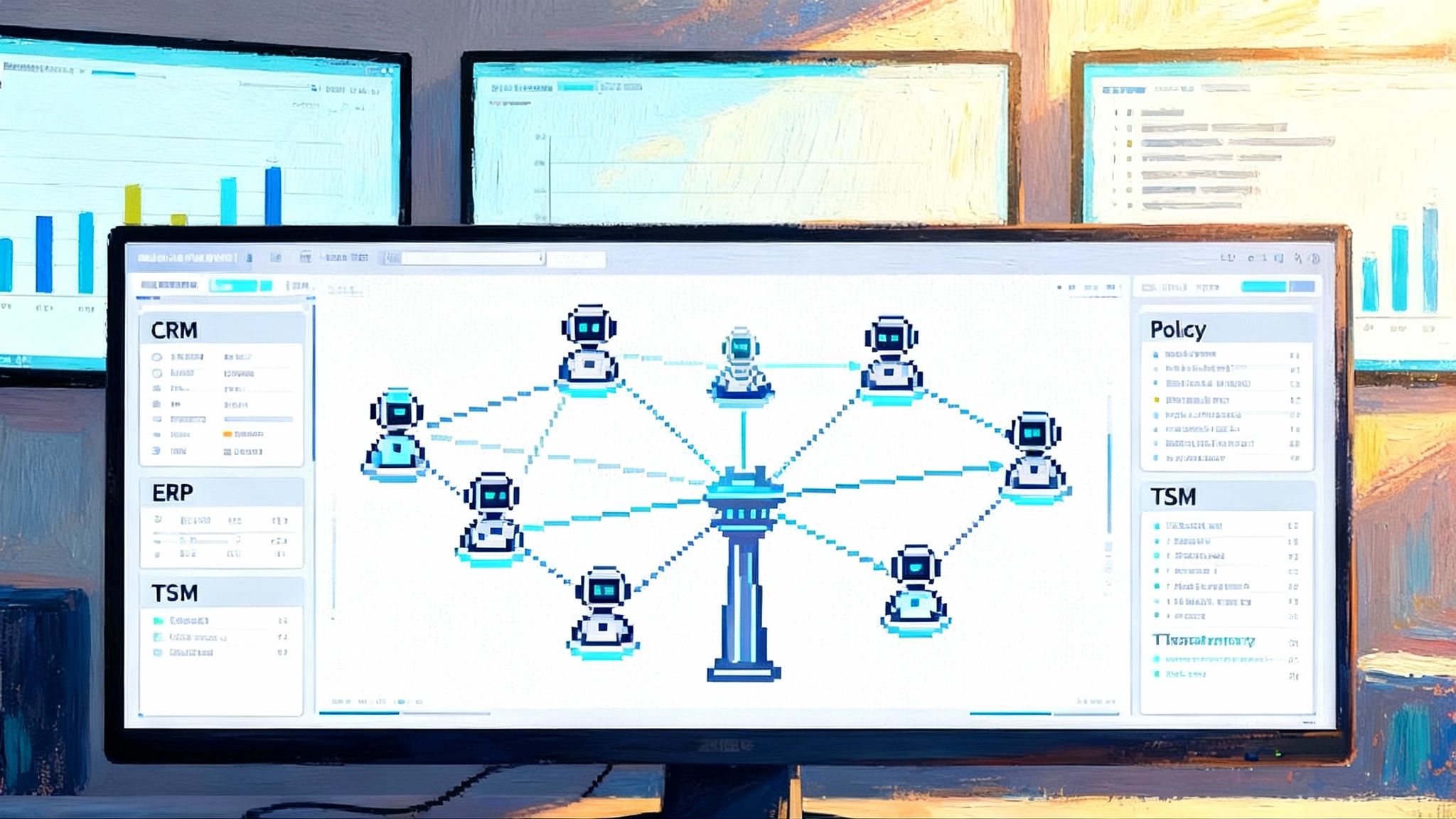

Under the hood: from product catalogs to an offer graph

Traditional comparison engines index products and prices. A savings layer needs a richer object: the offer. An offer is a product plus everything that changes what you actually pay or receive. Think of it as a multi edge graph where each edge changes the net effective cost.

- Product node: brand, model, variant, specs, identifiers, embeddings from title and image.

- Merchant node: shipping speeds, return windows, price match policies, tax handling, location coverage.

- Incentive edges: coupon applicability rules, stackability, category exclusions, loyalty multipliers, cash back rates, card linked offers, student or military discounts, gift card promotions.

