AP2 Makes Agent Checkout Real: Google’s Payments Breakthrough

Google’s AP2 gives AI agents a rulebook to prove intent, identity, and spend limits at checkout. See how mandates and verifiable credentials enable card, bank, and stablecoin payments you can audit today.

The day agents started to buy

On September 16, 2025, Google introduced the Agent Payments Protocol, or AP2, alongside a coalition of partners across networks, wallets, processors, and marketplaces. With one announcement, agent checkout moved from polished demo to something enterprises can plan for this quarter. AP2 is not a shopping app. It is a common rulebook that defines what an agent is allowed to buy, how it proves that permission, and how a payment is authorized, settled, and audited. Google frames AP2 as complementary to agent standards like A2A and MCP, providing a safe default for agent-led transactions across cards, bank transfers, and digital assets. You can see the official framing in Google’s blog on powering AI commerce with AP2.

If you have been evaluating agents all year, you know how different this is. Agents that talk can summarize, draft, and plan. Agents that buy must be accountable. That shift requires cryptographic proof of intent, verifiable identity, clear spending policies, and receipts you can defend to a finance team or a regulator. AP2 brings those primitives into one playbook, and it builds on the direction set by Google’s broader agent stack in our coverage of the Agent Engine and A2A update.

What AP2 actually is

Think of AP2 as a common checkout language for software. It answers three questions at the moment of purchase:

- Authorization: Did a real user grant this agent the right to buy this item under these conditions?

- Authenticity: Is the cart the same cart the user approved, with trusted itemization?

- Accountability: If something goes wrong, who has evidence and control to fix it?

AP2 does this with two building blocks that will become familiar to product, risk, and finance teams:

