Agentic Checkout Arrives: UPI Inside ChatGPT Goes Live

India switched on a pilot that lets ChatGPT handle discovery, decision, and UPI payment in one conversation. Here is what agent-native checkout changes for merchants, banks, and platforms, and how it could scale globally.

Breaking: India switches on agentic checkout in ChatGPT

On October 9, 2025, India lit the runway for end-to-end commerce inside an AI by connecting the Unified Payments Interface to ChatGPT through a partnership among the National Payments Corporation of India, Razorpay, and OpenAI. Axis Bank and Airtel Payments Bank are in the initial banking cohort, and Bigbasket is an early merchant. The goal is simple to say and hard to do: let a user discover a product, decide to buy it, and pay without leaving a single conversation. Reuters confirmed the pilot and noted the obvious context: UPI already processes billions of transactions monthly, so an agent-led experiment here will generate real signal quickly.

This is not a novelty. It is the first credible proof that AI agents can own the full commerce loop at national scale. If it works in India, the pattern will not stay in one country for long.

Why this is a first: the whole loop in one chat

Most shopping journeys jump across tabs and apps. Discovery happens in a search bar or marketplace, comparison in a different site, and payment in a separate checkout. Even so-called one-click purchases still ask you to switch mental contexts. The pilot collapses those steps into a single thread where the agent keeps state, clarifies intent, checks availability, and completes payment.

Picture a grocery run. You ask ChatGPT for a weekly plan under a budget. It suggests a menu, compiles a cart from a supported merchant, checks stock, applies a coupon, asks you to confirm, and then initiates a UPI collect request to your chosen bank. You approve in your bank app, the agent shows the order number, and you are done. No extra tabs. No copied order IDs. The chat becomes the cart, the checkout, and the receipt.