- Time edges: price history, sale calendars, restock signals, seasonality.

- Trust edges: seller ratings, counterfeit risk, warranty coverage, customer support responsiveness.

The agent’s job is to traverse this offer graph given your constraints, then propose the path that minimizes your net price and risk. That is why conversation matters. Every clarifying question, like “is open box ok” or “can you wait three days for delivery,” collapses parts of the graph and raises confidence in the final plan.

Conversation as constraint solver

Treat each user reply as a constraint that prunes the graph. Bright room implies higher peak brightness and anti glare coatings. Under nine hundred dollars filters out premium panels and narrows coupon strategy to flexible codes rather than brand locked ones. Willing to wait three days pushes you toward merchants with slower shipping but stronger price match policies. The agent ultimately returns not only a product but a price plan that can be defended with sources and timestamps.

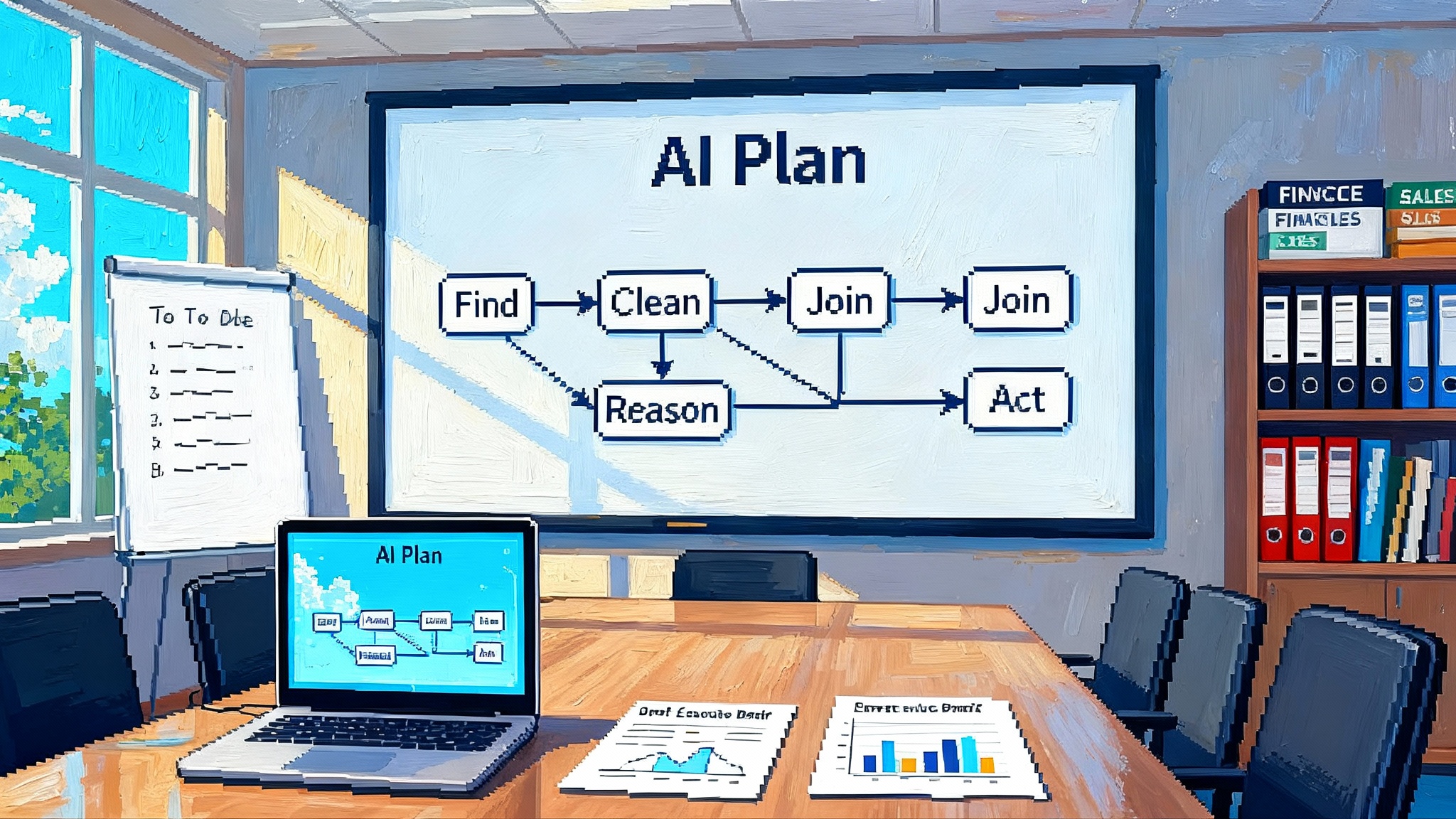

A builder’s blueprint for AI native savings

If you are building in this space, here is a practical architecture you can ship in quarters, not years. It focuses on four pillars that turn a chat into a savings engine.