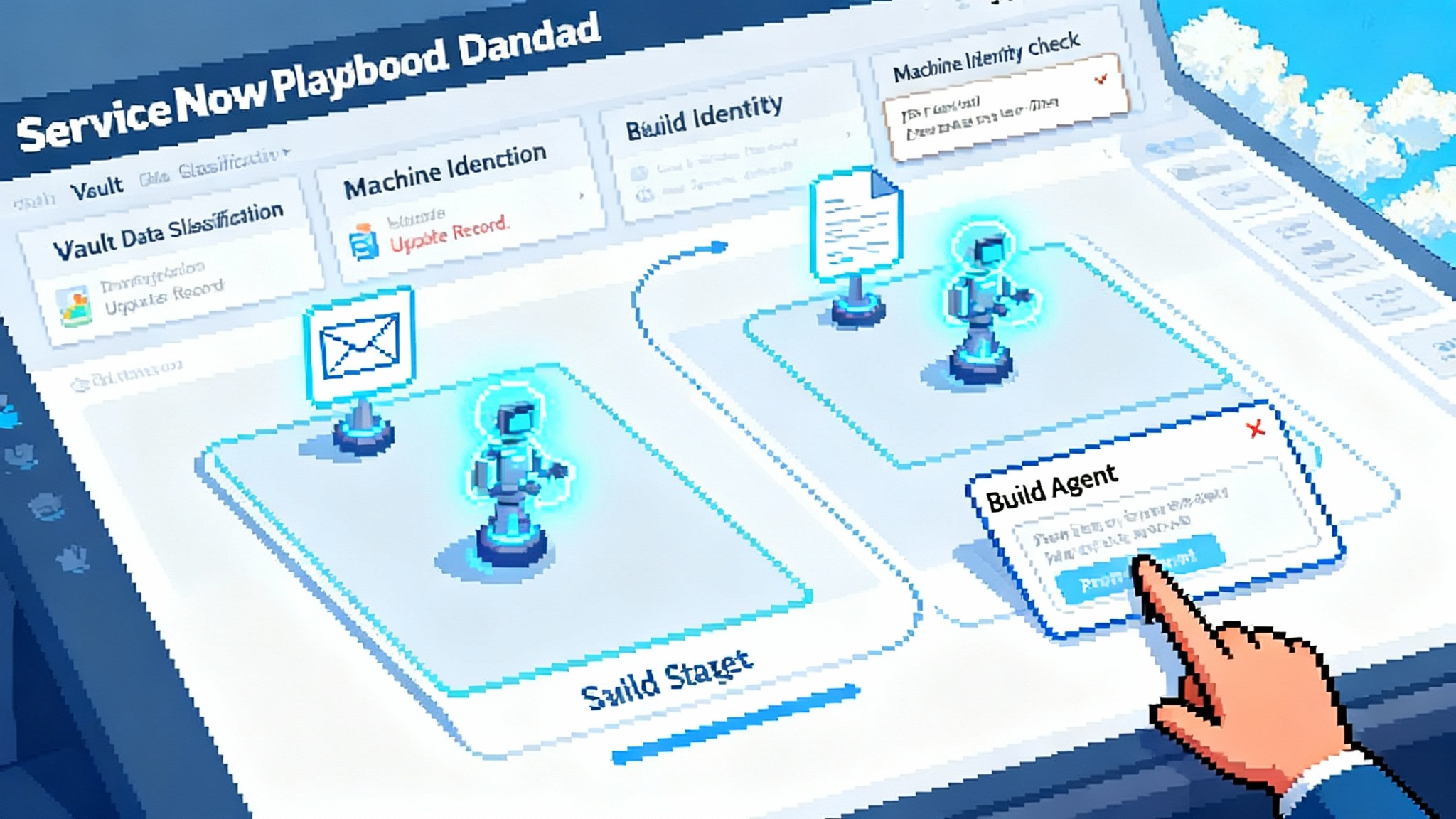

- Mandates. These are tamper resistant, cryptographically signed instructions that act like a digital power of attorney. A mandate captures the user’s intent or a specific cart, along with the constraints that must be respected.

- Verifiable credentials. These are cryptographic proofs that confirm who or what signed the mandate, so a merchant or payment provider can trust the instruction without a human on the screen.

AP2 treats these as first class objects and links them to the payment instrument. The result is a non repudiable trail from human intent to agent action to money movement. That evidence chain is the difference between an agent pressing the checkout button and an agent you can audit.

From talking to buying, in practice

The best way to understand AP2 is to walk through two flows it standardizes.

- Real time, human present. You tell your agent to find white running shoes under 120 dollars. The agent assembles options, you approve a specific cart, and AP2 binds that cart to a Cart Mandate. When the merchant charges, the payment request carries the signed cart so the processor can verify that what you saw is what you paid.

- Delegated, human not present. You grant an Intent Mandate with rules like buy two concert tickets if the total is under 300 dollars, purchase only from approved vendors, and try again if the first attempt fails. The agent can later buy without asking you again, because the signed mandate already encodes your policy.

For both flows, AP2 insists on item level detail, constraints, and identity. The insistence on itemization and policy is what upgrades agent checkout from a novelty into something a controller can trust. It also aligns with how modern assistants are moving from chat to execution, as seen when the ChatGPT agent goes live.

Stablecoins and real time rails, now plugged in

AP2 is agnostic to payment type. It can wrap a card authorization, a bank transfer on instant rails, or a stablecoin transfer. The important part is that the signed mandate travels with the payment request. This is where Coinbase’s x402 extension is notable. It brings a production ready path for stablecoin settlement into the AP2 world. In plain terms, agents can pay one another or pay merchants using stablecoins with near real time finality, while still carrying the same mandate and receipt structures that make audits possible. Coinbase details this in its post on AP2 and x402 for stablecoin settlement.

Here is why that matters:

- Micropayments become practical. An agent can pay a few cents to another agent for a translation or a web crawl without card minimums or slow settlement cycles.

- Liquidity and reconciliation get simpler. Stablecoin settlement reduces the gap between authorization and funds availability, which is where reconciliation pain and fraud concentrate.

- Hybrid is allowed. You can still use cards for consumer purchases to preserve chargeback rights and stick with bank rails for large invoices, while using stablecoins for agent to agent microtransactions. AP2 does not force a choice. It gives you a consistent policy and evidence layer across choices.