What agent-native payments change in product design

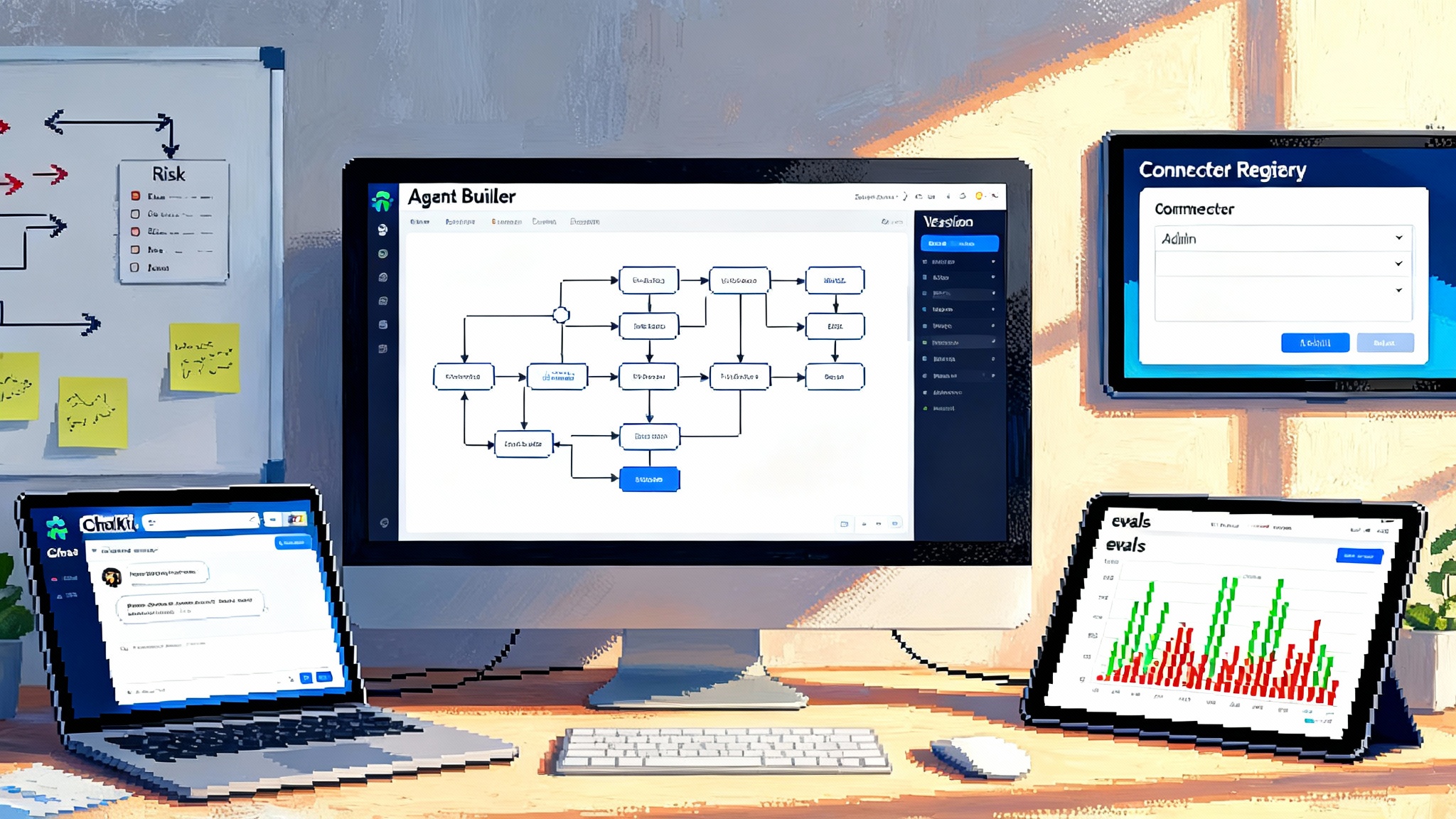

When conversation is the interface, product design shifts from screens to intents and from taps to commitments. Here are the big changes, with concrete actions for teams building on the pilot model.

1) Intent-driven flows replace page-driven flows

- What changes: The primary object is a user goal, not a screen. The agent must translate ambiguous language into a structured order.

- What to do: Define a minimal intent contract for your domain, such as item, quantity, delivery window, and budget. Instrument clarifying questions that resolve intent quickly. For groceries, that might mean a brief round on dietary constraints and substitution rules.

2) Background tasks with visible checkpoints

- What changes: Availability checks, address validation, and discount evaluation happen in the background. The agent must surface checkpoints so the user stays oriented.

- What to do: Adopt a three-checkpoint rhythm: building your cart, verifying prices and stock, and ready to pay. Each checkpoint should include a human-readable diff of what changed, for example, two items out of stock, substituted brand X for brand Y with a 5 percent discount.

3) Single source of truth for prices and inventory

- What changes: In a chat loop, stale data creates friction and refunds. The agent needs authoritative state from the merchant, not cached guesses.

- What to do: Expose an authoritative cart endpoint that always returns final prices, taxes, fees, and stock. Reject partial updates. Treat the merchant system as the ledger and the agent as a stateless orchestrator that reconciles to the ledger on every step.

4) Multi-turn cart editing is the default

