DualEntry’s 24-Hour ERP Migration Shakes Incumbent Moats

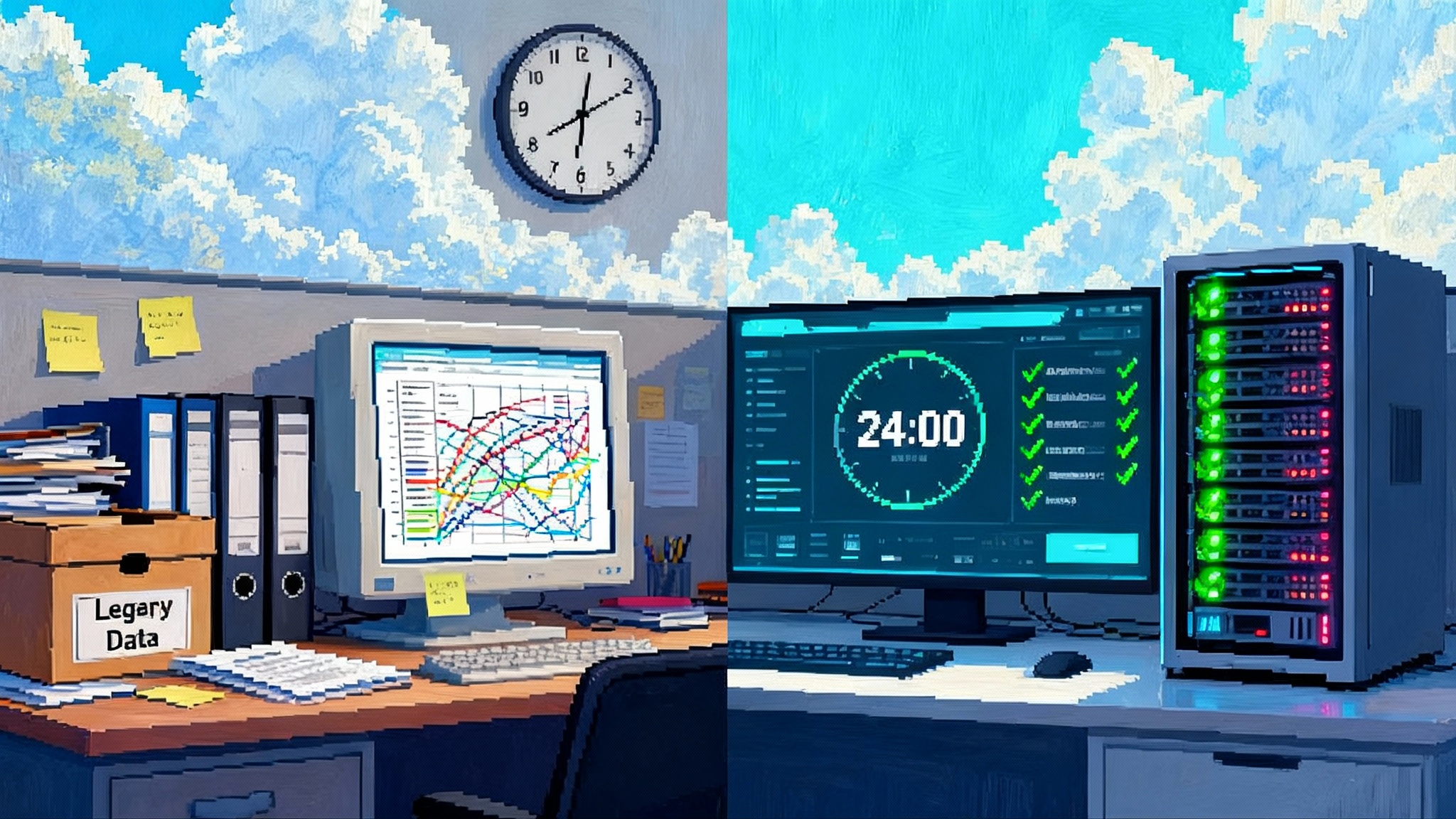

DualEntry claims it can move companies from legacy ERP to its AI-native platform in 24 hours. If it scales, the services moat around incumbents shrinks and finance teams gain a safer path to test real migrations.