How AP2 compares with Visa Intelligent Commerce and Stripe’s AI moves

These efforts overlap in goals but differ in how they help builders.

- Visa Intelligent Commerce. Visa is opening its network to agent use cases and working with model providers and platforms. The emphasis is acceptance at scale, bank relationships, and network trust. If you want an agent to present a Visa credential at millions of merchants with consumer grade protections like disputes and zero liability, Visa is building that path. AP2 complements this by defining how an agent proves intent and identity in a way any network could consume, including Visa.

- Stripe’s AI push. Stripe introduced a payments foundation model trained on vast transaction data, stablecoin financial accounts for global money management, and an agents toolkit that lets developers create payment objects or manage disputes from within an agent flow. If you operate your commerce stack on Stripe, these are powerful knobs. AP2 gives you a higher level protocol to declare when and why an agent may use those knobs, so the evidence is portable even if you mix providers.

Think of it this way. Visa focuses on the network side of who will actually accept and stand behind the payment. Stripe focuses on merchant side software and infrastructure to optimize performance, fraud control, and reconciliation. AP2 focuses on intent, identity, and policy portability so the same agent can transact across networks and processors without reinventing compliance.

The pragmatic Q4 2025 build guide

You can pilot AP2 without a platform migration. Here is a practical plan for the next ninety days.

1) Pick the right first surface

- Start with an internal agent users already trust: a procurement desk assistant, a developer tool purchasing bot, or a marketing agent that buys ad credits.

- Define risk tiers: low price discretionary buys under 500 dollars, medium purchases up to 5,000 dollars, and high value that always requires human signoff.

