Visa’s TAP launches: the trust layer for AI shopping

Visa introduced Trusted Agent Protocol, a payments-grade method for retailers to recognize legitimate AI shopping agents while keeping malicious bots out. See what to implement before peak season and how TAP fits with ACP and x402.

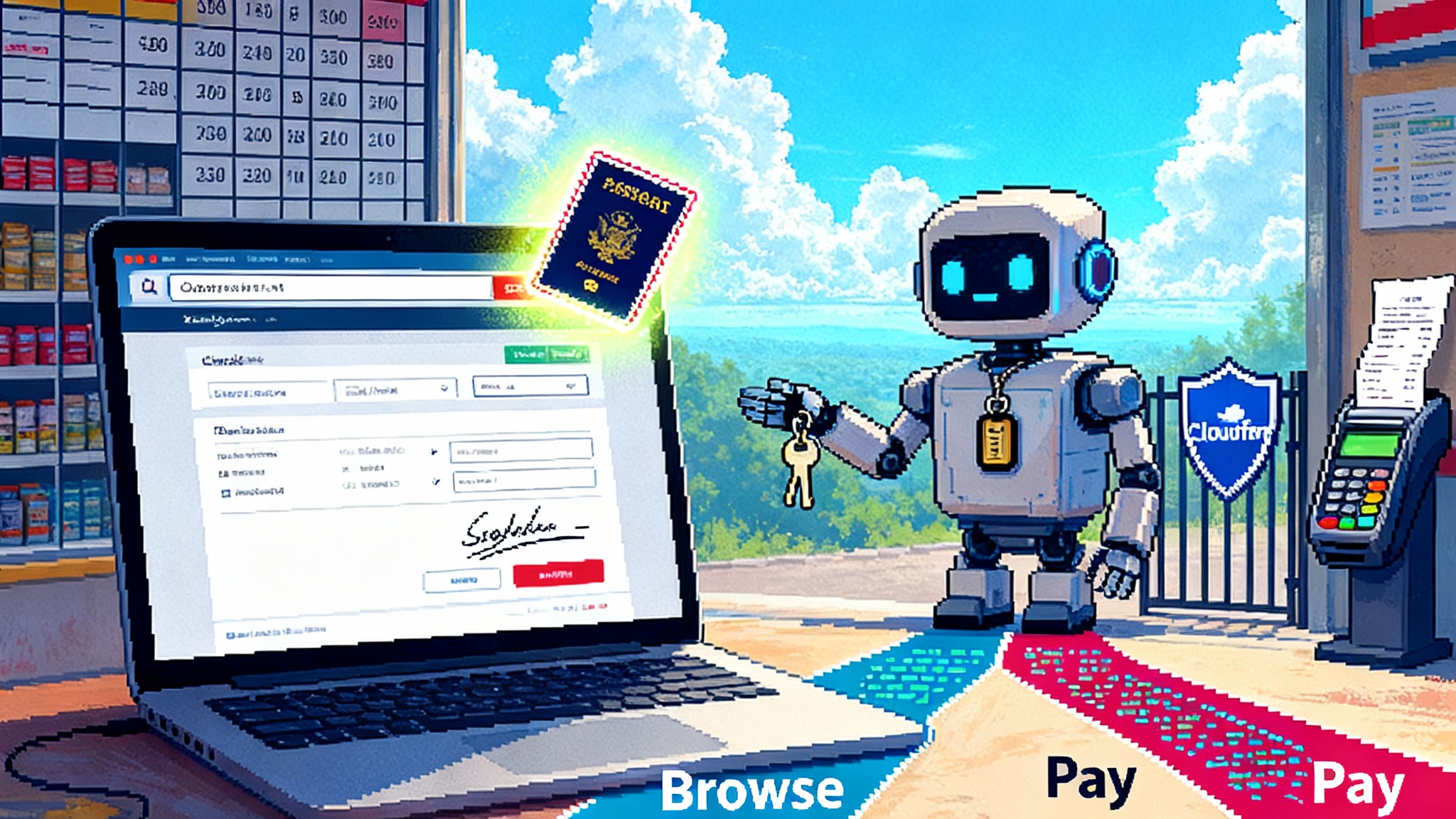

Breaking: Visa gives AI agents a passport for checkout

On October 14, 2025, Visa introduced Trusted Agent Protocol, an open framework that lets retailers distinguish a legitimate AI shopping agent from malicious automation. In Visa’s framing, TAP brings the reliability of card payments to automated web traffic by letting agents prove who they are, who they represent, and what they are authorized to do. See the official announcement in Visa announces Trusted Agent Protocol.

Think of TAP as a border checkpoint for your site. A vetted agent arrives with verifiable documents, not just a friendly face. Your bot defenses no longer have to guess based on device fingerprints or behavioral heuristics. They can verify signed claims and decide whether to let the agent pass, and on which paths.

For holiday 2025, this has real dollars attached. Agent-driven shopping is growing fast, but most bot managers are still tuned to stop automation at any cost. The result is false positives that reroute high-intent buyers to competitors. TAP aims to convert that uncertainty into predictable, low-friction revenue.

Why a payments-grade trust layer matters now

The false positive trap

Retailers face two opposing pressures. Shoppers increasingly delegate research and cart prep to assistants that check sizes, prices, inventory, and delivery dates. At the same time, security teams cannot afford to loosen bot rules with scalpers, scrapers, and fraud rings hammering endpoints. Without a way to prove identity, good agents get lumped in with bad bots.

TAP proposes a middle path. If an agent can prove identity, intent, and user authorization with strong signatures, merchants can welcome that traffic without weakening safeguards elsewhere. In practice, that means treating a trusted agent as a narrow, auditable session rather than as generic automation.

The card network playbook

Payments networks solved a similar problem decades ago. Issuers, acquirers, and standards bodies created shared rules so any card could transact with any merchant. TAP borrows that playbook for agentic commerce. The emphasis is on mature cryptography, reuse of web primitives, and compatibility with the checkout flows merchants already run.