Breaking: a 24-hour ERP cutover

Until October 2025, the phrase go live tomorrow belonged in sales decks, not reality. On October 2, 2025, DualEntry said customers could migrate from legacy systems to its AI-native enterprise resource planning platform in 24 hours. That claim arrived alongside a reported Series A round, as noted in Reuters coverage of DualEntry funding. The company calls the feature NextDay Migration and frames it as a way to compress cutovers that typically take months into a single day.

If accurate at scale, this is a watershed moment for mid-market finance and operations. Migrations have been the high-friction toll booth of the ERP category. They block switching. They create lucrative services ecosystems. They slow innovation. Fast migration erodes all three.

What is actually new

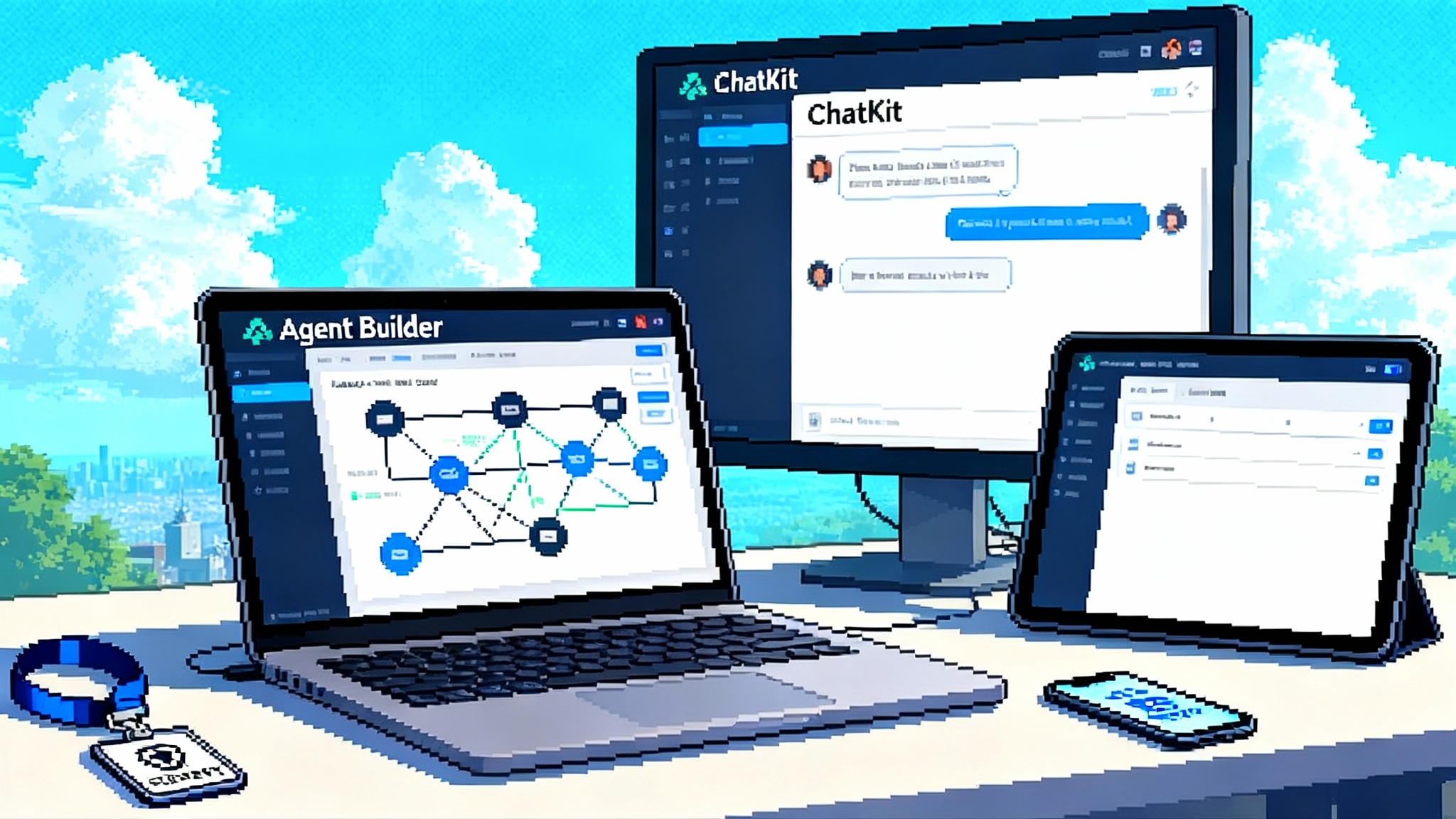

Speed alone is not new. Vendors have promised rapid implementations for years. The novelty is the combination of an AI-native ledger, an agentic data pipeline, and a go-live contract that starts billing only when the system is ready. DualEntry positions implementation as free and immediate, with the platform going live the day after kickoff, and markets compliance features like SOC 2 along with support for GAAP and IFRS. Its description of setup and security appears in Fast, secure, CPA-led implementation.

The last real platform shift in ERP was the move from on-premise to cloud. Cloud reduced hardware and maintenance costs, but it did not erase the months-long migration cycle. A credible 24-hour cutover would be the first material collapse of that timeline.

How NextDay Migration likely works

Picture a team of experienced implementation consultants who never get tired and can read, map, and validate data at machine speed. DualEntry says it has turned this job into a set of cooperating software agents that follow a strict checklist. Here is a simplified view of what such a pipeline needs to do.

1) Connect and copy without breaking anything

- Secure connectors pull ledgers, subledgers, and reference data from the source system. That usually includes chart of accounts, dimensions, vendors, customers, employees, items, open invoices, bills, bank transactions, fixed asset registers, and historical journal entries.

- The pipeline duplicates the data into a staging area. Nothing changes in the legacy system. The staging copy is the sandbox where the agents work.

2) Infer the source model

- Language model agents read the source system schema, field names, and actual records to infer the accounting meaning of each field. Think of it as a multilingual translator that speaks both the vendor’s database dialect and finance.