2) Wire AP2 into your agent toolchain

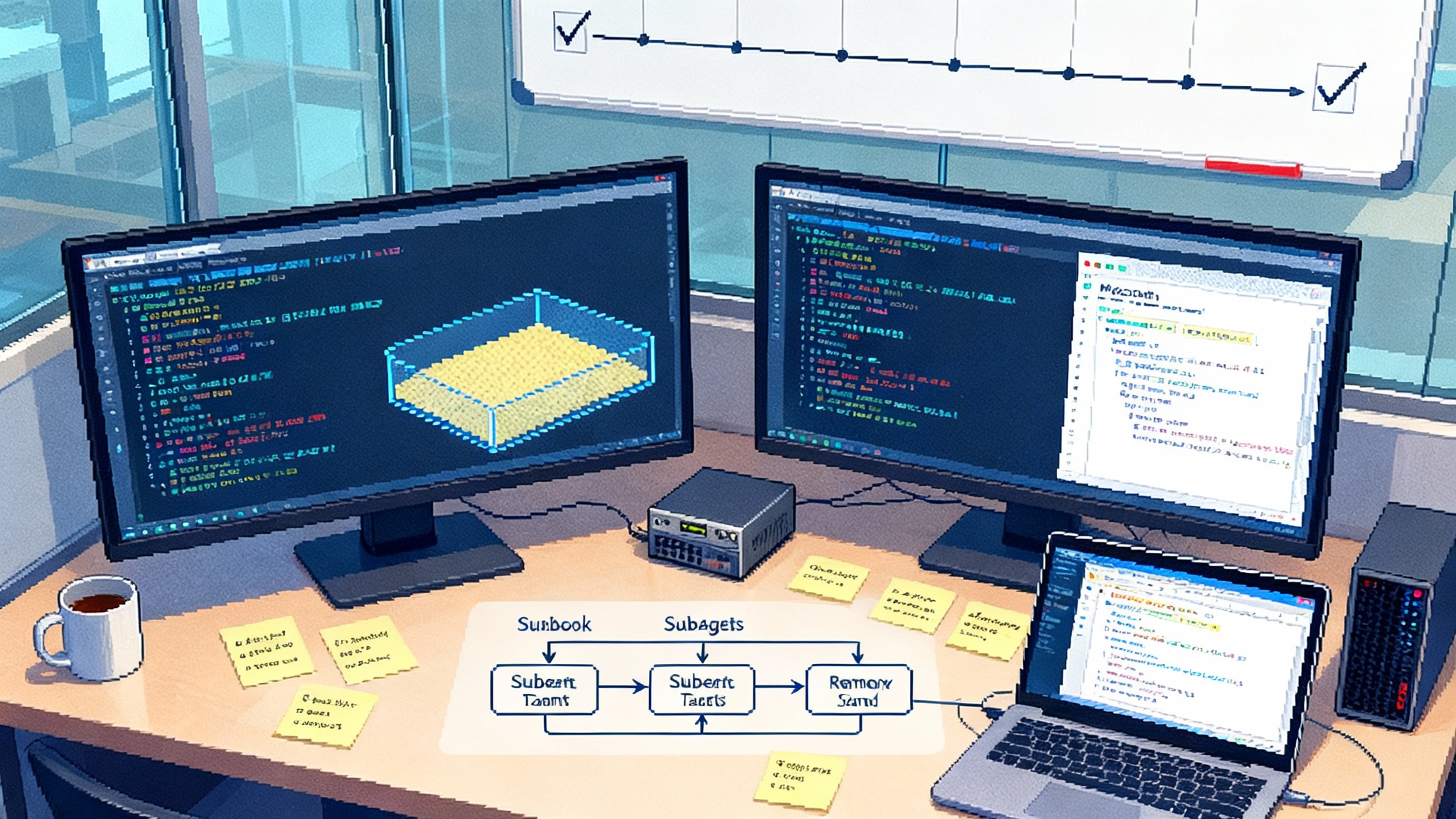

- If you use the Model Context Protocol, expose an AP2 tool that can create and sign Intent Mandates and Cart Mandates, fetch verifiable credentials for the user or service account, and attach mandate artifacts to a payment request.

- If your agents already speak Agent2Agent for orchestration, model a purchase as a sub task with a mandate requirement. Other agents in the workflow should not proceed unless a valid mandate is present.

- Consider how you will host policy logic and crypto safely. Developer teams exploring edge deployments should look at patterns we covered in edge native agent tooling.

3) Choose your rails and wallets

- Cards for consumer like purchases. You get mature acceptance and formal dispute rights. Configure network tokens and 3 D Secure where available.

- Bank real time rails for invoices and payouts. Fast and often lower cost, but with different dispute mechanics. Align with your treasury and accounts payable team.

- Stablecoins for agent to agent and microtransactions. If you test x402, make sure your treasury has clear in and out ramps, balance limits, and an accounting policy for on chain receipts.

4) Implement spend controls in the mandate

- Hard limits: per transaction cap, daily and monthly budgets, and maximum number of retries.

- Scope: merchant category code allow list, brand or marketplace allow list, and forbidden vendors list.

- Temporal rules: time windows for delegated purchases, expiration dates, and blackout periods.

- Context rules: only when a task context matches a project identifier or cost center.

5) Design the receipt and reconciliation path

- Store the signed Intent Mandate and Cart Mandate as first class records linked to the general ledger entry.

- Require item level data in carts. Map each line item to an internal account code or cost center before approval.

- Generate a human readable receipt that cites the mandate identifier, the credential used, and the payment reference. Your auditors will ask for this.

6) Plan the chargeback and dispute loop

- For card transactions, route disputes to your existing chargeback workflow. Attach the mandate chain as evidence. Update reason code mappings so the presence of a valid Cart Mandate triggers a standard evidence package.

- For real time bank rails, define an error correction path that can trigger a refund or a make whole credit, since chargebacks may not exist. Keep the same evidence packaging to speed investigations.

- For stablecoins, adopt a policy that mirrors a card style right to contest within a time window. Since settlement is near instant, the remedy will be a new compensating transfer. Automate the remediation so the agent can initiate it under policy with human review.

7) Close the identity loop

- Issue verifiable credentials to employees and service accounts. Tie them to your directory with lifecycle automation so a role change revokes signing authority.

- Bind marketplace or supplier identities to credentials, so an agent can verify it is dealing with an approved counterparty.

8) Add observability and a kill switch

- Build a purchase journal that streams mandate events, cart approvals, and payment outcomes to your telemetry system.

