From Demos to Dollars: New Gen’s Agentic Checkout Goes Live

Agent shopping just leaped from demos to revenue. Visa’s Trusted Agent Protocol verifies assistants as real buyers, and New Gen’s AI-native storefronts give merchants low code paths to accept and fulfill agent-driven orders.

Breaking: agentic checkout is now real

For two years, artificial intelligence assistants staged shopping theater. They found products, generated links, and then handed the hard part back to humans. In November 2025, that changed. Visa formally detailed the Trusted Agent Protocol, a framework for verifying that an assistant is legitimate and authorized to buy on a customer’s behalf. The announcement sets the trust layer for agentic commerce to move into production instead of living as prototypes and blocked bots. You can read the official overview in the Visa Trusted Agent Protocol release.

In parallel, the startup New Gen turned on an AI native storefront platform that lets agents and humans use the same product brain and the same embedded checkout. New Gen launched this approach on July 10, 2025, with a focus on the assistant era rather than a retrofit of legacy flows. The company’s claims are summarized in the New Gen launch announcement. The bigger story is how these two moves flip large language model apps from link droppers into buyers over the next 6 to 12 months.

Alongside these shifts, our coverage of agents increasingly points to a world where the web itself becomes callable. If you want more context on how browsers and assistants converge, see our analysis of when the browser becomes the agent. And for what happens as agent infrastructure scales, revisit our piece on meta agents hit the stack.

Why this is a startup led moment

If the 2010s were the platform decade, the agent era is shaping up as an ecosystem decade. Big Tech will still matter, but today’s breakthrough has a startup at the tip of the spear and a network company providing rails. New Gen built a storefront specifically for conversational intent and programmatic agents. Visa provided the trust, identity, and payment primitives that every merchant already speaks. That pairing creates speed. Startups ship opinionated experiences quickly, and networks propagate standards across millions of checkouts without asking merchants to rebuild sites.

The practical result is not a walled garden. It is connective tissue that lets an assistant, a brand site, and a payment network agree on who is acting, on whose behalf, and with what limits. Once that exists, new experiences stop being gimmicks and start becoming reliable orders.

The new rails, in plain language

There are three essential pieces to agentic checkout. If you understand these, you can map any vendor pitch to a real capability.

1) Agent verification that proves a trusted assistant is buying

Most merchant sites treat automation as hostile. Bot defenses block headless browsers, scripts, and any request that looks non human. That is sensible when the only automated traffic is scraping or fraud. It breaks down when a consumer hires an assistant to buy something.

Trusted Agent Protocol gives merchants cryptographic proof that the actor on the other end is a recognized agent, not a random bot. Think of it like checking a passport at the door.

How it works in practice:

- Each agent request carries a signed header stating who the agent is, what it intends to do, and when the signature expires. The signature is bound to the merchant’s domain and to the specific action, so it cannot be replayed elsewhere.

- The request can include a signed bundle describing the consumer the agent represents, such as an account identifier or loyalty number that the merchant already knows. That helps the site connect the dots without fragile scraping.

- The merchant verifies the signature with mechanisms the site already runs, adds a few new checks to its bot rules, and can safely let the session proceed.

This is the difference between block all bots and welcome trusted agents with guardrails. The merchant’s security posture stays intact, and the assistant can browse in a controlled lane.

2) Tokenized credentials so agents never touch card numbers

Agents cannot pass raw card numbers around. Tokenization turns a real card into a network token that is safer to store and more resilient when a card number changes. Visa Intelligent Commerce exposes tokenization, passkeys, and account references as standard building blocks. An agent can carry a payment token and the merchant can accept it without inventing a new flow.

In practice, the agent arrives with a payment token, a limited scope instruction like up to 120 dollars at Merchant X today, and optional consumer identifiers. The merchant verifies the token’s provenance, applies its own risk checks, and completes the order as if the customer had typed card details. If the agent needs step up verification, the site can trigger a brief additional check such as a passkey or a bank confirmation. The consumer’s card number never travels through the agent.