This trust foundation also aligns with the reality that agents are moving from demos to real work. We have seen this across the ecosystem, from enterprise platforms that make agents the primary unit of work to assistant-driven checkout experiments. If you are tracking that shift, you might also be following how Amazon Quick Suite makes agents the unit of work and how Agentic Checkout arrives inside ChatGPT.

What TAP is in plain terms

At the protocol level, a vetted agent adds one or more signed objects to each request it sends to a merchant. In simplified terms:

- Agent recognition signature. Proves the request comes from a trusted agent and binds the signature to the merchant’s host and the specific path the agent is trying to access.

- Consumer recognition token. Links the agent to the human it represents so the merchant can recognize a guest, a repeat visitor, or an account holder without exposing unnecessary personal data.

- Payment container. Carries payment identifiers or tokens in a format compatible with existing checkout flows, whether the merchant uses a payment service provider or vaults cards on file.

These pieces travel as HTTP headers and request bodies and are verified with well-known web cryptography. TAP also defines intent tags, such as agent-browser-auth for browsing and agent-payer-auth for payment, which allow merchants to scope what the agent is permitted to do at each step and to build precise rules in their edge security stack.

Importantly, TAP’s approach lines up with Cloudflare’s verification model for signed automation. If you already run Cloudflare, you can validate signatures at the edge and propagate a verified signal to your origin for policy decisions. For details, see the reference in Cloudflare Web Bot Auth guidance.

Why this matters for the 2025 holiday rush

This season, most customers will still press the Buy button themselves. What changes is the path to that button. Agents will do more of the pre-work: price discovery, inventory checks, delivery-date estimation, and cart assembly. If your defenses block those steps, the assistant will route the shopper to a store that does not. If you recognize the agent and allow it to proceed with tight guardrails, you get a high-intent visitor who is already committed to purchase.

A practical rule of thumb emerges for operations teams: treat an authenticated agent with a scope-limited intent as you would an authenticated user session with a narrow set of permissions. You are not greenlighting all automation. You are enabling one named actor to do one specific job on specific paths.