- What changes: Users will change their mind mid-conversation. The system must handle replace, remove, split shipments, and promotion rules without breaking the order.

- What to do: Model the cart as an immutable history with diffs. Present revisions as a tidy list in the chat, for example, replaced 1 kg tomatoes with 800 g cherry tomatoes, price updated from ₹60 to ₹72. That history doubles as your audit log.

5) Error handling becomes a conversation pattern, not a modal

- What changes: Bank timeouts, UPI collect expiries, or address mismatches will happen.

- What to do: Define natural language fallbacks mapped to precise machine states. Example: your bank did not respond in time. I can resend the request, switch to another bank account, or save this cart for later. Always show a timer for how long the current authorization remains valid.

Trust, security, and compliance: consent inside the dialogue

Agent-led payments live or die on trust. The pilot has a strong sandbox, because UPI is familiar, tightly regulated, and already optimized for authorization with a user present. Treat consent as a first-class product surface, not a footer checkbox.

1) Just-in-time consent

- Why it matters: Consent given too early is forgotten. Consent given too late feels like a trap.

- How to do it: Ask for approval at the last responsible moment with a crisp summary: merchant, items, total, delivery, and payment instrument. Never reuse an old approval for a new total. In India, pair the summary with a UPI collect request that the user approves in their bank app. The bank app remains the place where the user enters their UPI PIN.

2) Reversible authorization and friendly reversals

- Why it matters: Conversation mistakes are common. People will approve the wrong thing.