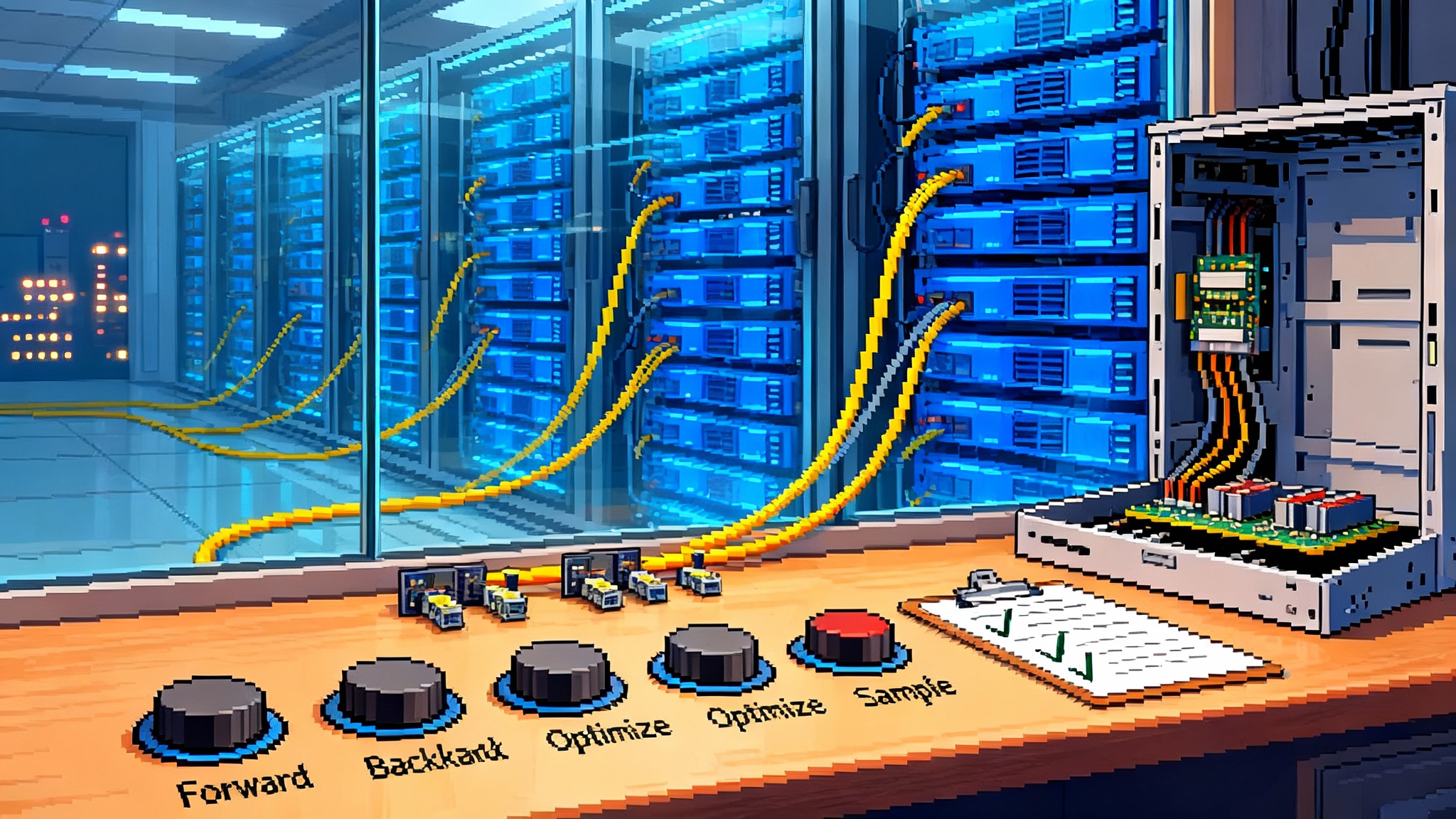

3) Model Context Protocol Servers to normalize capability access

The Model Context Protocol, often shortened to MCP, is an open method for assistants to talk to tools and services. An MCP Server is the software layer that exposes a company’s capabilities to agents in a structured, permissioned way. Visa and payments partners are now providing MCP Servers that bridge assistants to tokenization, consent, and related application programming interfaces.

Why that matters: instead of teaching every agent a bespoke payments API, the assistant can discover capabilities through the MCP Server, ask for what it needs in natural language, and the server translates that into the right calls. It is like a universal adapter for trusted payments. For a broader look at how APIs are evolving toward agent first, see our explainer on APIs go agent first.

What New Gen actually turned on

New Gen is not another chatbot in the corner of a web page. It is a storefront that exposes the catalog as structured knowledge for agents and a dynamic interface for people. The same product knowledge and policies flow to both. That matters because agents are increasingly the top of the funnel. If they cannot read your store or safely buy, your brand gets skipped.