What merchants should implement this week

Here is a concrete, no-regrets checklist you can start now. It assumes you have a web application firewall and a bot management layer.

-

Verify signatures at the edge

Enable HTTP signature verification and check for TAP intent tags. Enforce short-lived timestamps and a nonce to block replay attacks. Cache and rotate agent public keys using a well-known discovery path. Expose the verification result to your application in headers so downstream code can make explicit allow or deny decisions. -

Route trusted agents differently from unknown bots

Create a policy tier in your bot manager. Unknown automation is challenged or blocked. Trusted agents with valid signatures can fetch product detail pages, inventory, and price endpoints. Apply rate limits based on intent and path rather than a blunt throttle across your entire domain. -

Bind intent to your domain and action

Only honor agent-browser-auth on product and search pages. Only accept agent-payer-auth on checkout endpoints. Reject any attempt to reuse a browsing signature on a payment path. Log all failed or out-of-scope attempts for investigation. -

Recognize the human behind the agent

Map the consumer recognition token to your customer records. If there is a match, prefill carts or account details according to your privacy policy. If there is no match, treat it as a consented guest session with your normal anti-fraud controls. -

Keep your checkout intact

Do not rebuild your payment stack. TAP is designed to slot into existing flows. Continue to authorize and settle through your payment service provider. If you support cards on file, use your existing tokenization and Payment Account Reference rails. If the agent presents a usable payment token, treat it like any other vaulted credential and run your normal risk checks. -

Update fraud playbooks

Add agent-specific risk signals to your models: signature issuer, key age, variance from typical human behavior for the same customer, and velocity across product and cart endpoints. Challenge when those signals diverge, even if the signature is valid. -

Publish an agent-friendly access policy

Alongside robots.txt, publish a clear allow-and-intent policy for trusted agents. This is not a formal standard, but it helps support teams resolve disputes faster and gives partners explicit guidance on what is permitted. -

Test with friends-and-family agents

Run controlled tests with a few known agents before the big rush. Measure completion rates, cart size, and the rate of false positives in your bot manager. Use those results to tune rate limits and intent scopes. Share early findings with your customer support and fraud teams so they can spot anomalies during peak.

What agent builders must do to get in the door

If you are building a shopping agent, TAP is quickly becoming the price of admission for mainstream retail sites. To clear the bar:

- Implement HTTP signatures with the prescribed fields. Use an approved algorithm, include created and expires timestamps, and generate a unique nonce per session. Bind each signature to the merchant’s host and the exact path requested.

- Publish your JSON Web Key Set at a well-known location. Support rotation and revocation. Expect merchants to cache keys for performance and to block on mismatch.

- Separate browsing and payment intents. Present agent-browser-auth for catalog and availability. Present agent-payer-auth only when initiating payment steps. Keep scopes narrow and auditable.

- Carry consumer recognition responsibly. Pass only the identifiers the merchant needs to recognize the user, consistent with consent and applicable law. Do not spray personal data across sites.

- Be a good network citizen. Respect robots files and rate limits. If a merchant denies a path for agents, honor it. Your credibility depends on leaving a clean audit trail.

- Plan for edge verification. Many merchants will validate at the CDN or gateway. Keep signatures valid across all ingress points and ensure consistent behavior behind load balancers and multi-region deployments.