- The agents look for patterns that indicate business rules. A prefix in a journal entry might imply a location dimension. A specific vendor naming convention might imply a department mapping. These are hypotheses that the system then tests against known accounting constraints.

3) Map to the target ledger

- The system chooses or generates a target chart of accounts and dimension structure. Some customers bring their own templates, others adopt the vendor’s. Either way, the agent proposes a mapping table that sets one-to-one, many-to-one, and conditional mappings.

- Example: all expense accounts 6000 through 6999 map to Operating Expenses, except 6400 which maps to Marketing. If a vendor name matches a known marketing roster, reclassify to Advertising. The agent writes these rules and explains them in human language so a controller can approve.

4) Rebuild the world, then prove it

- Once mappings are approved, the pipeline rebuilds balances, open items, and aging schedules in the target system. It then runs reconciliation tests. Trial balance tie outs, subledger to ledger roll ups, and bank balance checks are deterministic. If the numbers do not match to the penny, the agent flags the discrepancy and retries with adjusted rules.

- The system generates an audit pack that documents source files, mapping rules, transformation logs, and reconciliation results. Think of it as the receipts you show an auditor six months later.

5) Cutover and parallel close

- On go-live day, a read-only snapshot is taken from the old system at a specific cutover time. The pipeline replays delta transactions into the new ledger. Teams then run a parallel close for the first month. If something looks off, the agent can unwind a mapping rule and replay the affected entries.

If you have ever sat through a 12-week implementation, you can see where time collapses. The slow parts are not the button clicks. The slow parts are understanding messy data, writing mapping rules, and proving it all ties out. The agentic approach attacks exactly that.

A day in the life of a 24-hour migration

Consider a hypothetical consumer brand with three legal entities on a patchwork of QuickBooks Online and spreadsheets. The finance team spends every month-end wrestling with bank reconciliations, intercompany eliminations, and a fragile set of scripts that break without warning.

- 9 a.m. Day 1: Implementation kickoff. The controller grants read access to banking data, the legacy ledgers, and shared drives with historical exports. The team confirms cutover time tomorrow at 6 p.m.