1) Offer graph

- Unified schema: create a single schema that joins product identity, merchant policy, incentive rules, and fulfillment constraints. Use canonical identifiers where available, but fall back to embedding based matching for long tail products.

- Rule engine for incentives: encode coupon logic as machine readable rules, including stackability, minimum basket thresholds, new customer gates, and channel restrictions. Maintain an allowlist of code sources to avoid affiliate hijacking or denial of cash back.

- Policy fetchers: crawl and cache merchant policy pages and help center articles, then normalize them into structured assertions like “price match within 14 days against approved competitors” or “no coupons on certain brands.”

2) Receipt parsing

- Ingest channels: accept email receipts via forward, photo snapshots at point of sale, and order status pages through user authorized connections. Give users a default option to redact addresses and names.

- Line item extraction: parse item names, quantities, unit price, taxes, shipping, and applied promotions. Attach merchant policy at the time of purchase to build eligibility for future price adjustments.

- Post purchase opportunities: if a price drops within the policy window or a better coupon appears that would have applied, prompt the user with a pre filled request. Do the paperwork where allowed. Savings should not stop at checkout.

3) Real time price intelligence

- Multi source ingestion: combine product feeds, sitemap parsing, cart simulations for coupon validation, card linked offer networks, and public merchant APIs. For long tail categories, consider human in the loop validation to train your matchers.

- Freshness budgets: index popular items hourly and the long tail daily. Use anomaly detection to prioritize rechecks for sudden price swings.

- Counterfactual tests: simulate applying candidate coupons in a headless browser to estimate success rates before suggesting them in chat. Do not promise a code that fails when the user clicks.

4) Trust and guardrails

- Claims ledger: every price claim should be accompanied by source and timestamp, as well as a confidence score that the agent can summarize in plain language.

- Hallucination hard stops: block the model from inventing coupon codes or policies by gating sensitive outputs behind deterministic checks and retrieval only sources.

- Misrepresentation risk: display the merchant of record and who pays the cash back. Make refund and price adjustment eligibility explicit before checkout.

- Privacy by design: receipts and payment tokens should live in separate vaults. Train on synthetic data or on aggregated features only, never on raw receipts without explicit consent.

The immediate pressure on affiliates, feeds, and margins

Savings aware agents turn affiliate marketing into a programmable channel, and that has real consequences.

-

Affiliate networks: last click now belongs to the agent that assembles the savings stack. Expect higher scrutiny of attribution windows, more server to server tracking, and a shift from generic coupon pages to high intent chat sessions. Networks will start to price per verified savings event or net new margin rather than per click or per order. Merchants will ask for agent transparency on coupon sources to limit cannibalization.

-

Product feeds: the feed becomes a negotiation surface rather than a static list. In addition to price and availability, merchants will expose eligibility flags like stackable coupon categories, price match rivals, and loyalty accrual rules. Agents will return structured counter proposals like “convert this to a store card offer and I can route ten thousand high intent shoppers this week.” This flips optimization from keywords to incentive design.

-

Merchant margins: the agent does not invent discounts, it sequences existing ones. That makes leakage visible. If a merchant sees that thirty percent of orders run through non stackable codes that erode margin with no lift in conversion, they will prune those programs. On the flip side, agents can guide budget toward incentives that drive profitable acquisition, such as first order cash back capped by category or buy online pickup in store that saves shipping costs.

Here is a simple illustration of the math. A two hundred dollar small appliance has a gross margin of thirty dollars after cost of goods and shipping. A ten percent coupon, five percent cash back, and three percent affiliate commission can wipe out that entire margin and then some. If the agent swaps the coupon for a loyalty multiplier worth future value, and uses a card linked offer funded by the network instead of merchant cash back, the merchant can preserve five to ten dollars of margin while the shopper still sees a meaningful benefit.

Roadmap for the next two quarters

For builders

- Design your offer graph first. Product embedding quality matters, but the rules that decide whether a code applies will drive user trust. Build a small, precise rule engine before scaling your model.