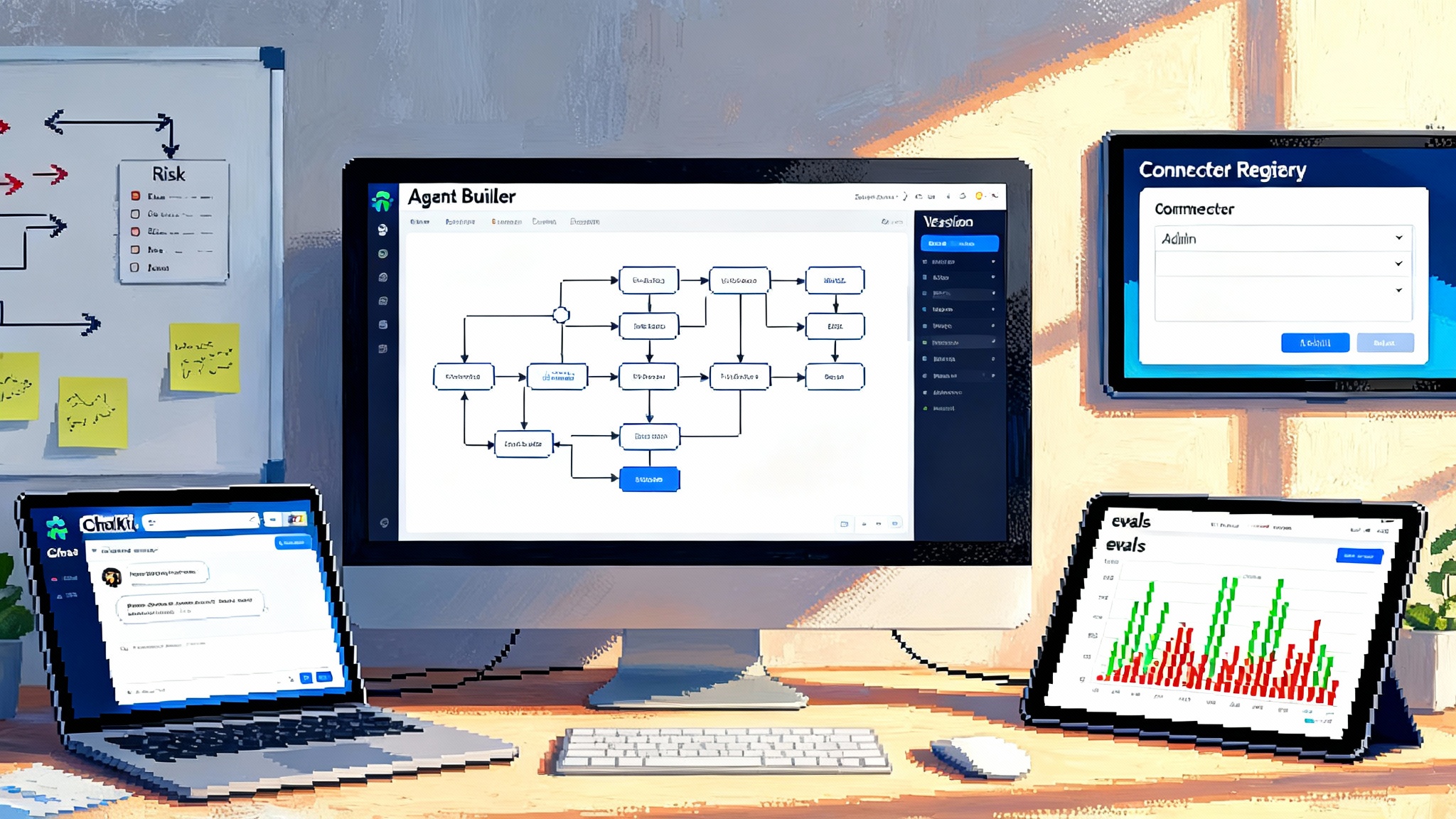

TAP vs ACP vs Coinbase x402

Three ideas sound similar but solve different layers of the stack:

- TAP is a trust and intent signal for the open web. It tells a merchant that a specific agent is recognized, it acts on behalf of a real user, and it is allowed to perform a specific action on a specific path.

- Agentic Commerce Protocol (ACP) is a merchant checkout contract. It defines how agents and merchants talk during checkout sessions, what endpoints exist, and how orders and webhooks behave. It keeps the merchant as the system of record and works with the merchant’s existing payment processor. As of late September 2025, the Agentic Checkout specification has been circulating in draft form.