- 11 a.m.: The pipeline builds a knowledge graph of the company’s vendors, customers, items, and dimensions by analyzing descriptions, memo fields, and historical coding patterns. It proposes a consolidated chart of accounts with department and location dimensions.

- 1 p.m.: The controller reviews three mapping exceptions flagged by the agent. Two are accepted. One is rejected because a promotional expense was miscoded for a quarter. The agent adjusts and replays.

- 3 p.m.: Reconciliation tests pass. The agent produces a draft audit pack and a checklist for the controller to sign.

- 6 p.m.: The legacy system is snapshotted. Delta transactions are replayed into the new ledger.

- 9 a.m. Day 2: Users log into the new ERP. Bank feeds are live. The team runs a same-day parallel close dry run to confirm that the new system produces the same trial balance.

Now replace QuickBooks with NetSuite or Sage Intacct and the same idea holds, just with more objects and rules. The secret is not magic. It is scale in data mapping and a willingness to shoulder migration risk that integrators have historically priced by the hour.

Why this threatens incumbent moats

ERP incumbents benefit from three overlapping moats that slow down switching and lock in customers.

- Services dependency. The product may be licensed as software, but the real switching cost is people. Third-party consultants configure, build integrations, and manage change. If a vendor’s ecosystem earns more from professional services than the vendor earns in software margin, there is little pressure to reduce migration time.

- Data gravity. The longer you stay, the deeper your historical data becomes in a proprietary schema. You can export it, but getting it to reconcile elsewhere takes human time. That is where the cost hides.

- Process entanglement. Over years, a company adapts workflows to the system’s quirks. Those adaptations become policy. They are sticky.

A credible 24-hour migration weakens all three. If a new vendor can take the risk out of cutover and deliver a reconciled ledger overnight, the argument for staying put shrinks. The services ecosystem feels the shock first, because its hours are the moat. If those hours fall by an order of magnitude, the value shifts to software and to high-leverage advisory work rather than configuration labor.

This is part of a broader pattern we are seeing as agentic systems move from demos to daily work. We have documented similar shifts in operational contexts in our look at agentic AI in daily operations, where repeatable agent workflows collapse timelines once owned by services.

What this means for mid-market finance teams

For controllers and chief financial officers, the benefits are not only speed.

- Lower switching risk. A parallel close in week one creates confidence that the new books are right. You can validate subledger tie outs before committing downstream processes like procurement or payroll.

- Faster time to control. Because mappings and reconciliations are programmatic, the system can run continuous controls from day one. Outlier detection, vendor master hygiene, and intercompany netting can be scripted rather than added later.

- A chance to modernize the chart of accounts. Many teams carry legacy account structures that no longer fit the business. An agent that proposes a modern structure with a trail of mapping explanations gives you the rare chance to simplify without losing historical comparability.

There is also a cultural shift. When setup is days instead of quarters, finance leaders can run true software evaluations. You can test a month-end on a live environment and keep the incumbent running as a safety net. That is how sales and marketing teams trial tools. Finance has not had that luxury.

Where the risks are hiding

Acceleration helps only if quality holds. Three risk buckets deserve clear eyes.

- Data quality and lineage. If the source data is messy, an agent will move the mess faster. Teams should insist on a lineage view that shows, for any balance, the original source row, the mapping rule, and the transformation log.

- Controls and approvals. The agent should produce a human-readable playbook for each mapping and require explicit approvals for exceptions. Make sure segregation of duties is enforced so the person approving mappings cannot also post manual journals without review.

- Auditability. Your first external audit after migration is the real test. Ask for an exportable audit pack that includes the cutover snapshot, reconciliation reports, and a catalog of every rule. Auditors should be able to sample from the source and land on the reconstructed entry in the target ledger.

Practical safeguard checklist for finance leaders:

- Run a two-week parallel close. Post both sets of books and compare. Do not skip variance analysis.

- Establish a mapping dictionary before kickoff. Define how you want departments, locations, and product lines represented. The agent can propose, but you control the taxonomy.