- How to do it: Treat the period between merchant acceptance and fulfillment as a soft window where the agent can cancel or adjust within merchant policy. Show a visible countdown, for example, you can cancel without penalty for 10 minutes. For goods that already shipped, initiate a return flow and show the return label status.

3) Spend limits and scoped sessions

- Why it matters: People worry that a smart assistant might overbuy.

- How to do it: Let users set per-session caps, per-merchant caps, and daily caps. Store these as policy, not preference, so enforcement is strict, and show the policy in plain language every time a purchase begins. If a cap is reached, pause and ask for a higher limit with fresh consent.

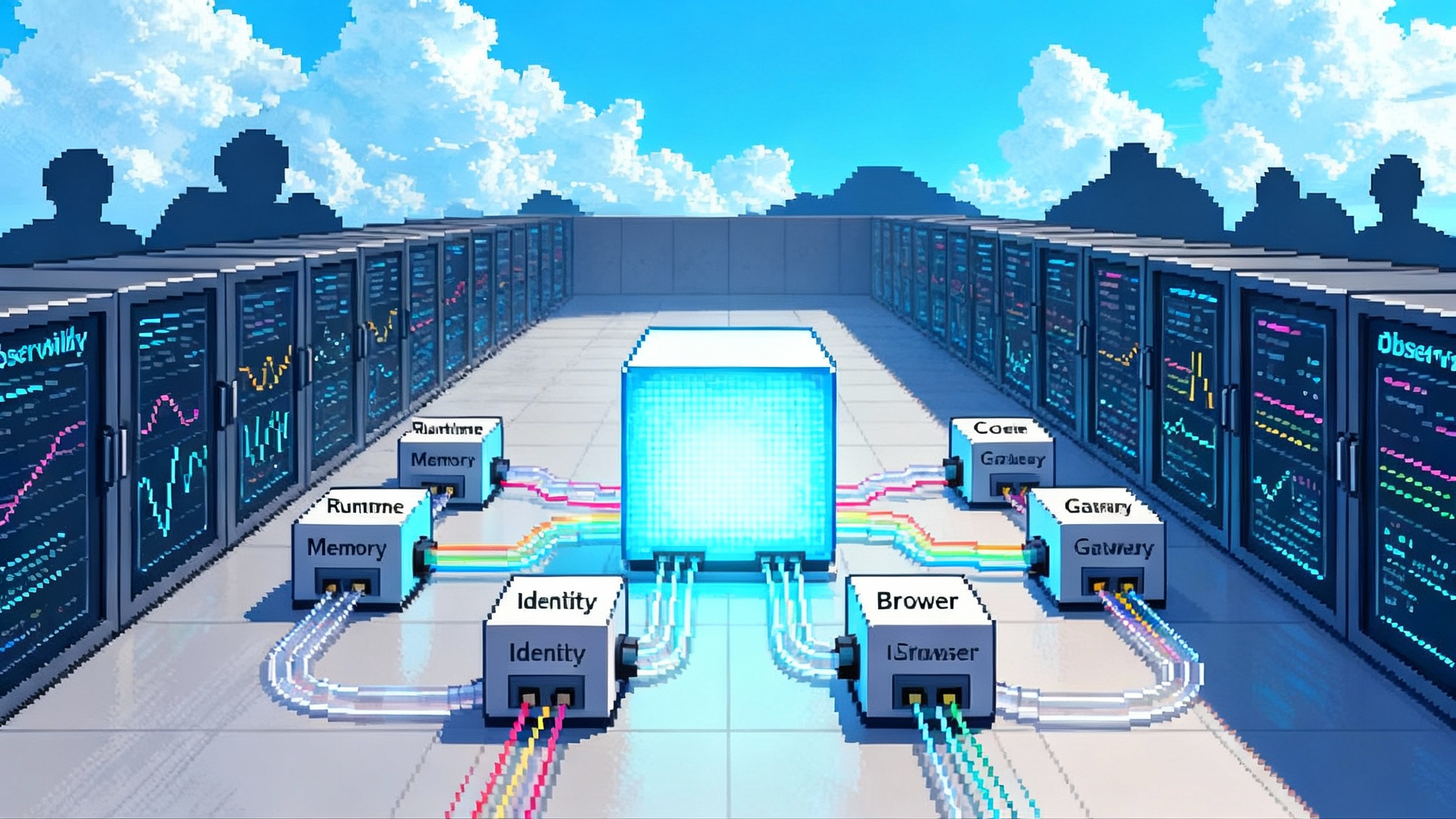

4) Identity and device checks

- Why it matters: The agent should not authorize on a device the user does not trust.