- Coinbase x402 is a payment rail for machines. It uses HTTP 402 to request and accept payment over stablecoins such as USDC, often on the Base network. It shines for machine-to-machine payments, pay-per-use APIs, and microtransactions.

These are not rivals so much as layers. A realistic 2026 stack for autonomous checkout could look like this:

- Identity and intent: TAP proofs at the edge, verified by your CDN or gateway.

- Conversation and state: ACP-like endpoints for cart creation, shipping quotes, taxes, and order confirmation.

- Settlement: Your existing processor for cards and wallets, optionally complemented by x402 for digital goods, pay-per-use data access, or instant refunds.

Interoperability is the theme. TAP aligns with recognized standards bodies to travel across networks and work with multiple payment methods. ACP aims to be processor-agnostic. x402 sits outside traditional card rails and expands what an agent can pay for. Together, they pave a path to autonomous checkout while preserving merchant control and platform accountability.

If you are tracking how teams bring agents into production workflows, the broader context includes how Microsoft's Agent Teams arrive and how enterprise suites are reorganizing around agent-first models.

A simple flow to make this concrete

Picture a shopper instructing an assistant: find a medium blue sweater under 80 dollars that can arrive by Friday.

- The agent signs a request to the merchant’s product page with agent-browser-auth. Your edge validates it and routes it past generic bot challenges.

- The agent includes a consumer recognition token. Your site sees the customer has a loyalty account and a stored address, and uses that to personalize stock and delivery dates.

- The agent assembles a cart through ACP-style endpoints, getting taxes and shipping quotes without exposing sensitive data.

- At checkout, the agent switches to agent-payer-auth and presents a payment container. Your processor authorizes normally. If the item is digital and you support an instant settlement rail, the agent can pay a small follow-on charge immediately.

- You log the signatures and intents for audit and fraud monitoring, and you return a receipt and an order status endpoint the agent can poll or subscribe to.

Nothing in that sequence requires you to abandon your processor or rebuild checkout. TAP turns the unknown visitor into a verifiable counterpart. ACP keeps your systems the source of truth. A programmable rail such as x402 expands where instant machine payments make sense.

Guardrails and gotchas

A trust layer is only as strong as its weakest operational link. Treat these as non-negotiables:

- Short signature lifetimes. Enforce narrow created and expires windows. Replays should fail by default.

- Nonce discipline. Require a unique nonce per session or interaction and reject duplicates.

- Domain binding. Only accept signatures that name your host and the exact path. Tolerate no wildcards.

- Key hygiene. Rotate keys on a regular schedule. Cache discovery responses but honor cache-control and revocation signals.

- Least privilege. Treat browsing and payment as separate scopes. Never let a browsing signature reach a payment path.

- Observability. Store signatures, issuer, key id, and decision outcomes for at least one chargeback cycle. That evidence will shorten disputes and train your fraud models.

- Privacy by design. Minimize the consumer identifiers you accept. If you do not need it for recognition or fraud controls, do not ingest it.

What to watch between now and 2026

Three milestones will determine how fast agentic commerce matures:

- Standardization momentum. Watch for working drafts that encode best practices for agent identification and user authorization. TAP’s choice to ride known web standards gives it a running start.

- Merchant reference implementations. Expect a handful of large retailers to publish early data on conversion rates and false positive reductions from TAP-verified agents. That will give everyone else a playbook.

- Interop demos. The most convincing proof will be end-to-end paths where an agent uses TAP to browse and pay, ACP to manage the session, and either traditional processors or a programmable rail for settlement.

Bottom line for this season

For the next six weeks, your goal is not to greenlight every agent. It is to stop guessing and start verifying. Add TAP verification at the edge. Split browsing and payment scopes. Recognize the customer when they consent to be recognized. Keep your existing processor in place. Where appropriate, pilot a programmable settlement rail for instant digital delivery or refunds.

The web rewards merchants who move early when the primitives change. This is one of those moments. Give agents a way to prove themselves, and they will repay you with clean carts, fewer challenges, and customers who arrive ready to buy.