Under the hood:

- New Gen hosts an AI native subdomain, often something like ai.brand.com, that exposes products, attributes, availability, and fulfillment rules as a clean, machine readable index.

- Human visitors see a conversational interface that can filter across specs, compare bundles, and guide a purchase without bouncing between pages.

- Agent visitors get compact responses suited for automation plus verified paths to browse and buy via Trusted Agent Protocol. An agent can request precise details, confirm a variant, then proceed to embedded checkout using a network token rather than scraping forms.

For the merchant, the benefit is consistency. You manage one catalog and one policy brain that serves both humans and assistants. This replaces brittle scripts that break every time the site changes.

Zero or low code ways to accept agentic orders

Most brands do not have an agent team. They have an overwhelmed web crew and a backlog. The good news is you can start without a rebuild.

- Drop in verification: update bot and firewall settings to accept Trusted Agent Protocol traffic, and add a lightweight signature verification step. This is similar to adding a fraud detection script or a new payment method. Many commerce platforms will package this as a plugin.

- Embedded checkout: if you already support network tokenization through your processor, enabling agentic checkout may be a configuration change plus an additional consent screen. The agent brings the token. Your site treats it as a recognized, low friction credential.

- Agent tools for non developers: acceptance toolkits are emerging that let business users execute invoice and pay by link flows with plain language prompts. They sit on top of MCP Servers, so the heavy lifting is abstracted away. Early pilots suggest a marketer can light up a basic agent flow without filing a ticket.

- AI native storefronts: New Gen’s approach lets you spin up a parallel storefront in days. You continue to operate your main site. The AI storefront handles assistant traffic and high intent human sessions, then drops orders into your existing cart and fulfillment systems.

The pattern is additive. You integrate a verification step, you accept tokens, and you expose a few flows to agents. None of that requires a head to toe redesign.

Early verticals that benefit first

Direct to consumer brands, travel, and marketplaces are already structured around programmatic decisioning. That makes them natural early adopters.

- Direct to consumer replenishment: consider a skincare brand that sells monthly refills. A customer tells an assistant to restock every six weeks, within a 50 dollar budget, only if the brand is offering a seasonal discount. The agent checks the AI storefront, sees a promotion, confirms the shade and size, and completes the purchase using a token the brand’s site already trusts. No shopping cart abandonment. No missed upsell.

- Travel booking: an assistant can assemble an entire trip as a set of verifiable intents. It looks up flights and fares, matches hotel options to loyalty preferences, then presents a simple confirmation. When the traveler approves, the agent executes purchases on the airline and hotel sites as a trusted caller, passing a tokenized payment and the traveler’s loyalty identifiers. The suppliers keep the customer relationship and the traveler gets instant confirmations without tab juggling.

- Marketplaces: agentic buyers thrive where selection is broad and time is scarce. A marketplace can accept trusted agent sessions that search across seller catalogs, optimize for speed to delivery or total price, and check out with a marketplace held token. Since the marketplace already handles fraud, shipping, and disputes, adding agents often means higher conversion on mobile and voice.

Guardrails for risk and consent

Autonomous purchasing is only as good as its controls. The new rails bake in several layers of protection.

- Explicit consent in the right context: agents should present a clear prompt before any first purchase with a merchant. The prompt should include the merchant name, expected amount range, and a time window. The merchant can require that the first order include a brief step up such as a passkey. Subsequent orders can run within the limits the consumer approved.

- Spend and scope limits: authorizations should be bound to a specific merchant, category, and cap. For example, allow 200 dollars this week at a named travel site, or allow three orders under 40 dollars each from a skincare brand this month. Limits can expire or be revoked by the consumer anytime.

- Merchant visibility without data sprawl: the site should see a durable but privacy preserving account reference rather than raw personal data. That allows order lookups and support without exposing unnecessary attributes.

- Replay protection and audit trails: every agent message is time bound and bound to a domain. Merchants should log verified agent sessions and outcomes. If a dispute occurs, the merchant can show the chain of consent and the signed messages that drove the order.

- Bot defense tuning: security teams should update web application firewalls to distinguish between verified agents and generic automation. The goal is not to relax defenses. It is to add an allow lane for signed traffic and keep everything else blocked.

Get these right and agentic checkout becomes a source of fewer chargebacks, not more.

A concrete flow, start to finish

Picture a customer asking an assistant: Find a carry on suitcase under 200 dollars that fits in United’s overhead bin, ships in three days, and matches my saved blue accessory set.

- The assistant queries several AI storefronts and finds a match.