- How to do it: Bind the session to device signals and require step-up checks when risk signals change, like a new device or network. In India, let the bank app perform strong customer authentication. The agent should only pass the signed intent and await a definitive success or failure.

5) Data localization and minimization

- Why it matters: Regulators care where payment and identity data travel.

- How to do it: Keep sensitive data with the merchant or payment processor. The agent should pass tokens, not card or account numbers. Delete transient payment tokens once the order is settled, keep only the minimum data needed for support and refunds, and log access paths for audit.

Platform strategy: who owns what in an agentic checkout world

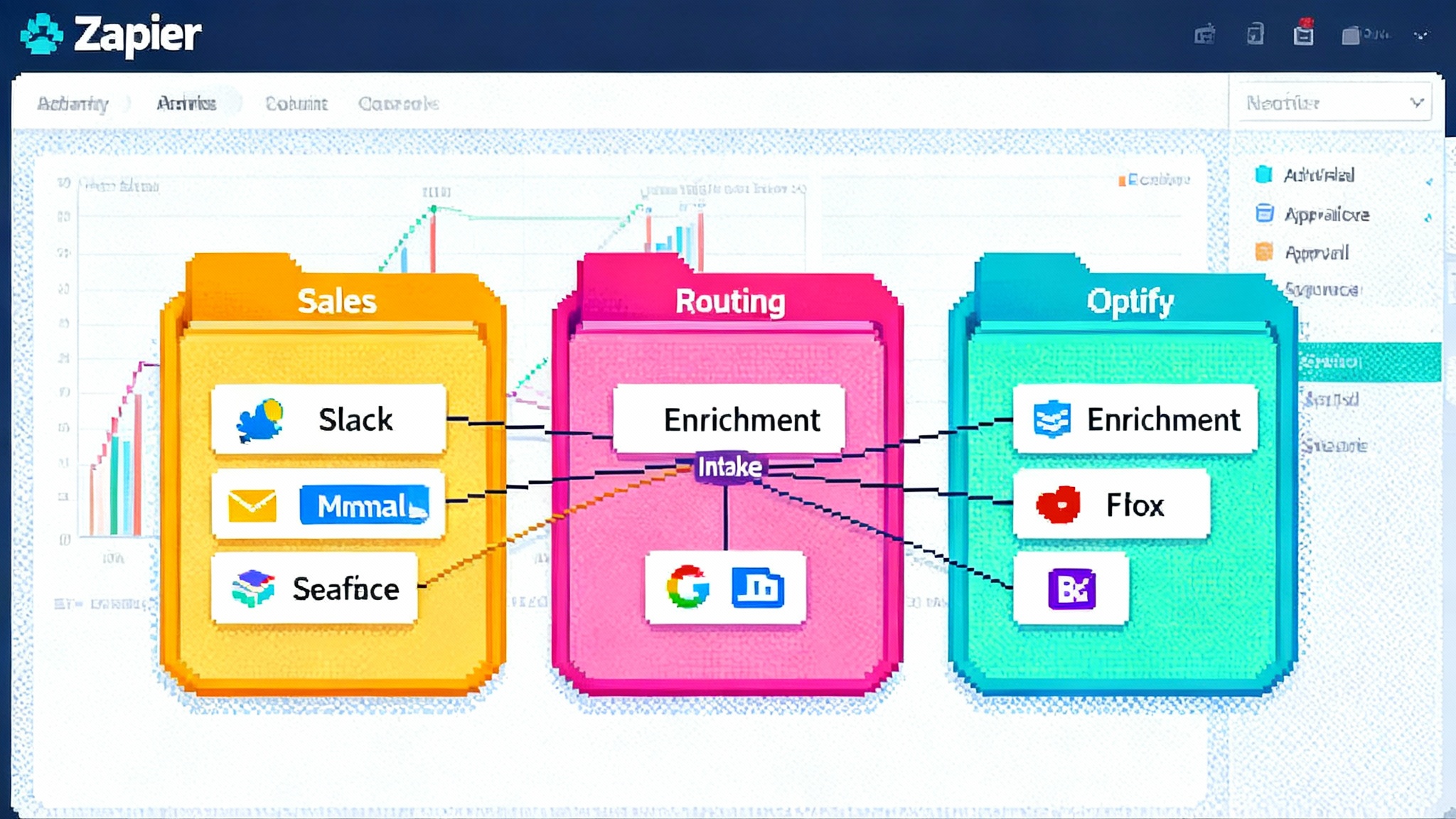

A question hangs over every new rail and interface: who owns the relationship. In this pilot, roles are more complementary than competitive.

- NPCI runs the rails and rules. Banks remain the custodians of accounts and authentication. Razorpay is the aggregator that knows how to talk to both. ChatGPT becomes the agent that coordinates discovery, decision, and payment on the user’s terms. No one is displaced. Everyone is made legible to everyone else through interfaces and policies.

- Why it matters for merchants: Traffic and intent move toward the place where decisions are made. If a user asks the agent for a gift under ₹1,500 that ships tomorrow, and your catalog fits, you will want to show up in that conversation with accurate availability and fast confirmation. The discovery funnel and the checkout funnel are merging.

- Economics: Expect a fee on completed orders and nothing for impressions. This keeps incentives aligned. If the agent drives a sale, it earns a small take. If it does not, the merchant only spent time exposing a feed. The take rate will be compared against marketplace commissions. Merchants will ask whether agentic checkout lifts conversion enough to justify the fee.

- Data governance: Merchants will push to keep the customer relationship. The right split is simple. Merchants hold order, fulfillment, and support data. The agent holds conversation history and only the minimum needed to orchestrate. That split keeps responsibilities clear and makes support easier to audit.

A week before this India pilot, OpenAI announced Instant Checkout in the United States with Etsy and an on-ramp for Shopify merchants, a related but distinct track that runs on cards and processors rather than UPI. If you want the product details and technical spec, see how OpenAI detailed Instant Checkout and the Agentic Commerce Protocol.