- Create golden test cases. Pick past months with known anomalies and ensure the new system reproduces them. Include foreign currency revaluations, revenue recognition edge cases, and intercompany eliminations.

- Lock change windows. Freeze source system configuration for the 48 hours around cutover to avoid schema drift.

- Document exception authority. Write down who can approve overrides and how they are escalated.

The systems integrator question

If migration time collapses, what happens to the partners who have built thriving businesses on implementation projects? They will not disappear, but their focus will shift.

- From build to design. Rather than writing scripts and moving data, partners will design operating models, internal controls, and reporting frameworks that fit the business. That work is higher leverage and harder to automate.

- From hours to outcomes. Fee models that reward speed will replace time and materials. Fixed fee for a reconciled, audited first close is a useful benchmark.

- From single-vendor loyalty to multi-platform expertise. When switching costs fall, customers will expect partners to be fluent in more than one system so they can provide objective advice.

For integrators who adapt, the pie may grow. The work becomes more strategic and less repetitive. For those who do not, the addressable hours shrink.

What the next 12 months could look like

- Fast-follow features from incumbents. Expect ERP leaders to announce automated migration tooling, reference mappings, and fixed-fee offers. Vendors will try to match the 24-hour narrative even if the underlying process is not yet fully automated.

- More agentic modules. If migration agents prove reliable, expect the same approach to spread to reconciliations, allocations, and revenue automation. The principle is the same: define the rules, run at machine speed, prove with tests, and maintain an audit trail.

- Auditor guidance. Assurance firms will publish practice notes on how to test agent-driven migrations. They will likely ask for evidence that rules are versioned, that replays are deterministic, and that sampling can start from either side of the transformation.

- Buyer behavior changes. Controllers will pilot systems with live data before final selection. The win goes to the tool that produces a clean parallel close and a tight audit pack with minimal handholding.

- New pricing norms. If implementation is bundled and migration risk sits with the vendor, subscription prices will bake in that cost. Buyers should compare total cost over three years rather than headline license numbers.

These changes echo what we have seen in other agent-first products where data and memory become the new levers. For background on the strategic role of data, see our analysis of how the Environments Hub makes data the moat. For the operational side of durable context, explore how memory as a control point reshapes software design.

How to evaluate a 24-hour promise

If you are considering a move, here is a concise evaluation playbook.

- Ask for a time-stamped plan. The vendor should specify kickoff time, data sources, cutover window, and parallel close schedule. Vagueness is a red flag.

- Demand a reconciliation scorecard. Trial balance tie out, subledger roll ups, foreign currency checks, and bank reconciliations should be reported with pass or fail status, not anecdotes.

- Inspect the audit pack before signing. Do not wait until after go live to learn how evidence is stored and exported.

- Validate controls. Confirm role-based access, approval workflows, and change logs are live on day one. Test them.

- Negotiate accountability. Fixed fees, credits for missed timelines, and a clear rollback plan change behavior.

The competitive backdrop

Mid-market finance teams have long chosen between starter accounting tools that are easy to implement and full ERPs that are powerful but slow to adopt. That trade-off is fading. If new entrants can make migrations both fast and provable, the core advantage of incumbents narrows to ecosystem breadth and advanced modules. Those are significant advantages, but they are not unassailable.

Meanwhile, the economic context favors automation. A shrinking pipeline of certified public accountants, rising close complexity, and always-on board reporting demand more output per person. If an AI-native ERP can remove months of migration friction and start paying back in the first close, buyers will listen.

Bottom line

A credible 24-hour cutover is more than a headline. It is an attack on the switching costs that have defined ERP for two decades. DualEntry’s NextDay Migration is the sharpest current expression of that attack. The gains are obvious: lower risk to try something better, faster access to controls and automation, and the freedom to change tools again if the business outgrows them. The risks are also real: quality lapses move faster, controls must be proven, and auditors will demand rigorous evidence.

If you lead finance, run a live pilot and demand a parallel close within a week. If you run a partner business, move your services up the stack to controls design and outcome guarantees. If you build ERP software, assume the clock on migrations has been reset and plan accordingly. The first vendors to make 24 hours boring will shape the next decade of finance operations.