- Add post purchase logic. The fastest delight is catching a price adjustment the shopper did not expect. It proves your agent works for the user when they are not looking.

- Measure realized savings, not suggested savings. Count only discounts that clear in settlement and cash back that actually posts. Publish that rate.

For merchants

- Clean up your feeds. Include policy flags like coupon exclusions and return windows. State price match criteria in machine readable form. The agent will find them anyway, so you might as well make them accurate.

- Shift affiliate payouts to agent friendly terms. Prefer server to server events that verify net new customers and enforce code eligibility. Offer bonuses for no coupon redemptions combined with loyalty enrollment to align with margin goals.

- Prepare for real time negotiation. Decide what you will trade in chat: extra loyalty points, store credit, or shipping upgrades. Give the agent a simple menu with caps so you can manage unit economics.

For leaders mapping this change to go to market motions, the mechanics of ranking and placement inside AI answers also matter. We explored that angle in how to win placement in AI answers.

Agent to merchant APIs and the path to cartless checkout

The next obvious step is direct connections between agents and merchants. Instead of pushing a user to a site, the agent requests a real time quote, applies incentives, reserves inventory, and completes payment with a token. Merchants keep control of risk and fulfillment, while the user enjoys a one screen experience.

Two building blocks already exist in the market.

-

Hosted payment tokens that travel across sites, like network supported click to pay and wallet buttons, reduce the friction of filling a checkout form. Programs such as Amazon Buy with Prime show that checkout can move into surfaces the merchant does not fully control while still meeting fraud, fulfillment, and customer service requirements.

-

Lightweight order placement APIs that expose tax, shipping, and inventory in real time. Many brands already publish subsets of these for marketplaces or partner apps. The delta is to give vetted agents scoped access tied to a user session and a pre authorized payment token.

Expect beta versions of these agent to merchant APIs to arrive over the next one to two quarters in categories where offers are simple and fraud risk is lower, such as accessories, home goods, and direct to consumer staples. Early agreements will cap order values and limit returns until both sides trust the flow. The prize is large: a checkout that feels like a reply in a chat, not a separate task.