How this fits with the broader agent ecosystem

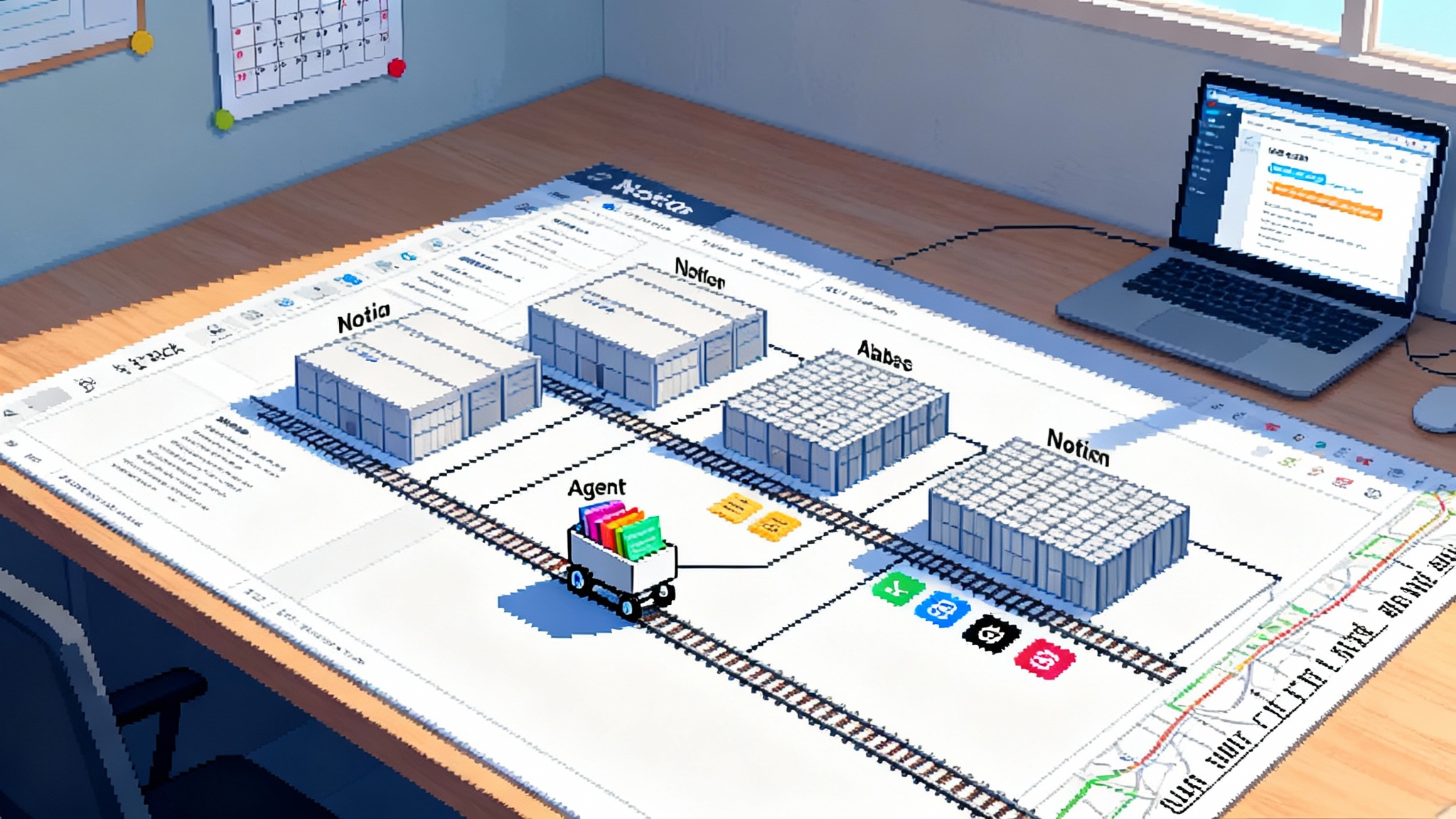

Agent-native checkout is landing as adjacent parts of the stack mature. Merchant catalogs and order ledgers are getting interfaces that language agents can reason about. Agent runtimes are improving predictability, memory, and tool-use. Customer support bots are graduating into real operators.

- If you are tracking the infrastructure race, see how AWS is framing the start of agent runtime wars and what that implies for developer platforms.

- If you are building agents that must touch real business systems, look at how AgentKit turns demo bots into shippable agents with the guardrails enterprise buyers expect.

- If you are on the support side, Zendesk’s shift to outcome-focused pipelines shows how to turn bots into operators who can own a resolution, not just a reply.

Together, these trends point to a single question for product leaders: when the conversation becomes the surface, how will your systems prove trust and deliver speed without screens to lean on.

The road from UPI to the world: a 12 to 18 month map

It is early, but the contours are visible. Here is a plausible expansion path and what each step unlocks.

0 to 3 months: prove reliability in one country

- Expand the pilot to a few more national merchants beyond groceries, like pharmacy and quick commerce, where speed matters and order lines are short.

- Add more banks to smooth out spikes and downtimes. UPI’s success is about coverage as much as technology.

- Build a standard refund and returns playbook inside the chat. Show refund bounds, for example, instant for UPI Lite or one to three days for standard UPI, and keep users updated with event receipts.

3 to 6 months: richer carts and order edits

- Move from single-item to multi-item carts with shipping splits and promotions. Let the agent optimize cost versus speed with user-set preferences like deliver in one box if it saves at least ₹50.

- Introduce saved lists and repeat orders. A simple memory of pantry staples that can be refilled on a schedule will feel magical and save time.

- Light up UPI Autopay for subscriptions where appropriate, with clear controls to start, pause, or cancel. The agent should state renewal dates and upcoming charges in plain text.

6 to 12 months: add more rails and wallets region by region

- In markets with instant account-to-account rails, map the pattern one by one. Brazil’s Pix, Singapore’s PayNow, the United Kingdom’s Faster Payments and Variable Recurring Payments, and the European Union’s SEPA Instant are natural candidates. Each has its own consent model and refund rules, so the agent must adapt its dialogue to local norms.

- For card-heavy markets, rely on tokenized cards and delegated payment flows through processors. The agent passes a limited-scope token, the merchant completes authorization and capture in their normal stack, and the user sees a clear record in the chat.