- It requests product specifics from the chosen brand’s site, sending a signed intent that says it is a trusted agent and is only browsing this product page. The site verifies the signature and responds with the exact dimensions and stock by color.

- The assistant asks to buy. It sends a new signed message for payment, with a tokenized credential and the consumer reference the merchant already recognizes.

- The site verifies the signature, confirms the token, runs internal risk checks, and prompts the customer for a quick passkey because this is a new merchant.

- On success, the site returns an order confirmation and tracking details. The assistant stores the receipt and updates the traveler’s packing list.

No scraping. No brittle forms. No card numbers. The steps feel familiar to the merchant’s stack, yet the experience for the customer is night and day.

What changes in the next 6 to 12 months

- Assistants get purchasing lanes. Browsing agents will move from the blocked pile to a verified allow list. That single change lifts conversion for any brand that welcomes them.

- Catalogs become agent readable by default. More merchants will expose structured product data with strict rate limits and signed access. This reduces scraping and lowers operational noise.

- Processors and issuers publish MCP Servers. Instead of custom integrations, you will connect your agent to a trusted payments capability once and reuse it across flows. Innovation accelerates as the cost to try a new use case falls.

- Checkout becomes consent first. Expect a norm where consumers approve spend ranges and merchant allowlists at the agent level. It will feel like a wallet limit, not like typing a code on every order.

- Discovery and fulfillment reconnect. Agentic sessions will hand the merchant rich intent signals, letting the site personalize offers, fulfillment promises, and post purchase support. That blurs the old line between adtech and checkout and unlocks higher lifetime value.

What to do this quarter

A practical playbook for leaders who want the upside without chaos:

- Identify agent heavy journeys. Look for replenishment, bundles, and single decision purchases. These are the easiest to convert.

- Stand up an AI native storefront pilot. If you are time constrained, start with a small subdomain for your top 200 SKUs and validate that agents can read variants and policies.

- Add agent verification. Work with your payment and security partners to verify Trusted Agent Protocol signatures at the edge and update firewall rules to allow verified traffic while continuing to block everything else.

- Turn on tokenized checkout for the pilot. If your processor supports network tokens, confirm you can accept a token from a trusted agent session and bind it to your risk policies.

- Ship consent screens. Require an initial one time passkey or equivalent step up for new agentic buyers, then respect spend caps and merchant allowlists.

- Measure agent conversion separately. Tag verified agent sessions, track checkout completion, returns, and chargebacks. You cannot improve what you do not measure.

- Train support. Give your service team visibility into agent orders and clear instructions on how to revoke consent if a customer asks.

- Socialize a risk playbook. Define rules for when to fall back to human confirmation, such as high ticket, unusual shipping, or multiple rapid orders.

- Run a marketplace or travel test. If you operate a platform, pilot an agentic lane for top sellers or routes. Network effects multiply once agents can complete orders end to end.

- Share the wins. Report reduced abandonment, faster checkout times, and lower fraud rates to your finance and product leaders. That momentum unlocks the next phase.

The startup smell test

You will see many products marketed as agent ready. Here is how to evaluate them without getting lost in jargon.

- Ask which signatures they verify and how they prevent replay. You want domain and action bound, time limited signatures that your infrastructure team can check.

- Confirm how payment credentials move. Tokens from the network or your existing wallet mean safer operations and easier compliance. Raw card numbers in scripts should be a hard no.

- Verify revocation. Consumers must be able to revoke an agent’s permission, and merchants must be able to blacklist a misbehaving agent without collateral damage to human customers.

- Demand logs. If a dispute happens, you will need a clean trail of signed intents, amounts, and outcomes.

- Inspect the integration path. Plugins and toolkits that fit your current stack will beat bespoke rewrites.

The bottom line

Agentic checkout just gained a trust and payments backbone, and a startup shipped the store that uses it. New Gen’s AI native storefronts let assistants and people interact with the same catalog and the same embedded checkout. Visa’s Trusted Agent Protocol gives merchants the confidence to accept those sessions, using identity, consent, and tokens they already understand. Add MCP Servers as the adapter between agents and payment networks, and the path from conversation to confirmed order becomes both short and safe.

This is not a rerun of the platform era. It is a network plus startup moment that invites builders to create new ways to shop without breaking what works today. If you are a merchant, your move is simple. Give assistants a lane, give customers clear controls, and let your store sell to whoever shows up, human or agent. Six months from now, the brands that do will feel like the web got faster. Twelve months from now, their revenue will show it.