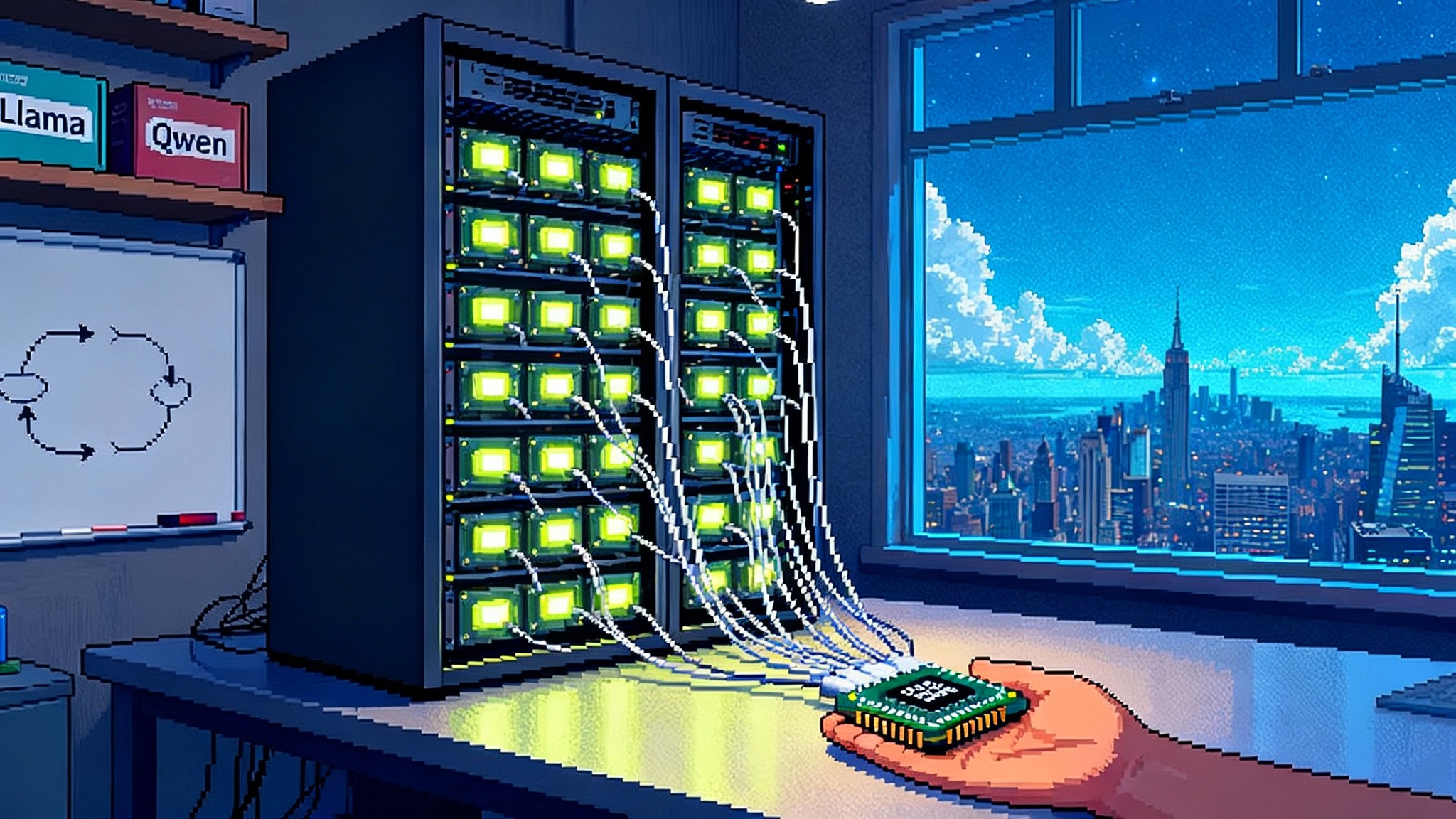

For teams building enterprise grade agents that must pass security reviews and integrate with existing systems of record, it helps to see what a hardened toolchain looks like. We cover that arc in how enterprise AI agents become real.

Guardrails that keep the ecosystem healthy

As this model scales, guardrails will decide who wins long term.

- Content provenance: require that any price claim shown to a user links back to a verifiable source with time and scope. Make that link visible in the chat so users can inspect it.

- Coupon stewardship: agents should respect exclusive codes, private lists, and brand exemptions. Build automated tests against merchant robots and coupon terms pages to avoid policy drift.

- Dispute resolution: define a clean path when an agent promises a discount that fails at checkout. Standardize make good options like instant store credit or cash back top ups, funded by the agent.

- Data minimization: parse receipts for line items and prices, but delete addresses and payment details that are not needed for savings logic. Allow users to opt out of training even on aggregated features.

KPIs to prove it works

Teams should anchor decisions to a handful of measurable outcomes that reflect real user value and sustainable merchant economics.

- Realized savings rate: percentage of suggested savings that actually clears, measured at settlement and cash back posting.

- Offer accuracy: share of agent recommended offers that fully apply without manual user tweaks.

- First message to checkout time: minutes from initial user query to completed purchase, with distribution not just averages.

- Margin preserved per order: difference between the merchant’s baseline unit economics and post agent economics, normalized by category.

- Customer effort score: number of tabs opened, forms filled, and steps required, before and after adopting the agent.

Competitive context without the noise

A savings layer is not a browser extension alone, and it is not a general chat bot that reads the web. It is a system designed to change net price with high confidence. That sets a different bar than a deal site or a creator link. Capital One Shopping and Honey have proven the surface demand. Klarna and several retailers have conversational search for catalogs. The shift now is to blend those familiar flows with policy aware incentives, post purchase monitoring, and real time checkout. Price.com’s entry matters because it coordinates these pieces rather than adding one more widget to the stack.

What success looks like

- For consumers: fewer tabs, more confidence, and savings that post. Clear receipts, visible sources, and follow up alerts that feel like a service, not spam.

- For merchants: higher conversion with margin preserved, cleaner affiliate spend, and fewer customer service tickets about missing discounts. Offers that target profitable segments rather than blanket codes that leak value.

- For the ecosystem: feeds that carry rules, not just rows of products, and APIs that turn negotiation into a first class step in shopping. Better reporting that attributes value to the right actor in the flow.

The takeaway

Shopping is becoming a conversation that ends with a receipt you can trust. Price.com’s beta is a visible marker on that road. The technical lift is real, but the blueprint is practical: an offer graph that knows the rules, a receipt parser that keeps watch after checkout, price intelligence that stays fresh, and guardrails that earn trust. Build those, and your agent will not just find products. It will find value.