- Mobile wallets come next, not first. Apple Pay and Google Pay can slot in as express options where platform rules permit. Keep a uniform consent surface in the chat so the payment method is a detail, not the experience.

12 to 18 months: cross-border and category depth

- Start cross-border in digital goods and services where shipping and customs complexity are low. Music lessons, software licenses, and online events are workable pilots.

- Add travel and local services with verified providers. The agent can bundle steps, for example, flights with seat selection, hotel with late checkout, and airport transfer. Each item should keep its own refund and change policy visible.

- Expect regulators to publish early guidance on agent-led payments, especially around liability and dark pattern prevention. Prepare a compliance kit that shows your consent patterns, logging, and reversal policies in a format regulators can test.

What to build now: a practical checklist

For merchants

- Ship a high-fidelity product feed and an authoritative cart endpoint. Include price, tax, fees, shipping options, delivery dates, stock status, and substitution rules.

- Implement idempotent create, update, and complete endpoints for orders. Emit webhooks for order events so the chat stays in sync with the real system.

- Pre-agree refund and return windows with the platform, and expose friendly reversals for the first hour after purchase where feasible.

- Design conversational copy. A great summary line beats a fancy checkout page: item names, quantities, delivery date, total, and payment method in one clean sentence.

For payment processors and banks

- Support scoped tokens tied to a single merchant and a single amount, with expiration baked in. The agent should never hold raw credentials.

- Provide reliable status codes and retriable errors for collect requests and mandates. Ambiguity is expensive in a chat interface.

- Offer spend limits that a user can set and change, and expose those limits to the agent through a readable interface.

For product teams

- Define a red-team plan for prompt-based fraud, refund scams, and social engineering. Simulate attacks where a user is tricked into approving a look-alike merchant or a changed total.

- Add transparent notifications. Every payment should produce a durable message with merchant, amount, items, and a link to view or cancel. Users will take agentic checkout seriously if it behaves like a bank app in terms of receipts.

- Measure outcomes that matter: consent acceptance rate, reversal rate within the soft window, successful delivery confirmations, and time to resolution on support. Optimize for trust, not just conversion.

What the United States rollout signals

OpenAI’s Instant Checkout went live on September 29, 2025 for U.S. buyers with Etsy and an on-ramp for Shopify merchants. It uses cards and express options rather than UPI, and it is powered by an open specification for orders and payments called the Agentic Commerce Protocol. The U.S. launch proves there is merchant appetite for agent-native checkout and that buyers will complete a purchase in a chat when consent is clear and the summary is crisp. India’s pilot extends that concept to account-to-account payments at national scale.

For builders, the key takeaway is to design for plural rails. Your dialogue, consent objects, and order ledger should be payment-method agnostic. The user experience should feel consistent whether the authorization happens in a bank app or via a tokenized card. The plumbing can change region to region; the trust pattern should not.

The catch: risks to watch and how to mitigate

- Failure modes at the edges: UPI timeouts, bank maintenance windows, or catalog mismatches can degrade trust. Mitigate with retries, clear timers, and fast fallbacks. If a bank is down, offer to save the cart or switch accounts.

- Prompt risk and user over-delegation: People may let the agent decide too much. Keep humans in the loop with summaries and confirmations. Offer conservative defaults like capped spend and slower but safer shipping when the user gives only partial intent.

- Platform dependence: If agentic checkout concentrates discovery and conversion in a few platforms, merchants risk losing pricing power. Diversify channels and insist on data portability for order and support records.

- Regulatory drift: As agent-led flows grow, expect new rules on conversational disclosures and refund timing. Design your consent steps to be testable and legible now, not after the rules arrive.

The real headline

The news is not only that you can pay inside a chat. The real story is that the chat now understands enough about what you want to safely take action. India’s pilot shows that agents can do more than suggest. They can commit, with your permission, and close the loop. If you are a merchant, this is a new storefront where the shelf and the checkout are the same line of text. If you are a platform or a bank, this is a chance to make your systems legible to language and to people. The next year will decide whether this pattern remains a pilot or becomes the default way we buy. Build for consent that feels like clarity, for background tasks that feel like help, and for payments that feel like a promise kept. That is how agentic checkout moves from novelty to norm.