- Create thresholds that automatically pause delegated purchasing if declines, refunds, or vendor mismatches spike.

- Give a human on call the authority to revoke all active delegated mandates with one action.

9) Run a sandbox to production path

- Use synthetic merchants and test cards or testnet stablecoins to rehearse happy paths and edge cases like price changes, split shipments, and partial refunds.

- Define success measures: agent conversion rate versus human checkout, average time to purchase, reconciliation time per transaction, and number of support tickets per 1,000 orders.

10) Ship a three use case pilot

- Autonomous procurement. Allow the agent to renew seats or buy approved accessories under a budget and vendor list. Measure time saved and exceptions caught.

- Usage based software licensing. Let the platform agent upsize or downsize seat counts daily under a spend ceiling, with mandates capturing the reason and team.

- Marketplace purchasing. Enable an agent to buy certified plug ins or data sets in your internal marketplace, with line item receipts and chargeback support.

Concrete examples to copy

- Developer tools. A build agent monitors continuous integration minutes. When usage hits 85 percent of the monthly quota, it buys a top up bundle from an approved vendor, capped at 300 dollars, and attaches a mandate that cites the project code. Finance sees the signed mandate and cart itemization in the receipt and auto clears the expense.

- Field ops. A support agent needs spare parts. It can place urgent orders under 1,000 dollars from specific distributors during business hours. A delegated mandate enforces vendor and price caps. Any after hours purchase requires a human approval which becomes the Cart Mandate.

- Data pipelines. A research agent pays another agent 9 cents per successful document crawl. Settlement uses stablecoins for speed and cost. The mandate includes a limit of 200 dollars per day and an allow list of data sources.

Risk, simply handled

There is no free lunch in payments, especially with software in the loop. Here is how to keep risk in bounds without freezing innovation.

- Policy is code. Treat mandates as programmable policies. Keep them under change control and code review. Version them like you would a service level objective.

- Price drift and bait switch. Have the agent re sign the Cart Mandate if the total changes, even by one cent. If a merchant cannot return item level data for a re signature, block and escalate.

- Identity freshness. Short lived credentials reduce blast radius. If a job role changes or an employee leaves, your credential automation must revoke signing authority immediately.

- Vendor impersonation. Require cryptographic identity on the merchant side as well, not just on the buyer. If a supplier cannot present a trusted credential, force human review.

- Replays. Ensure every mandate has a single use token bound to the cart. Payment providers should reject reused tokens.

What this means for networks, processors, and merchants

- Networks. AP2 gives you a consistent envelope to carry into your authorization messages. It does not replace network rules. It makes agent initiated commerce more predictable for issuers and acquirers.

- Processors and payment service providers. You can differentiate by becoming mandate aware. That means validating mandate structure, attaching evidence to authorizations, and offering dispute tooling that understands agent flows.

- Merchants and marketplaces. Treat the Cart Mandate as a contract. If your system cannot return precise line items and totals, fix that first. Your conversion will rise with agents that can trust your itemization.

What to watch next

- Standardization. Expect AP2 concepts to show up in network rules, issuer policies, and marketplace terms. The language will converge around mandates, credentials, and itemized carts.

- Real time rails. Instant bank payments and stablecoins will carve out agent heavy microtransactions. Cards will keep consumer protections and high acceptance. The winning stacks will mix them.

- Tooling. Expect developer kits from processors and networks to wrap AP2 so you do not write your own crypto, signature storage, or evidence packs. That will widen adoption.

The bottom line

AP2 gives enterprises a way to let software buy on their behalf without reinventing compliance. The combination of mandates, verifiable credentials, and portable receipts turns noisy prompts into accountable purchases. Visa is preparing the network side for agents. Stripe is sharpening the merchant side with models, money management, and dispute tools. Coinbase’s x402 shows how stablecoins make tiny, fast transactions workable. The stack is finally aligning.

If you ship one thing this quarter, make it a narrow agent that can buy within a small budget under a clear mandate, then measure the time you get back. Once an agent can buy safely by default, you will not go back to agents that only talk. That is the real breakthrough.